Aave’s Q3 showed resilient revenue and calmer rates — and Stani is eyeing a Q4 macro tailwind

Net interest remains the workhorse as liquidations prove the risk framework is sound

CineVI/Shutterstock and Adobe modified by Blockworks

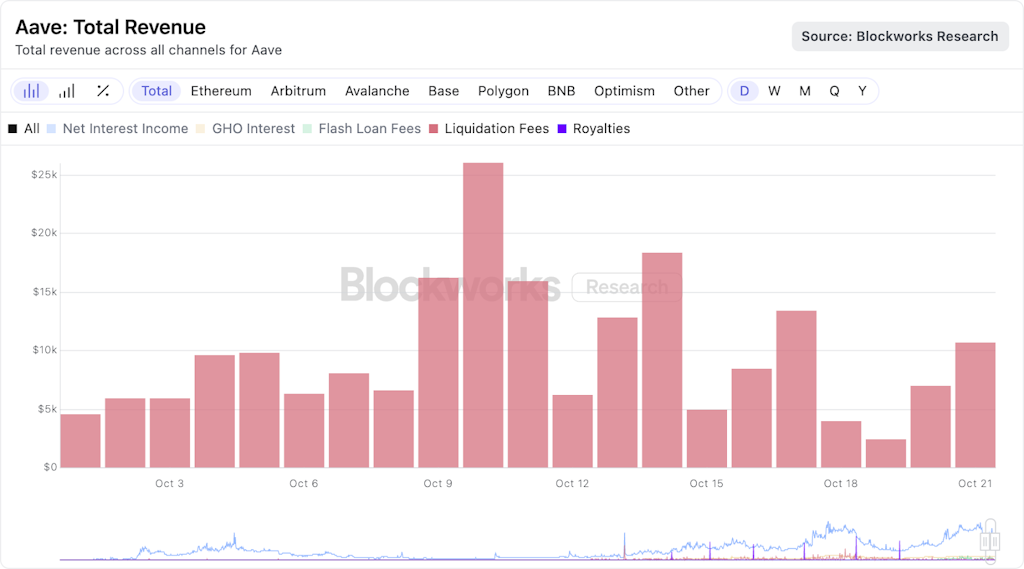

As markets melted on October 10, and many centralized exchanges stuttered, Aave didn’t flinch.

The protocol automatically liquidated over $200 million in collateral, preserving solvency without disruption, as Aave founder Stani Kulechov told a DAS London audience last week during a panel on DeFi rate markets.

“It was scary because of the size of the protocol today,” Kulechov said. “But things ended up well. DeFi really proved itself.”

