NFT Market Bound For Correction, Crypto Portfolio Managers, Collectors Say

“Just like any instruments in the market, I believe NFTs will see a correction,” BKCoin Capital’s Kevin Kang told Blockworks

Source: Shutterstock

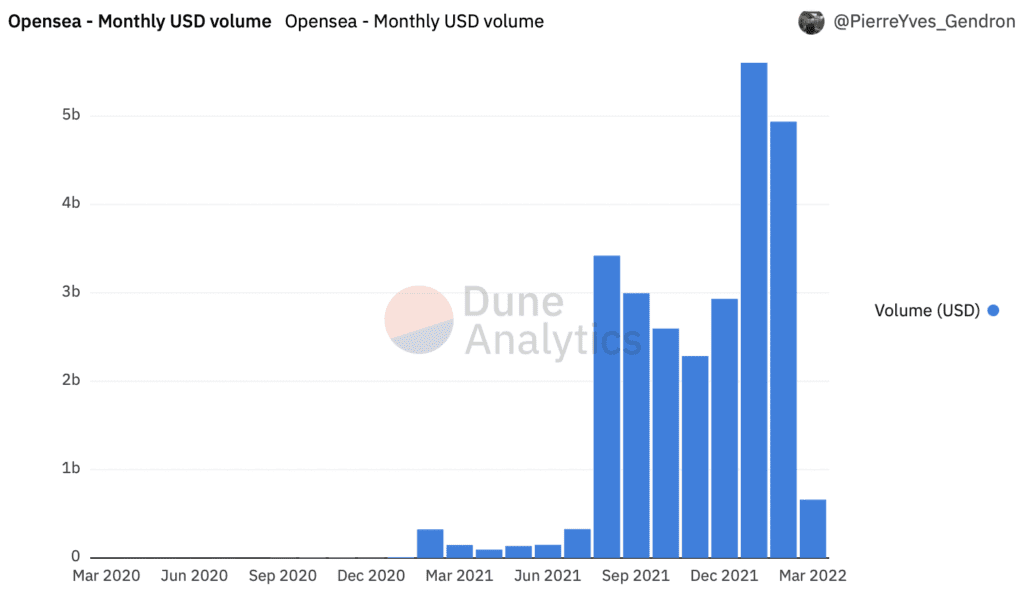

- OpenSea’s trading volume has declined 36.9% in the past month, according to DappRadar

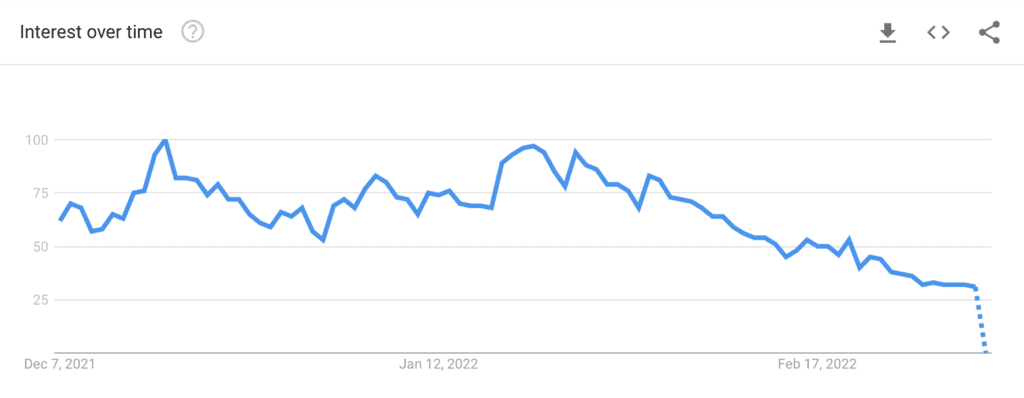

- Per Google Trends, global search entries for “NFT” have plummeted since February

From artist Beeple selling an NFT for $69 million at Christie’s auction house to Block’s Jack Dorsey minting his first tweet, 2021 was the year of the NFT.

Bullish signs carried into 2022. NFT (non-fungible token) marketplace OpenSea notched a record single-day trading volume in January at $261 million of ether, according to data from Dune Analytics. The platform also recorded 546,000 active users — another record high.

Benjamin Cohen, managing partner of crypto fund Web 3 Equities, told Blockworks when a market grows “that fast,” it is “ fair to assume that [it] will experience large swings and corrections.”

The multi-billion-dollar industry took a turn in February. OpenSea’s trading and transaction volumes fell, plunging 36.9% and 14.49% respectively over the past month, according to blockchain data dashboard DappRadar.

OpenSea monthly USD volume | Source: Dune Analytics

OpenSea monthly USD volume | Source: Dune Analytics

NFTs generated over $4 billion in sales in February, per DappRadar – declining 28% from January. Trading volumes last month, however, are still higher than November and December.

Searches for “NFT” dropped 58% in February from January, according to Google Trends.

Searches for “NFT” dropped 58% in February from January | Source: Google Trends

Searches for “NFT” dropped 58% in February from January | Source: Google Trends

“Just like any instruments in the market, I believe NFTs will see a correction,” Kevin Kang, founding principal at crypto hedge fund BKCoin Capital, told Blockworks. “NFTs will not be immune to the risk-off sentiment in the market as mainstream art collectors tend to see NFTs as a riskier asset.”

Potential signs of a downturn include Sotheby’s CryptoPunk auction, where a pseudonymous consignor withdrew a lot of CryptoPunks — valued at $30 million — minutes before the sale.

Investors may also be put off by reports of an SEC investigation homing in on fractional NFTs’ potentially violating securities laws.

Stephen Young, founder of marketplace NFTfi, told Blockworks the “money grab projects will die” in NFTs, but the broader blockchain-based collectible market will not.

“[NFT] prices are a bit crazy, so we are in [a] kind of bubble and frothy stage of the market,” Young said. “[NFTs] are just disconnected from the bubble in the crypto markets. The [number of NFTs] will just continuously increase. At some point, there’s not going to be enough new people buying to be able to absorb that supply.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.