Empire Newsletter: Fan tokens mirror Champions League performance

Tokens for soccer teams Paris Saint-Germain and FC Barcelona mirror their victories and losses

rosdemora/Shutterstock modified by Blockworks

Dueling tokens

As Paris Saint-Germain and Barcelona FC duked it out in the Champions League round of 16 over the past few weeks, their fan tokens mirrored the ups and downs almost perfectly.

The tokens have really small market caps, both under $40 million. Mix that with a diehard fan base sporting Binance accounts, and you get super volatile markets when the two teams clash.

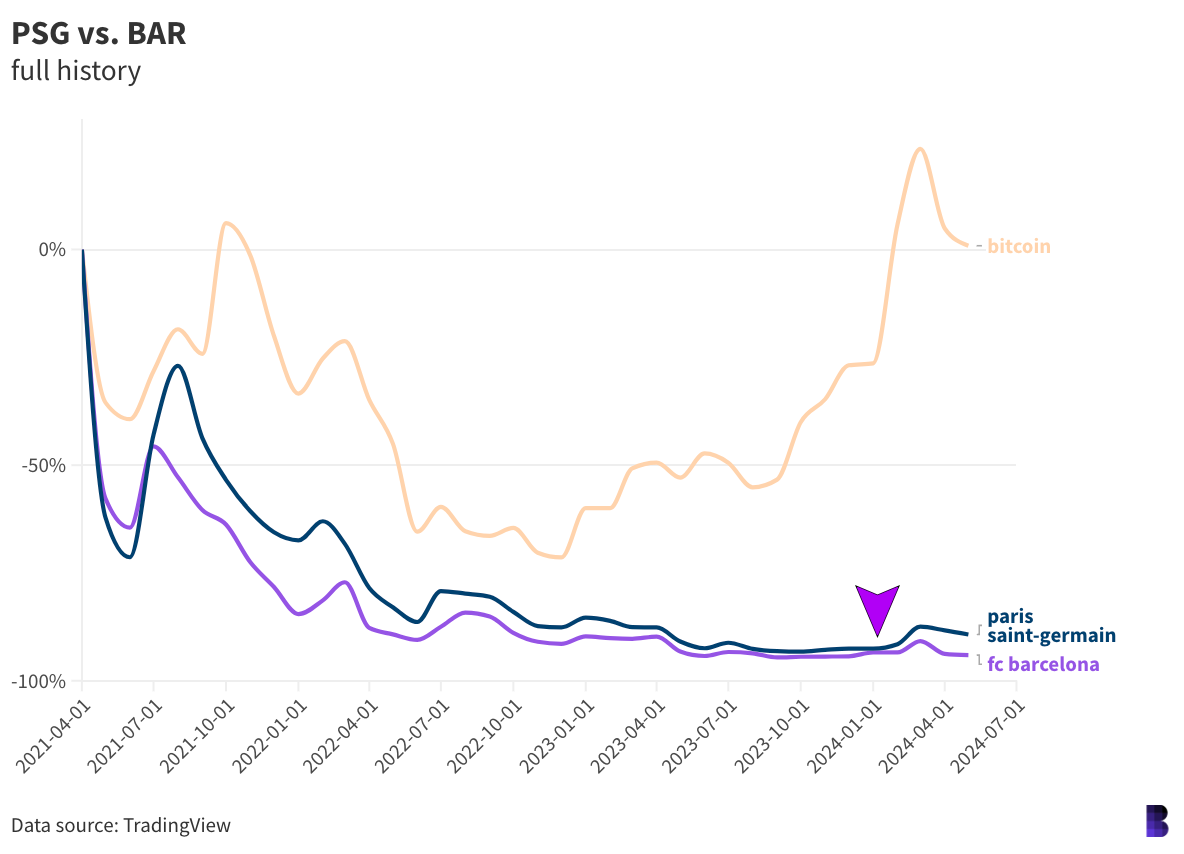

To be clear: Both tokens have lost more than 90% of their value since their debut during the 2021 bull market’s peak. Whatever matches both teams won seem to have done little for either token’s price.

The Champions League finals started at the purple arrow — not long after all-time lows

The Champions League finals started at the purple arrow — not long after all-time lows

But it just so happens that both tokens bottomed out in the leadup to the Champions League finals, which began in February, and have since been in lockstep with match results.

This makes it super fun to zoom in.

