Congress Presses State Department for Info on Costs, Benefits of Crypto

The bill will require the Treasury and the State Departments to compile a report on how crypto impacts the effectiveness and enforcement of sanctions against Russia

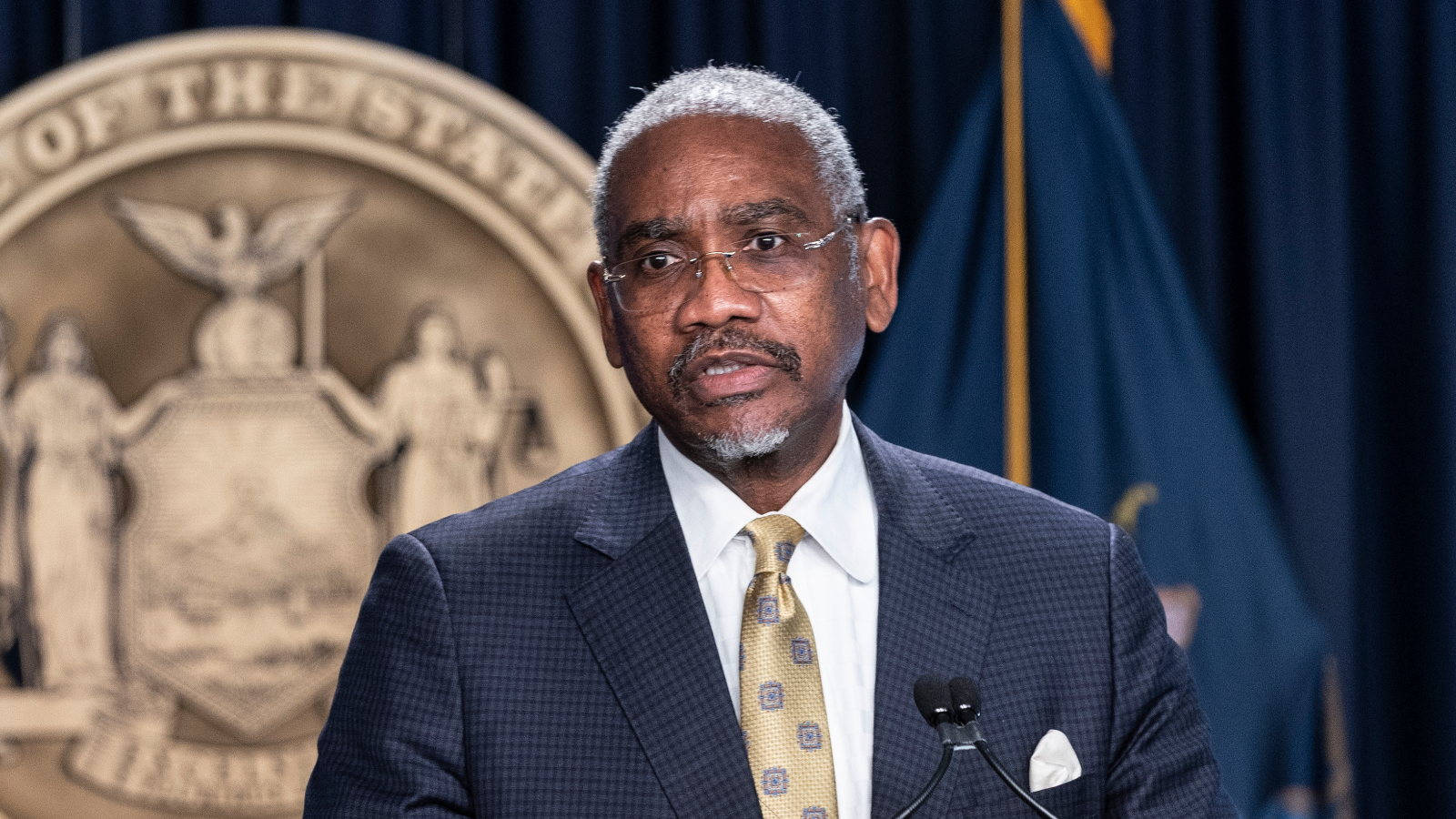

New York Rep. Gregory Meeks | Source: Shutterstock

key takeaways

- Congress moves ahead with the Russia Cryptocurrency Transparency Act

- Lawmakers want to know when, why and how the State Department uses crypto to reward whistleblowers

As the war in Ukraine rages on, Congress is keen on figuring out exactly what role cryptocurrencies have played in the conflict in the past seven months.

The Russia Cryptocurrency Transparency Act passed the House on Tuesday and moved to the Senate, where it is currently in committee. The bill covers several topics that have gained attention since Russia’s invasion of Ukraine.

“The imperative of starving Valdimir Putin of funds for Russia’s illegal war in Ukraine has brought renewed focus on the role cryptocurrencies can potentially have in money laundering and sanctions evasion,” bill sponsor Rep. Gregory Meeks, D-N.Y., said in a statement after the legislation passed the House.

The bill will require the State Department to submit a report to Congress detailing how “cryptocurrencies or other technologies incorporating blockchain” have been used to promote economic development and provide humanitarian aid to Ukraine, according to the current draft. It will also ask the Treasury and the State Department to compile a report on how cryptos impact the effectiveness and enforcement of sanctions against Russia.

The bill also asks the Secretary of State to notify certain Congressional committees at least 15 days before making a payment in crypto under its “Rewards for Justice Program,” a counterterrorism program that rewards individuals for information about illicit activity.

The State Department said in 2021 that some rewards may be paid in cryptocurrencies, but with this new bill, Congress will want an explanation on why digital assets are being used as opposed to fiat currencies and traditional payment methods.

A new diplomatic point person on cryptoassets

Under the bill, the Department of State would be required to appoint a new role: the Director of Digital Currency Security.

“Though there are legitimate and valuable use cases for cryptocurrencies, some digital asset products can be used to mask the origins of transactions and facilitate sanctions evasion,” Meeks said.

The notion of whether cryptocurrencies can be used to evade sanctions has been an ongoing debate since the start of the war. While lawmakers, particularly on the political left, have argued that cryptos play a significant role in illicit financial activities, digital asset proponents counter that crypto’s transparent nature makes this nearly impossible at scale.

“I will quote my successor as counselor to the deputy secretary of the Treasury, who recently said ‘you can’t flip a switch overnight and run a G20 economy on cryptocurrency, there just isn’t the liquidity,’” Michael Mosier, former acting director and current deputy director and digital innovation officer of the Financial Crimes Enforcement Network (FinCEN), said during a March Congressional hearing.

Also on Tuesday, as the Russia Cryptocurrency Transparency Act was passing in the House, the Senate heard from Elizabeth Rosenberg, assistant secretary for terrorist financing and financial crimes, and Andrew Adams, director of the KleptoCapture task force at the Department of Justice. The hearing, held by the Committee on Banking, Housing and Urban Affairs, touched on how cryptocurrency mixing services may be used in sanction evasion.

“When [sanctions] can serve as a deterrent to any criminal that would seek to use a mixer in order to launder their funds — the funds of the proceeds of corruption, or other criminal activity — that’s an effective avenue we can use in order to signal that we cannot tolerate money laundering,” Rosenberg said. “Whether that’s for a Russian criminal actor, an Iranian, a North Korean, or wherever they may come from.”

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.