Bitcoin Price Finds Footing Near $35K as Market Macro Conditions Badger Crypto

Daily volume on the sell-side for the Bitstamp exchange shows downside momentum also coincided with bitcoin’s recent sell-offs

source: SHutterstock

- Bitcoin is trading around the $35,000 mark and is down 18% over the course of a week

- Tensions mounting on the Ukraine border, inflation concerns and rising interest rates are adding fuel to macro market conditions

Bitcoin’s price continues to falter following hundreds of millions of dollars in liquidations on Thursday.

The world’s largest crypto by market value is currently changing hands for around $35,076, according to data by provider CoinGecko. Data also shows the crypto is down more than 18% over a seven-day period, its worst weekly showing in almost eight months.

“We are seeing a trifecta of forces coming into the new week,” Jon de Wet, CIO at Australian crypto trading firm Zerocap.

Tensions are rising on the Ukraine border, inflation concerns are finally being taken seriously by the market, and in response, the tapering and [interest rate] hiking cycle is being priced in aggressively, with risk assets being dumped.

The Nasdaq 100 ended Friday down about -2.4% and has fallen 9% over the past seven days of trading. The index is now approaching its early-October lows of around 14,400. Meanwhile, tech stocks including Apple and Google were also down by around 2.2%.

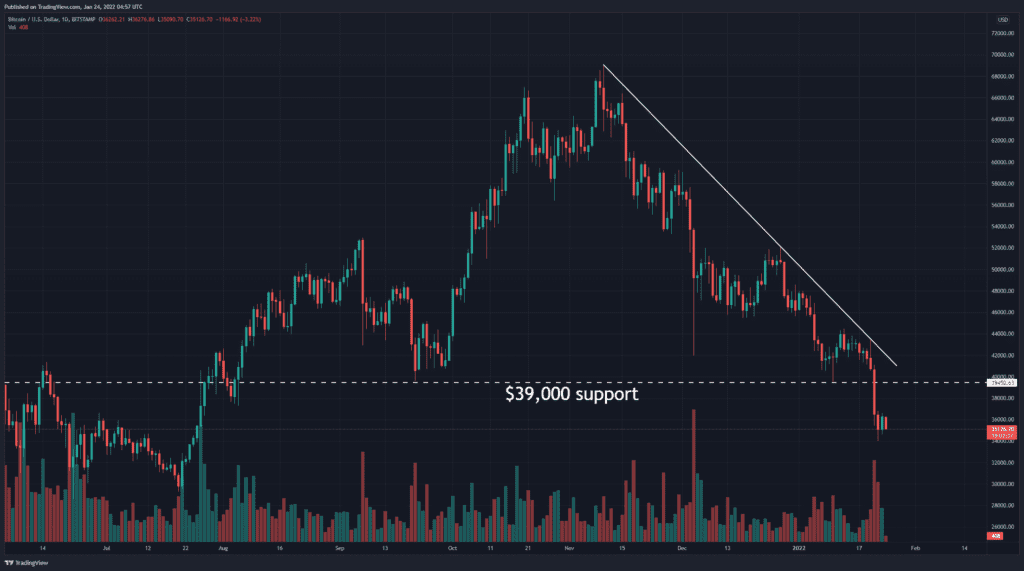

BTC/USDT – Bitstamp. Credit: Tradingview

BTC/USDT – Bitstamp. Credit: Tradingview

Daily volume on the sell-side for the Bitstamp exchange shows downside momentum also coincided with bitcoin’s recent sell-offs seen Jan. 19-Jan. 22. A drop in an asset’s price on the daily time frame, alongside growing seller volume, is generally considered a bearish signal in market technician terms.

Bitcoin’s daily chart shows a sharp decline in prices — buying pressure has failed to push prices above the sloping trendline — as well as a break of the previous support near $39,000.

With all of that said, crypto on-chain data is bullish, said de Wet. He noted long-term holders were “aggressively” buying the dip.

“The net position change on exchanges for BTC is negative — which means investors are pulling BTC from exchanges, creating supply constraints, said de Wet. “Perpetual Funding rates are bouncing between negative and positive — showing indecision from shorter-term traders.”

Other cryptos in the top 10 by market value were also down on the day with LUNA, DOT and SOL giving up the most gains between 1.8% to 10% respectively.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.