Arizona Senate advances effort to add crypto to state retirement funds

The concurrent resolution seeks to “encourage” pension fund managers to consider crypto in their allocations

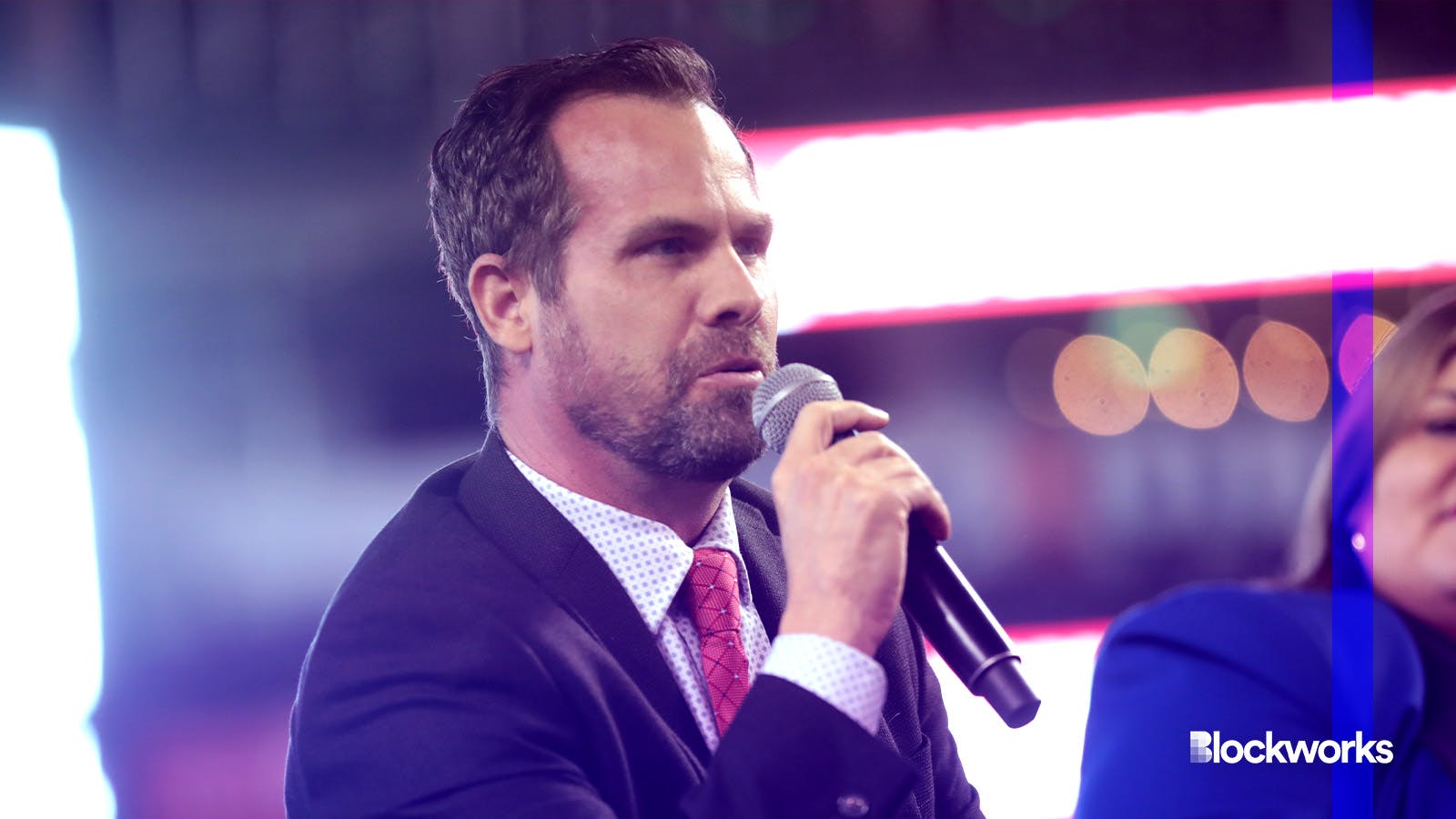

Arizona State Senate President Warren Petersen | Gage Skidmore/"Warren Petersen" (CC license)

The Arizona state Senate has advanced a resolution that would have lawmakers and state retirement fund managers look into allocating a portion of portfolios to bitcoin ETFs.

The concurrent resolution, introduced less than a month after the US Securities and Exchange Commission allowed bitcoin ETFs to start trading, seeks to “encourage” the Arizona State Retirement System (ASRS) and the Public Safety Personnel Retirement System (PSPRS) to monitor these new investment vehicles and consider adding exposure, according to a fact sheet.

The state Senate passed the resolution in a 16-13 vote late last month. Senators followed party lines, with all Democrats voting against the measure. The text is now before the state House Ways and Means Committee.

Republican state Senator Wendy Rogers, who in 2022 spearheaded an effort to make bitcoin legal tender in the state, voted in favor of the resolution. Rogers’ 2022 bill never made it to committee markup.

Read more: Arizona considers making bitcoin legal tender

As a concurrent resolution, the measure can proceed with support from the House and Senate, bypassing a signature from Arizona Governor Katie Hobbs. If passed it will not carry the same force as a law.

If passed, the resolution will ask the ASRS and PSPRS to create a “report on the feasibility, risk and potential benefits of directing a portion of state retirement system monies into digital asset ETFs, including a list of options and recommendations for how the state might safely invest in the digital asset class.”

It’s not the first time states have considered adding crypto exposure to pensions and retirement plans, but the newly-approved bitcoin spot ETFs provide a more accessible onramp.

A pension fund for firefighters in Houston, TX in 2021 announced a $25 million investment in bitcoin and ether, a purchase plan managers said was carried out via investment management firm NYDIG. A Fairfax County Police Officers Retirement System in Virginia started allocating funds to crypto-related investments in 2019, including a $50 million investment in Morgan Creek Capital’s blockchain fund.

Following bitcoin ETFs? Stay up to date with our bitcoin ETF tracker.

A CFA Institute survey in April 2022 found that 94% of state and government pension plan sponsors reported investing in crypto, although the nature of the investment vehicle was not specified.

The US Department of Labor has warned retirement plan fiduciaries “to exercise extreme care” before considering adding a cryptocurrency option to a 401(k) plan’s investment menu.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.