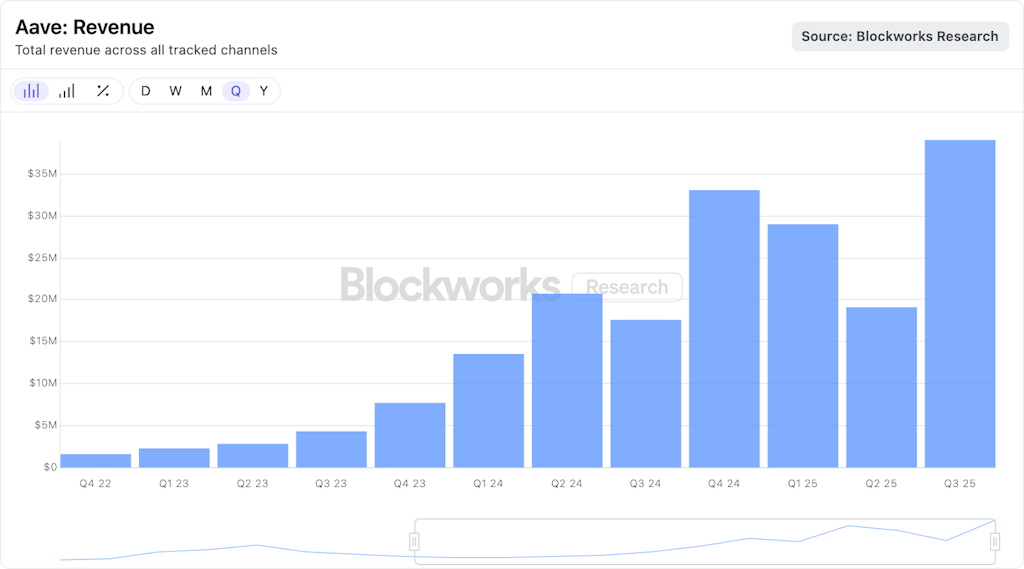

That resilience followed from a Q3 marked by steady deposits, healthy lending demand, and normalized rates. But looking ahead, Kulechov sees an even bigger shift coming: global rate cuts could reignite yield flows — and widen the rate spread between TradFi and DeFi.

The quarter ended with Aave’s lending machine looking sturdy and, increasingly, boring — in the good way. The protocol’s revenue stack was led once again by net interest income, with flash loans and liquidations a comparatively small slice. That’s exactly how the system is supposed to behave in a normalized rate regime.

Blockworks Research financials dashboard makes it easy to see the mix in one view | Source: Blockworks Research

Blockworks Research financials dashboard makes it easy to see the mix in one view | Source: Blockworks Research

A calmer rate backdrop also showed up in stablecoin supply APYs on Ethereum, which settled into the 3%–5% range after the late-2024 spikes.

Source: Blockworks Research

Source: Blockworks Research

That normalization coincided with a steady climb in total deposits and outstanding loans, pushing Aave’s footprint back toward cycle highs across deployments.

“What’s powerful about DeFi is transparency — you can actually see where the yield is coming from,” Kulechov said.

All together, that added up to a record quarter for the protocol, topping Q4 2024 and reversing a two quarter slide.

Source: Blockworks Research

Source: Blockworks Research

Kulechov was pleased with how DeFi dapps handled the bout of extreme volatility.

“They get stress tested based on the parameters and risk assessments done before events like this,” he said. “We liquidated over $200 million worth of collateral — that’s the native way the protocol keeps solvency in turbulence.”

Liquidation fee revenue, while modest, hit a 4-month peak | Source: Blockworks Research

Liquidation fee revenue, while modest, hit a 4-month peak | Source: Blockworks Research

Euler, by contrast, saw fewer liquidations, CEO Michael Bentley explained on the panel, citing a difference in the typical borrower mix.

“People build bespoke credit markets [on Euler] — some use just-in-time liquidity to market make or provide instant redemption for RWAs [and] every market on Euler has a unique use case,” Bentley said.

On product roadmap and Q4 direction, Bentley pointed to “more integrations with fintechs — and new products coming online.”

“We’ve been working a lot on fixed rate products, so we’re going to keep innovating and pushing out new products for integrators using Euler,” he said.

Kulechov’s focus heading into year-end is on macro.

“I’m super eager for central bank rates to go down. Historically, when that happens, financial innovation accelerates. Rate cuts could create big arb opportunities between TradFi and DeFi. If DeFi remains safe, we’ll see more traditional participants — neobanks, fintechs — plugging in for yield.”

When policy rates drift lower, spreads between on-chain funding and TradFi tend to widen, setting up the kind of basis-style flows that supported lending during prior easing cycles.

The quarter is also expected to see the launch of Aave V4, which aims to streamline the protocol’s architecture and expand its product surface for both crypto-native and institutional users.

Armed with granular data, DeFi watchers can track the same protocol levers Kulechov highlighted — deposits vs. loans, revenue composition, liquidation activity, and rate volatility — and judge whether the coming macro shift turns into the “arb opportunities” he expects.

If it does, Aave’s metrics should tell the story quickly: spreads widen, utilization grinds higher, and net interest continues to climb alongside deposits.

Watch the panel here:

The Next Generation of Rate Markets | DAS London 2025

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.