There’s a $450 billion behemoth forging BTC’s path to $100k

The Crypto-Industrial Complex is always churning, gobbling up coins much faster than they can be mined and sold

Sem_Sem/Shutterstock and Adobe Stock modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

Long ago, skeptics insisted that bitcoin was worthless because it had no intrinsic value. Times have really changed.

BTC wasn’t backed by anything, they’d say. There’s no revenue, cashflow or profits pooling with a single source, so no reliable framework for figuring how much each coin is worth. To zero, they said!

The correct answer was: Bitcoin doesn’t need to be backed by anything. Bitcoin backs bitcoin. After all, the first coins were sold only for the cost of the energy spent to mine them.

Today, there’s so much more to it. Bitcoin isn’t just powered by its industrialized mining sector.

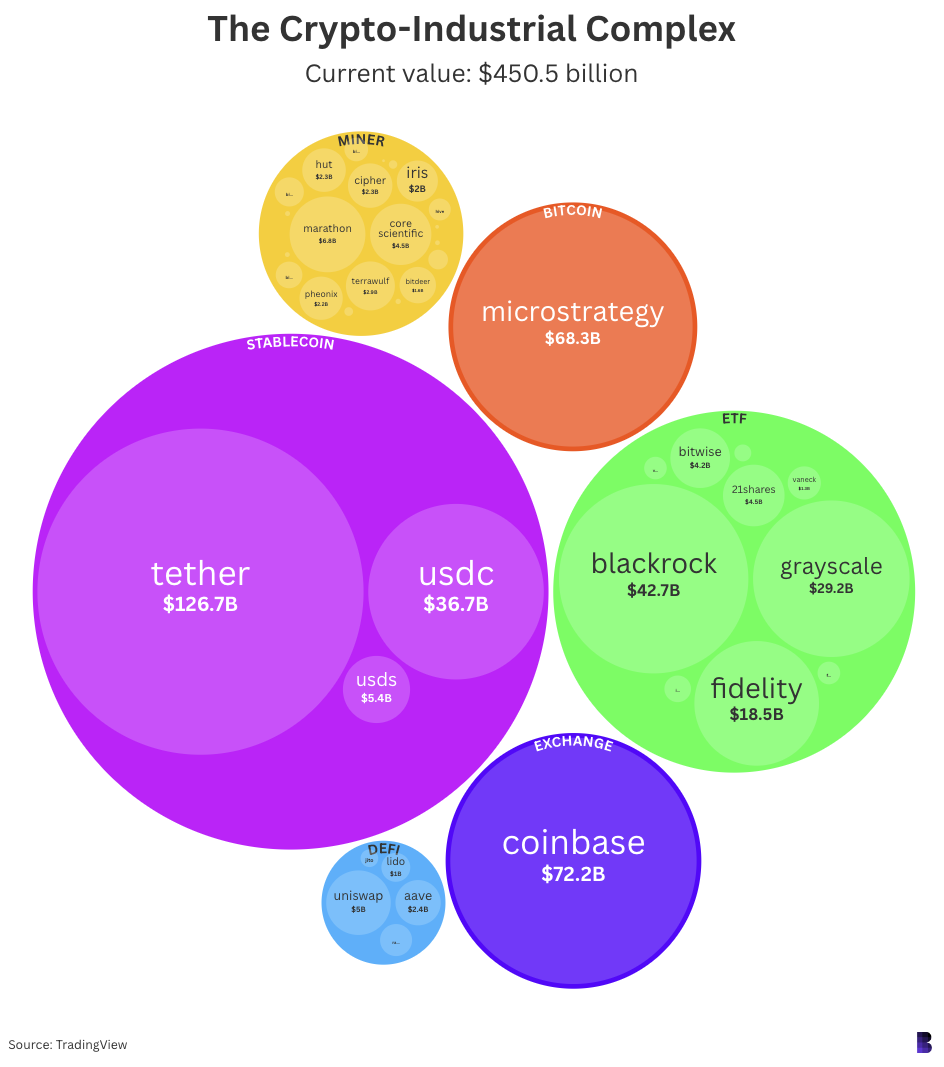

There’s now a whole Crypto-Industrial Complex forging a path for bitcoin and the wider crypto space — and it’s worth almost half a trillion dollars.

The half-trillion behemoth at the heart of crypto

The half-trillion behemoth at the heart of crypto

To be clear, the entire crypto market — as in the actual coins and tokens — has a $3 trillion-plus capitalization. The Crypto-Industrial Complex is a different beast.

It consists of the most prominent, influential, valuable entities and vehicles in the industry right now:

Publicly-traded stocks: MicroStrategy, Coinbase, bitcoin miners and ETFs.

Stablecoins: USDT, USDC and USDS (formerly DAI)

DeFi governance: Uniswap and Raydium (DEXs), Aave (lending) and restaking apps (Lido and Jito).

There are, of course, other big players worth including. Perhaps Ethereum giant Consensys, last valued at $7 billion in March 2022. Or Solana Labs and Binance, although the latter would’ve almost certainly taken a meaty hit to its valuation after its run-in with the DOJ.

