French Authorities Charge 5 Over Theft of Bored Ape NFTs

Self-styled crypto-sleuth ZachXBT recognized for detective work surrounding alleged theft of Bored Ape NFTs

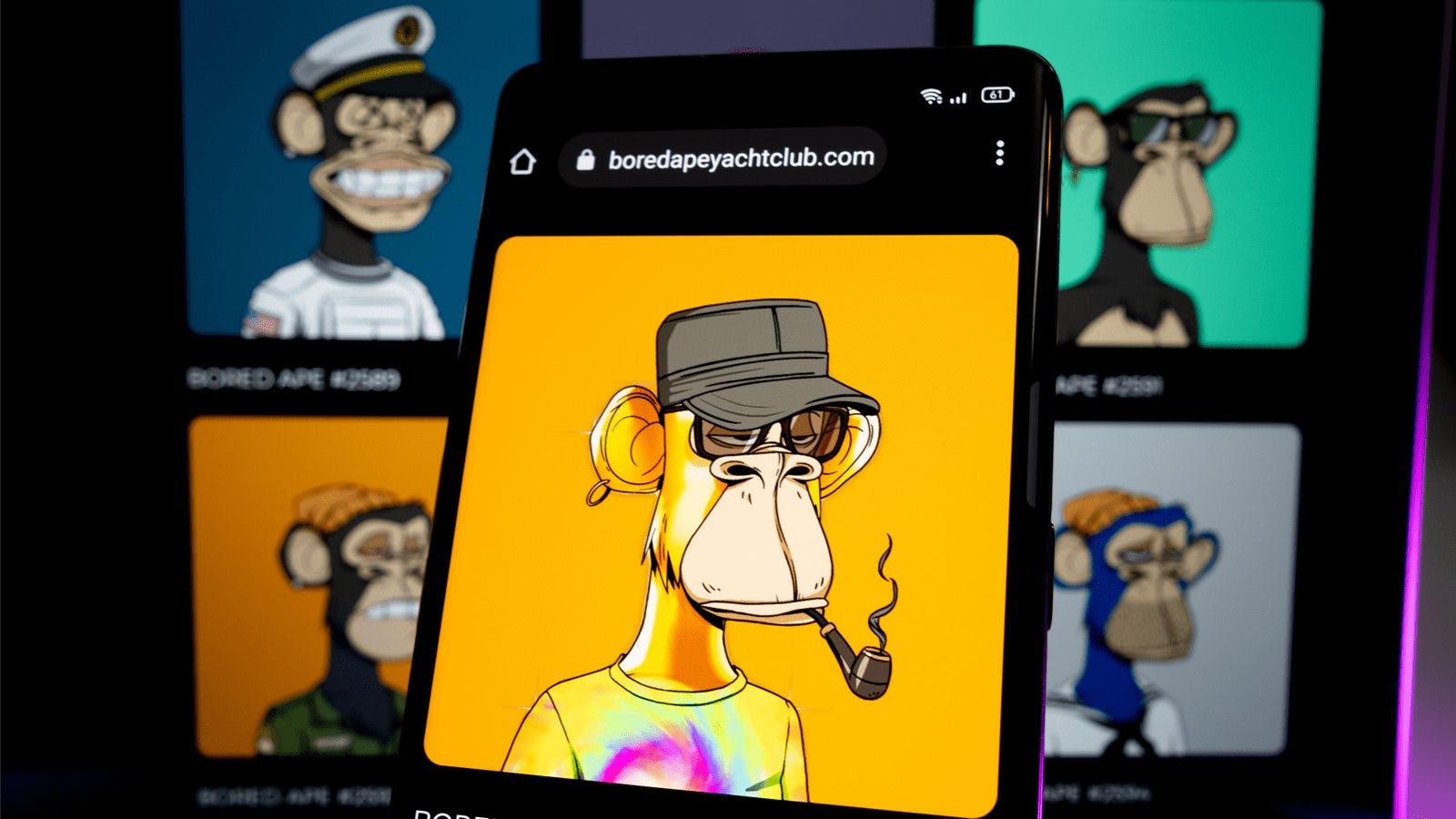

Bored Ape Yacht Club | Source: Shutterstock

- The individuals charged with the theft are said to be aged between 19 and 23

- Police investigations began in earnest after witnessing an internet sleuth attempting to track the stolen tokens

French authorities have charged five young individuals for allegedly using a phishing website to scam victims out of millions of dollars worth of their NFTs, including those belonging to the Bored Ape Yacht Club collection.

The five are said to have belonged to a criminal gang that stole the tokens, worth an estimated $2.5 million, between late last year and early this year, local media reported.

The alleged scheme saw the individuals use a website to con victims into handing over their tokens under false pretenses. The site promised to transform their tokens from static images into animated ones.

Among the five indicted, two are suspected of having masterminded the website including marketing. The other three are suspected of having conducted advertising for the site as well as money laundering.

Police said they opened an investigation in late August after being made aware of an analysis conducted by self-styled crypto-sleuth ZachXBT, who’d posted his findings to Twitter. Two of the individuals are said to have been identified using Zach’s detective work.

Around that time, Zach had identified at least three victims who’d been subjected to the scam. Police have identified five victims, including one individual who’d had three NFTs stolen, with one of the Bored Apes estimated to be worth over a million dollars.

“Over the past year, we’ve seen scammers become more creative with new methods to phish people in Web3,” Zach said at the time.

As a result of its own investigation, the Central Office for the Fight against Crime Related to Information and Communication Technologies — the country’s cybercrimes unit — placed seven people in police custody on Monday.

That included the five individuals charged, aged between 19-24, as well as the parents of one suspect — though the parents have since been released without prosecution at this stage, according to the report.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.