Bankless Is Now More Than a Media Company

Bankless is dipping its toes into the creation of DeFi tools under a new business vertical

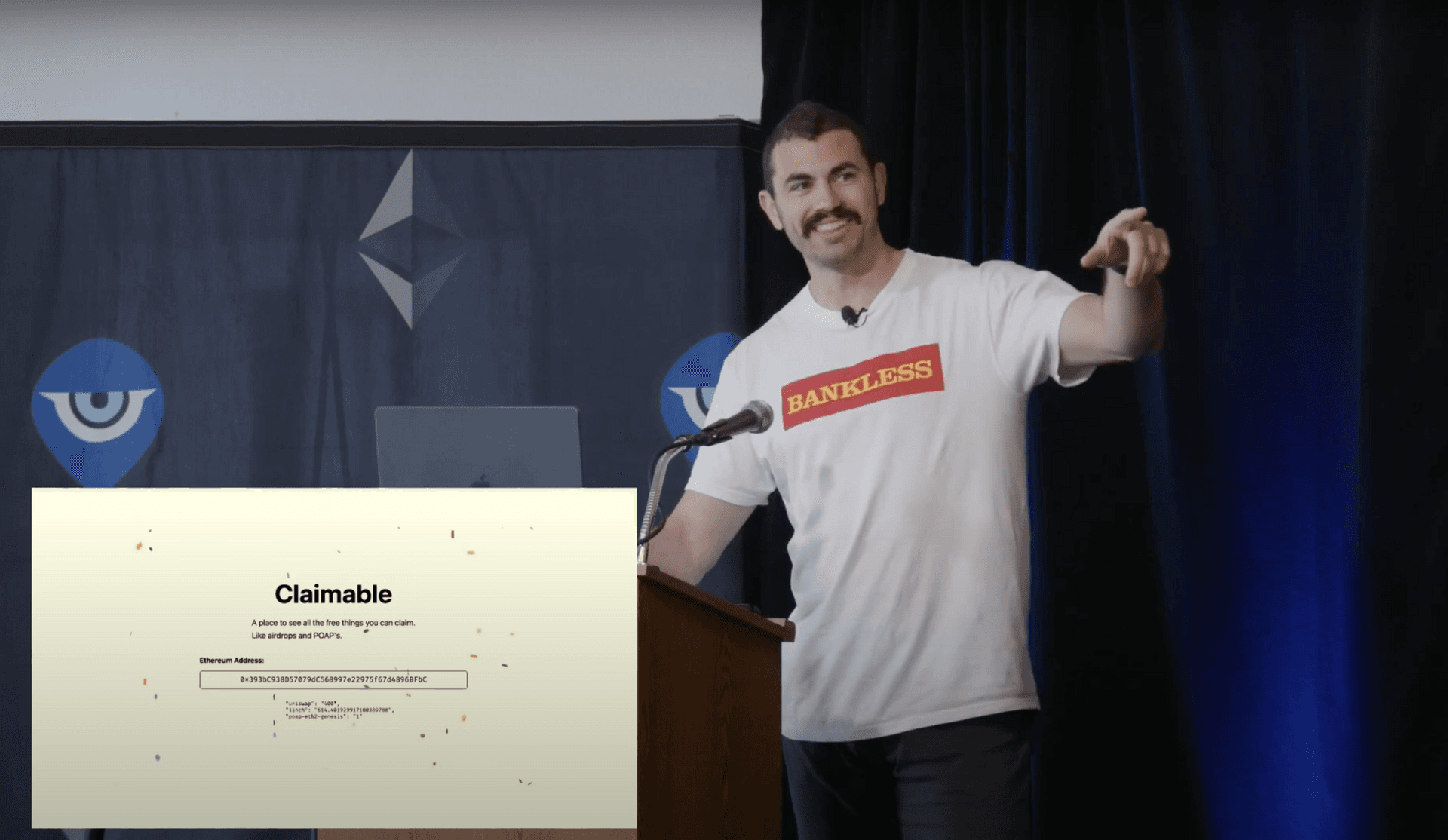

Bankless chief technology officer and Earnifi founder Dawson Botsford | Source: Bankless

Bankless, known best for its flagship podcast, is branching out beyond media.

The self-branded digital assets education outlet said Friday it is acquiring a tool designed to hook users up with software that automatically scans for unclaimed airdrops of digital assets.

Earnifi, picked up by the outlet for an undisclosed sum, will sit within a newly created vertical, dubbed Bankless Labs, which aims to bolster DeFi tools for its customers.

Terms of the deal were not disclosed, but it involves exclusively Bankless, LLC — the company started by Ryan Sean Adams and David Hoffman — and not the Bankless DAO, Bankless’ chief operations officer Rachel Cusack told Blockworks via email.

The purchase is part of Bankless’ ambitions to scale its educational programs next year, the outlet said in a statement. Its podcast has surpassed 30 million downloads, reinforced by a daily newsletter that now has more than 250,000 subscribers.

Seeking to leverage that growth, Bankless is hoping to scale into fresh markets with its Earnifi purchase. The startup said it has reclaimed a cumulative $150 million of lost assets.

Earnifi scans wallet data on chains compatible with the Ethereum virtual machine (EVM), such as Ethereum and Binance Smart Chain (BNB), to locate unclaimed airdropped tokens or NFTs. Users are notified via email of outstanding assets.

Co-founder Ryan Sean Adams said his company decided to acquire Earnifi after conducting a prolonged due diligence, including a number of conversations with its founder, Dawson Botsfor — following his fellow Bankless co-founder, David Hoffman, stumbling across the tool on Twitter early this year.

“EarniFi let him quickly check all of his Ethereum addresses, for all of the opportunities he had missed,” Adams said in a statement.

Added Adams: “A few minutes later, he was finding airdrops on wallets he didn’t even know he had.”

As part of the deal, Botsford is set to join Bankless as its first chief technology officer, where he will lead the Bankless Labs vertical.

Bankless, via its DAO, in true crypto fashion, issued a governance token, BANK, in May 2021. native governance BANK tokens to premium subscribers, with part of the token supply initial airdropped to premium newsletter subscribers.

The BANK token is a smart contract that runs on the Ethereum blockchain intended to be distributed directly from Bankless’ treasury. Holders can unlock certain perks, per its crowdsourced draft whitepaper.

As of publication, BANK was up about 13% in the last 24 hours, as denominated in bitcoin, to $0.0088 — propelled by an upswing on the news.

Disclosure: Bankless is a co-host of Blockworks’ Permissionless conference, a separate business line from editorial.

This story was updated on Dec. 2 at 2:03 pm ET with additional details.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.