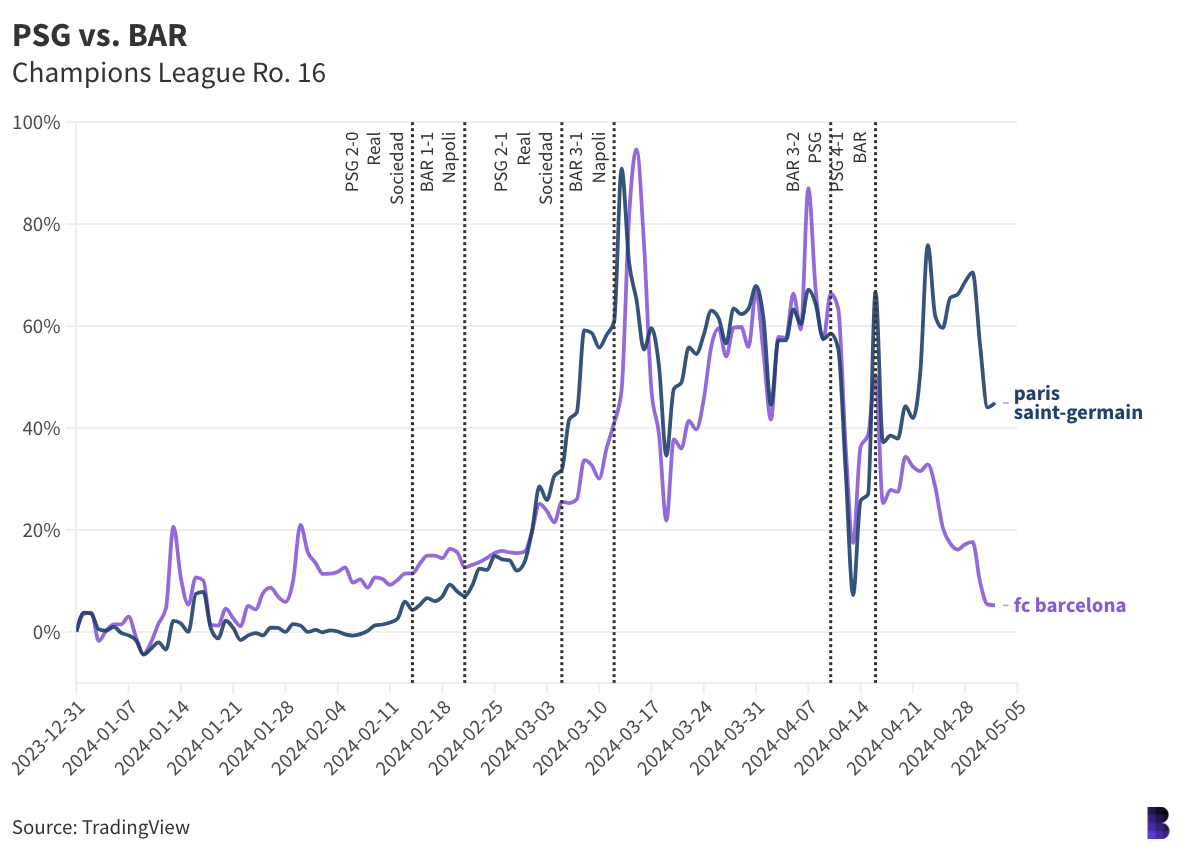

From Jan. 1, both tokens started the year in tight correlation, with FC Barcelona’s (BAR) seemingly the market favorite going into the knockout phase.

Paris Saint-Germain beating Real Sociedad 2-0 on Feb. 14 helped close some of the gap.

That, followed by FC Barcelona’s 1-1 tie with Napoli, led PSG to eclipse BAR for year-to-date returns, a little under 30% at that point.

Both tokens began pumping in the leadup to their second knockout wins, which secured quarter final positions. Paris Saint-Germain’s 2-1 win against Real Sociedad sent the token 25% higher, topping out alongside Barcelona FC’s cryptocurrency following its own 3-1 victory.

Now for the showdown. Paris Saint-Germain and FC Barcelona had advanced in the same bracket, which meant two matches back-to-back, in April, to determine who would head onto the round of four.

Barcelona came from behind to win 3-2, which for whatever reason sent both tokens dumping by 25%. Perhaps markets felt there was no clear winner going into the decider. Bitcoin’s struggles might’ve also had something to do with it, having dropped more than 10% around the first match.

Both tokens bounced hard leading up to the rematch, which the Paris club won easily 4-1. PSG would rally up to 15% in the following days. BAR has otherwise slipped by more than 20% and is now barely in the green for the year to date.

In a market where fundamentals often have little to do with price, fan tokens seem to be doing exactly what’s on the box — at least during the Champions League finals.

— David Canellis

Data Center

- FC Barcelona’s fan token sits at $2.46 while PSG’s at $4.75, per CoinGecko.

- Bitcoin’s back above $60,000, still down roughly 10% over the last seven days.

- BlackRock’s reported flows from Thursday were flat after it reported its first day of outflows earlier this week.

- Short liquidations jumped to $55 million in the past 24 hours, according to CoinGlass.

- Despite beating on earnings, Coinbase slipped in after-hours and early morning trading, hovering around $218 ahead of the bell.

