Ether Burns Hit $100 Million Post EIP-1559 Activation

Ether briefly enters a deflationary cycle as more blocks were burned than issued during one cycle.

Blockworks Exclusive Art by Axel Rangel

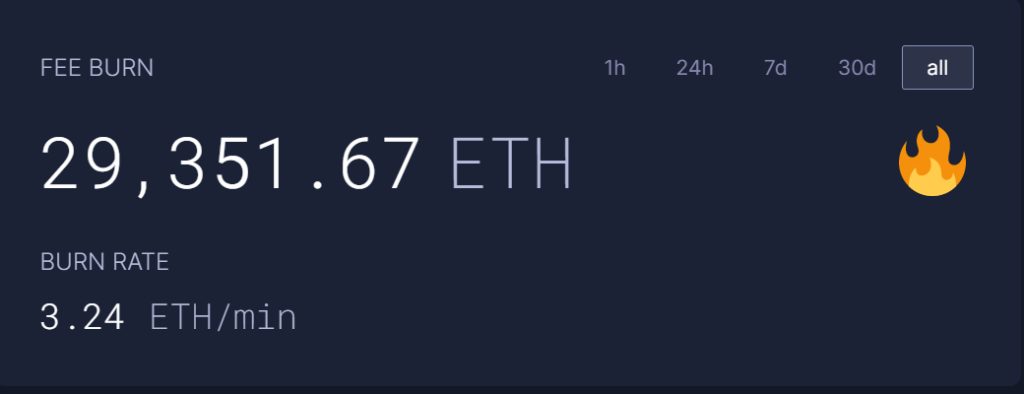

- Post activation of EIP-1559, nearly 30,000 ether have already been burned

- Because the volume of ether being burned, the money supply of ether briefly dipped into a deflationary state

The burn mechanism to control the money supply of ether has been in full force since the implementation of EIP-1559 with nearly 30,000 ether being burnt according to a tracker from ultrasound.money.

As part of EIP-1559, activated last week as part of the London Hard Fork, transaction fees that once went to miners are now destroyed through the issuance of burn blocks.

When the amount of ether burned exceeds the issuance, the Ethereum blockchain enters a deflationary cycle through the issuance of deflationary blocks.

On Tuesday, a tracker called ETH Burn Bot on Twitter showed that the annualized issuance of ether hit negative territory thanks to burns coming in at -3%.

According to ETH Burn Bot, annualized issuance is now between 1.6-2.5%. Prior to the implementation of EIP-1559, the money supply of ether has grown at 8.15% according to YCharts.

While ether’s move into deflation was only a temporary tip, it is expected to become a permanent fixture when the Ethereum blockchain moves to a proof-of-stake system as part of the ETH 2.0 transition in 2022.

But while the the reduction in money supply of ether is great for HODLers, and fulfills a promise from the London hard fork, the recent spike of activity on the ethereum blockchain has driven up the cost of gas prices for transactions.

Data from Dune Analytics shows that the average price of the gas for a transaction hit $20, before normalizing back to around the sub-$1 mark Wednesday. Despite this spike, gas prices are still down 44% from a year ago.

Ethereum is currently trading at $3,200, according to CoinGecko, up 4.5% on-day.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.