Bloomberg’s McGlone: Ethereum Will ‘Flip’ Bitcoin When World Transacts with USDT

Since its launch, Tether has almost always gone up and coincided with an increase in bitcoin’s value for the long-term view, Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said.

- After attending Blockworks’ Bretton Woods: The Realignment conference, McGlone said that crypto assets are enhancing the value of the dollar through stablecoins like Tether.

- “The performance of ether is up almost 400% and if you overlay that with bitcoin, bitcoin would be about $140,000,” he said

The world is going to transact digitally with the dollar — it’s just a matter of time, said Mike McGlone, senior commodity strategist at Bloomberg Intelligence.

Tether, also known as USDT (which stands for US dollar tether), is a stablecoin that aims to give traders a way to on-ramp and off-ramp crypto to dollars, so they have a safe harbor from volatility. In theory, stablecoins like Tether are backed by an equal amount of fiat currencies giving at 1:1 ratio though in reality that’s not always the case. Tether, and other dollar-denominated stablecoins, are often used by investors who want to avoid the volatility of other cryptocurrencies while still keeping value within the crypto markets.

“The world is going to trade in the dollar digitally, it’s just a matter of time. It’s about time for the US government to regulate it and then we will be crushing China,” McGlone said during the first Bloomberg Crypto Research Event on Wednesday.

The most widely traded crypto-asset is USD, and “there isn’t not one kind of any other currency on the planet even close to the volume traded organically and digitally on blockchains on something like this, it’s completely dollar-dominated and it shows what’s happening globally in the world,” McGlone said. When measuring the USD versus other currencies, there isn’t a better one, and “I think this is something that needs to be pointed out,” he added.

Source: CoinMarketCap

Source: CoinMarketCapUSDT has a market capitalization of over $65.62 billion, up 380.7% from $13.65 billion on the year-ago date. For reference, bitcoin’s market capitalization was $1.38 million on Wednesday, about 15% higher than $1.2 million on the year-ago date, according to CoinMarketCap data.

Since the launch of bitcoin, Tether has almost always gone up and coincided with an increase in value for the long-term view, McGlone said.

One of the top crypto trends McGlone said he’s watching is the digitalization of dollars. Bitcoin is well on its way to becoming the global digital reserve asset and after attending Blockworks’ Bretton Woods: The Realignment conference, McGlone said that crypto assets are enhancing the value of the dollar through stablecoins like Tether. “The most widely traded cryptos are digital versions of the dollar,” he wrote.

Ethereum to outpace bitcoin

Separately, McGlone keeps a close eye on Ethereum and has previously said to Blockworks, “Ethereum is basically the building block, it’s the go-to platform for the entire decentralization of finance.”

When Ethereum kicked in its new protocol change of EIP 1559, it reduced supply and has dropped the availability of the cryptocurrency to about less than 400 coins a day, which is a decent amount of supply constraints given the demand kicking higher due to NFTs McGlone said.

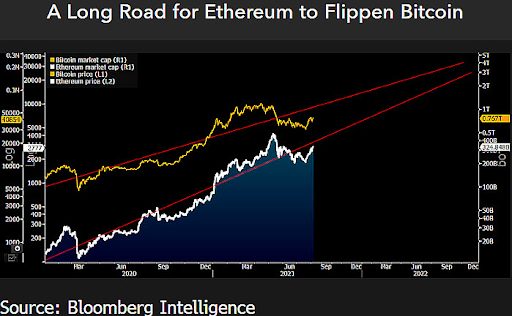

Bloomberg Intelligence previously reported, “If bitcoin were to catch up to ether’s performance this year, the No. 1 crypto’s price would approach $100,000. Though we see bitcoin on that path, there appears little can stop the process of Ethereum flippening.

“The performance of ether is up almost 400% and if you overlay that with bitcoin, bitcoin would be about $140,000,” McGlone said. “So I still expect bitcoin to get toward $100,000, the question is when, but right now it’s just a dog compared to what’s happening with Ethereum and DeFi,” he said.

Most NFTs are sold on Ethereum-based platforms, so to mint or trade one a user has to buy the ether, he added.

Riding the NFT wave, the largest NFT marketplace, OpenSea, hit $3 billion in monthly volume or 925,000 ETH during the month of August. In addition, the start-up has seen roughly 200,000 active wallets on its platform, Blockworks previously reported. According to NonFungible, NFT sales are valued at $1.6 billion for the month as of August 18, up from $900 million reported in the week prior.

“So there’s a demand push and supply constraint all happening at the same time and Ethereum is well below the high for the year which is about $4,500, to me that’s a matter of time to drag along bitcoin,” McGlone said.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.