NGMI

We got yet another bipartisan crypto bill in the House this week, this time from Reps. Drew Ferguson (R-GA) and Wiley Nickel (D-NC).

The pair introduced the Providing Tax Clarity for Digital Assets Act, which states that unrealized gains from staking activities are not subject to taxation.

The issue at the heart of the bill — taxing unrealized gains — made headlines when a Nashville couple sued the IRS after paying income tax on staked rewards they never cashed out. The IRS eventually offered the couple a refund, and no legal precedent was ultimately set.

Ferguson and Nickel’s bill would make it so digital asset rewards received from validating blockchain transactions, including staking and mining, either directly or through service providers, are not treated as taxable income upon receipt.

Nickel, a member of the House Financial Services Committee, has been a vocal advocate for the crypto industry. Earlier this year, he helped spearhead an effort in the House to appeal the SEC’s Staff Accounting Bill 121 — the guidance that says digital asset custodians should report a liability and “corresponding assets” on their balance sheets for all custodied cryptocurrencies.

It’s an effort most miners and validators can probably get behind, but don’t hold your breath. It’s an election year, so the odds of just about anything getting through are slim.

For a bill to move, the chair and the ranking member of the relevant House and/or Senate committee has to sign off.

For Ferguson and Nickel, that means getting the greenlight from Reps. Patrick McHenry (who is favorable toward crypto, but set to leave office) and Maxine Waters (who is decidedly not favorable toward crypto) of the House Financial Services Committee.

Keep your eye on the bill, though. Maybe a new version will be introduced next session.

Plus, we are still waiting on final guidance from the IRS on a slew of tax issues, so more legislation is probably on the way, too.

— Casey Wagner

13F szn

Want to close out the week on a positive note?

I think we can agree that it may not be the best week for ETFs — both BlackRock and Fidelity posted outflows Wednesday night — so let’s get into an update on a topic we’ve talked about before.

Remember a few weeks ago when I said that we weren’t seeing a lot of big institutions reporting bitcoin ETFS in their 13Fs yet? Well, we’re starting to see them trickle in.

The development isn’t necessarily a surprise, given that the bigger firms tend to file their 13Fs closer to the mid-May deadline.

To recap: 13Fs are a required form filed with the SEC which discloses the quarterly holdings for institutions that manage $100 million or more.

Most notably, BNY Mellon and BNP Paribas disclosed holdings in BlackRock’s bitcoin ETF IBIT.

BNY Mellon’s 13F shows that it owns nearly 20,000 shares of IBIT and roughly 7,000 shares of Grayscale’s bitcoin ETF GBTC.

BNP Paribas, on the other hand, only owns about 1,000 shares of IBIT.

So the holdings are very small potatoes for one of the oldest banks in the US and one of the largest banks in Europe. But the appetite has been established.

If you want more proof that investment managers are interested, take a look at Pittsburgh-based registered investment manager Quattro Advisors.

The 13F showed that they own 468,200 shares of BlackRock’s ETF, which adds up to be nearly $19 million. That’s a far cry from the $1.2 million of both GBTC and IBIT owned by BNY Mellon and the mere $41,684 of just IBIT owned by BNP Paribas.

Putting the nibbles aside, there’s one aspect of these filings that stands out. Namely, that many of the smaller fish are building up bigger positions.

For example, Legacy Wealth Management disclosed that it owns roughly $21 million of Fidelity’s ETF.

This was pointed out by MacroScope, but echoes what I’ve seen. The filings have really picked up ahead of the mid-May deadline and we’re starting to see the bigger players disclose their holdings.

Stay tuned.

— Katherine Ross

The Works

- Officials in the Netherlands have arrested an individual in connection with a fraud investigation into ZKasino, a crypto gambling platform recently accused of fraud.

- The Eigen Foundation says it plans to distribute additional tokens, citing community feedback.

- Jack Dorsey’s Block announced that it’ll invest 10% of its bitcoin profit into buying bitcoin.

- Mining firm Stronghold is weighing a sale following Bitcoin’s halving, Blockworks’ Ben Strack reports.

- China is beating the US when it comes to AI research, Axios reports.

The Morning Riff

I’ve been thinking about “what sort of market is this,” and I think Coinbase’s latest quarterly earnings holds the answer, at least part of it.

Look at the trading volumes. Consumer volume rose from $29 billion to $56 billion, a 93% quarterly increase, nothing to slouch at. But the institutional figure was the real monster — $256 billion, up 10% quarter over quarter.

I think these particular tea leaves tell us that, while retail is “here,” it’s not really here. Not as it was in past crypto cycles — not yet, at least.

There’s no corresponding media circus. No rush to buy any token that moves. I’m not fielding family calls about some weird and probably sketchy crypto investment scheme, long a personal hallmark of a retail-driven cycle.

Call it the other side of the bitcoin ETF coin: It’s the institutions, stupid.

— Michael McSweeney

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.