Blockchain Founders Fund Raises $75M to Invest in Web3, Blockchain Startups

The Singapore-based venture capital fund is expected to continue pouring money into Web3 and metaverse startups

Singapore, Source: Shutterstock

- The fund is expected to continue pouring money into Web3 and metaverse startups

- Notable investors included NEO Global Capital, Appworks and GSR

Singapore-based Blockchain Founders Fund (BFF) has raised $75 million for a new fund focused on backing blockchain, Web3 and metaverse startups, according to a statement Monday.

Notable investors of the fund include NEO Global Capital, Appworks, Sebastien Borget chief operating officer of The Sandbox and GSR. Metavest Capital, TechMeetsTrader, Zipmex, Baksh Capital, Octava and Aria Group also participated.

The early-stage fund, dubbed BFF II, is a continuation of BFF’s venture program model in which it invests in pre-seed and seed-stage projects. The fund’s portfolio includes a long list of crypto companies including blockchain game Splinterlands.

The fund has already poured capital into existing metaverse and Web3 projects such as FXDX, GRID, RD Land, Rebelbots, Health Hero, The Apocalyptics, FuseFi, Cross the Ages and Dogami, according to the statement.

“We continue to support our portfolio companies with their talent needs and expand the team with individuals that want to be at the cutting edge of blockchain,” said Mansoor Madhavji, partner at Blockchain Founders Fund.

Last year, venture capitalists invested more than $33 billion into crypto and blockchain startups with 67% of all funding rounds involving deals exceeding $100 million.

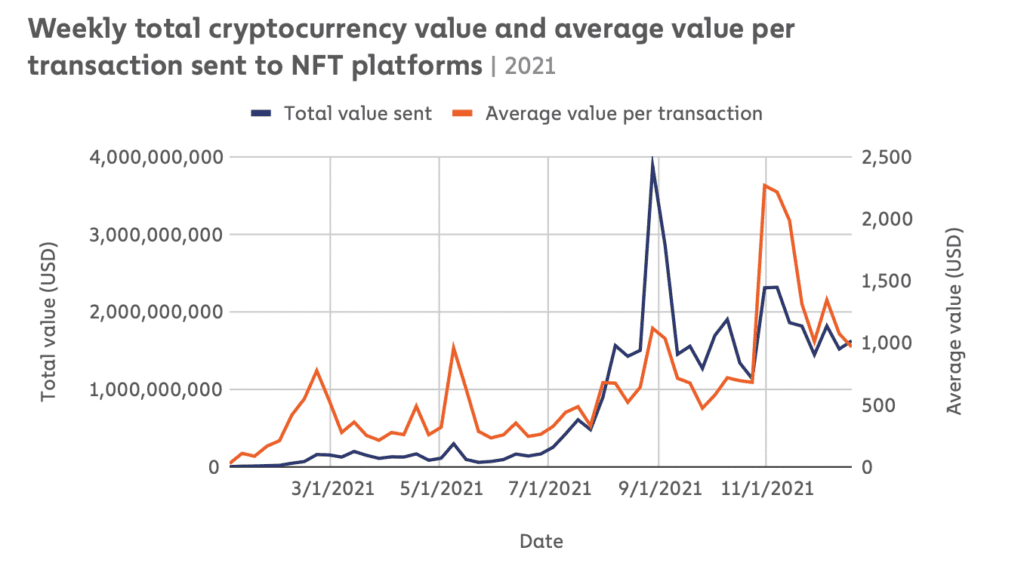

Source: The Chainalysis 2021 NFT Market Report

Source: The Chainalysis 2021 NFT Market ReportMeanwhile, demand for NFTs hit new heights in 2021, according to a report from Chainanlysis that showed users sent over $44.2 billion worth of cryptocurrency to ERC-721 and ERC-1155 contracts, two Ethereum smart contracts associated with NFT marketplaces and collections.

Continuing that trend, NFT project incubator NFT Investments announced Monday plans to acquire crypto venture capital firm Pluto Digital in a $129 million deal.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.