Not to mention the other funds holding billions in crypto altogether that aren’t ETFs, which don’t show up in this data, like Bitwise’s index fund BITW and the ever-expanding roster of Grayscale trusts.

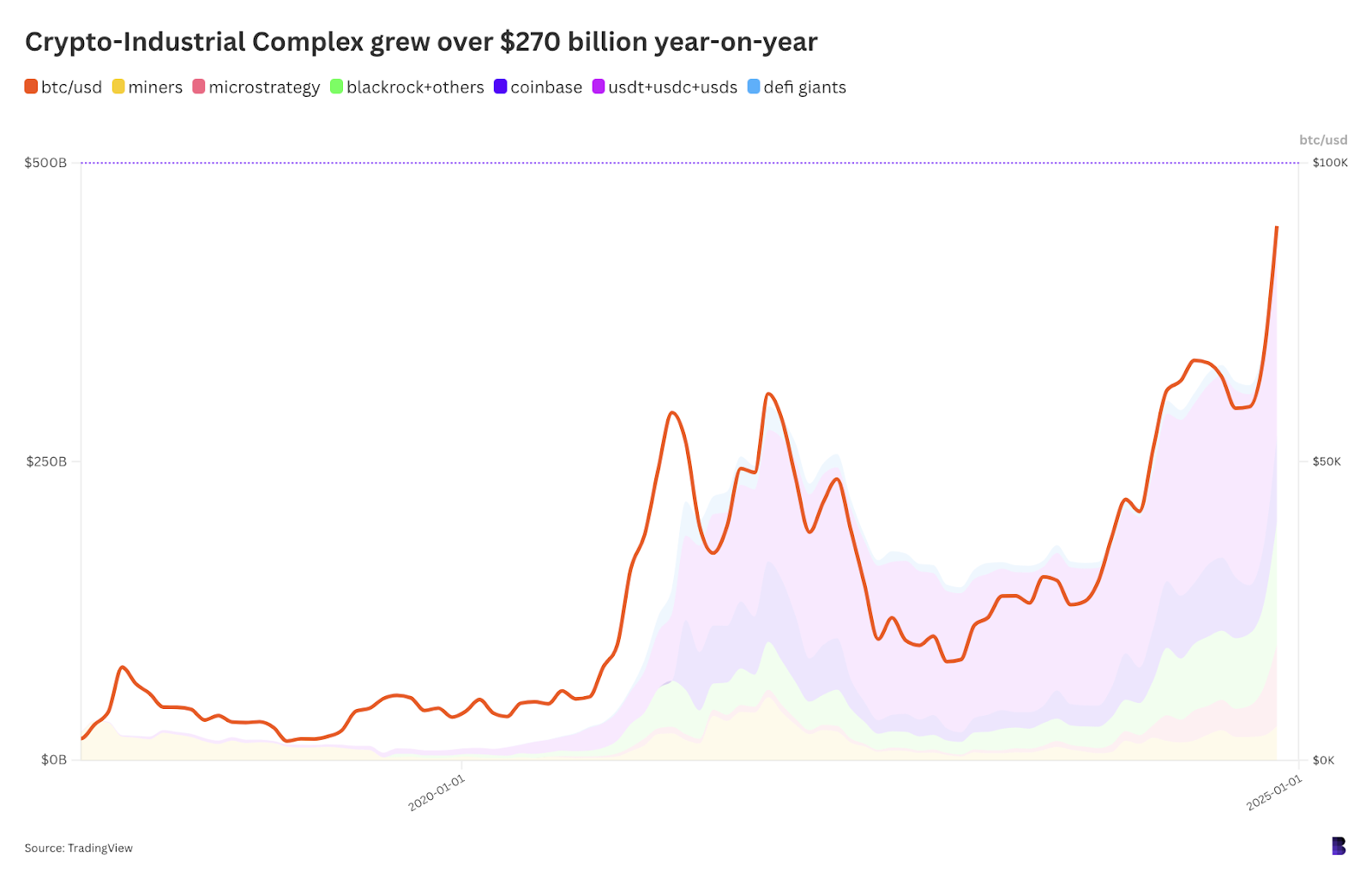

The Crypto-Industrial Complex now closely follows the price of bitcoin

The Crypto-Industrial Complex now closely follows the price of bitcoin

Still, for many, the Crypto-Industrial Complex as presented here would be the first points of entry into crypto (and, perhaps more critically for this newsletter, their valuations are easily trackable: up 140% year-on-year and 50% above its previous top in 2021).

- Michael Saylor, the bitcoin alpha bull provides the orange pull.

- Tether, the stablecoin with a compelling history, reveals just how deep the rabbit hole goes.

- Uniswap, Lido and Aave form the basis for DeFi 101.

- All while the public miners help keep Bitcoin humming.

The Crypto-Industrial Complex is always churning, gobbling up coins much faster than they can be mined and sold.

And here we are, just one more ~10% rally away from $100,000. If it felt unrealistic before, perhaps it’s because the Complex was much smaller than it is today, with fewer players.

Who knows what happens on the other side.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.