Despite Downturn, Crypto VC Market Poised for Growth, Investors Say

“Significant capital raises that closed last year will be deployed now, I expect an increased pace of activity,” Stan Miroshnik, co-founder of 10T Holdings, told Blockworks

Blockworks exclusive art by Axel Rangel

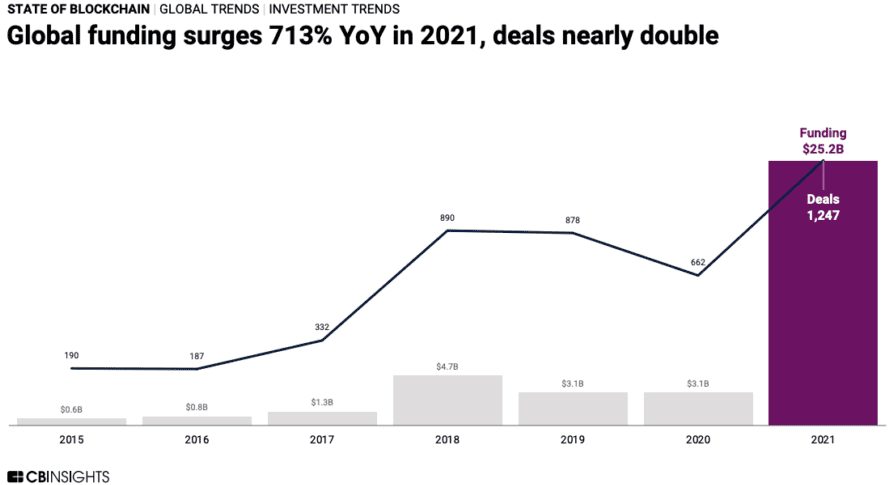

- Blockchain funding spiked 713% globally from $3.1 billion 2020 to $25.2 billion in 2021, according to CB Insights

- Animoca Brands CEO Robby Yung told Blockworks he isn’t seeing delays in funding due to dips in crypto markets

Despite a downturn in the cryptocurrency market, a number of venture capitalists don’t expect a slowdown in funding for private blockchain companies this year.

Crypto markets have fallen 24% on the month from $2.21 trillion to about $1.78 trillion, according to CoinMarketCap. But the drop hasn’t stopped investors from plowing money into private plays, Stan Miroshnik, co-founder and partner at 10T Holdings said to Blockworks.

“Significant capital raises that closed last year will be deployed now, I expect an increased pace of activity,” Miroshnik said. “The total amount of capital deployed will increase.”

Miroshnik helps manage 10T Holdings’ almost $1 billion in assets across two active, crypto-focused private equity funds and is raising money for a third one, Blockworks previously reported.

A handful of other crypto funds were launched last year, including Andreessen Horowitz, or a16z, which raised $2.2 billion in June. The firm is now raising $4.5 billion for new crypto funds this year, according to reports.

Animoca Brands CEO Robby Yung told Blockworks he isn’t seeing delays in funding due to the crypto dip, but expects the “velocity of things will naturally slow and will weed out people who were less serious.”

Even so, more institutional allocators want exposure to crypto and blockchain companies, even if it’s in smaller amounts.

“That’s a big shift in sentiment over the last six months,” Miroshnik said.

The volume of blockchain-focused funding raised surged 713% globally from $3.1 billion in 2020 to $25.2 billion in 2021, according to a report by CB Insights. This year it might even hit higher peaks after the average and median deal sizes jumped to $23 million and $4 million last year, respectively.

“I think the opportunity is much larger now,” Miroshnik said. “It’s trillions in an addressable market size and a pretty unique market opportunity.”

Last year, $6.4 billion, or $1 of every $4 raised for blockchain-focused funds, went to crypto exchanges and brokerages, CB Insights showed. Some of the largest capital raises were NYDIG with $1 billion, Forte Labs with $725 million and Celsius Network with $750 million.

Last month, crypto custodian Fireblocks raised its valuation over $8 billion after closing a $550 million Series E. On Monday, one of the largest crypto exchanges, FTX, closed a $400 million Series C round, increasing its valuation to $32 billion while the nine-month-old crypto wallet firm Phantom hit unicorn status with a $109 million funding round.

“FTX looks like an outlier, but we’ll see more players come in at $10 billion valuations or higher,” Miroshnik said. “There will definitely be many more $10 billion-plus companies minted in this ecosystem. The growth we’re seeing isn’t linear, it’s exponential.”

Even with such large capital infusions, exchanges and Defi protocols plus metaverse and gaming products aren’t indicative of where this industry will be three years from now, Yung said. “Now that we have maturity, you’re going to see products reflective of what the future holds compared to last year and the year before, because those were built on shoestrings,” Yung said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.