CFTC Commissioner: Regulators Can Benefit from Blockchain, If Done Right

CFTC Commissioner Dan Berkovitz said that financial regulators can benefit from blockchain’s open source nature, but need to proceed with caution.

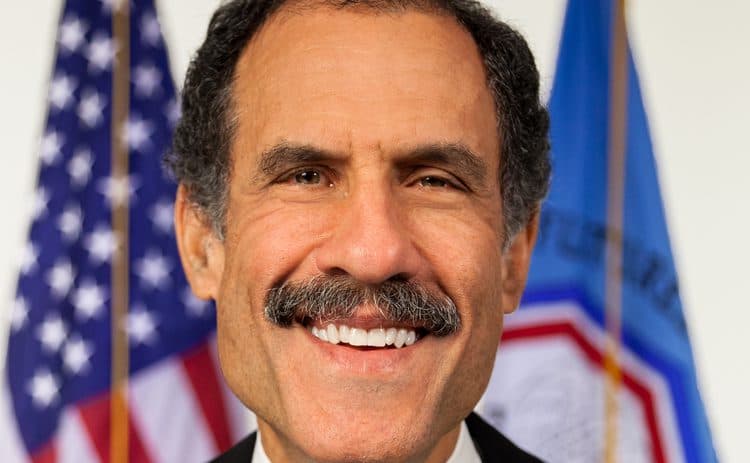

CFTC Commissioner Dan Berkovitz

- CFTC Commissioner Dan Berkovitz thinks the blockchain is an excellent source of information for financial regulators

- Decentralization does however pose a threat to the current regulatory framework and consumers will have to step up

Commodity Futures Trading Commission (CFTC) Commissioner Dan Berkovitz thinks blockchain will benefit United States regulatory groups in the long run, he said during a virtual panel hosted by Solidus Labs as part of its Digital Asset Compliance and Market Integrity Summit.

“There’s great potential, to the extent that transactions are conducted on an open blockchain, or something to that effect,” he said. “That can greatly help both us and the SEC in our market oversight. If there’s this additional public chain, there’s public analyses of who’s doing what.”

As much potential as the blockchain has, Berkovitz said, cutting out intermediaries does pose a regulatory threat.

“Right now, intermediaries in our markets are sort of critical,” Berkovitz said. “The point of regulation really falls most heavily on the intermediaries.”

The role of the intermediaries

Market intermediaries today, Berkovitz explained, are responsible for operating exchanges and a number of other associated functions. These groups control manipulation and clearing in addition to ensuring trading isn’t disrupted and funds are available.

“We have licensed entities that are responsible for assuring the integrity of the market, and protecting and safeguarding customer funds, and I believe we have a pretty robust system for doing it. It’s not foolproof. By no means is our system foolproof, but it works pretty well,” he said.

Unregulated exchanges do not face the same scrutiny from officials and are not performing the same regulatory safeguarding procedures, Berkovitz warned.

“My concern is that in an unregulated system where nobody’s accountable, the customer is out on their own. That model doesn’t doesn’t work very well,” Berkovitz said. “You’re going to have to have a protocol that addresses the issue, but not all regulation falls on the intermediaries, some of the falls on the market participants themselves.”

But it’s not just intermediaries that hold regulatory responsibility, Berkovitz said. It’s also consumers, especially in the case of decentralized exchanges.

“Absent intermediaries, the burden of regulation, of reporting, of record keeping, of ensuring positions aren’t too large, may fall or would fall directly on the market participants,” he said. “It’s not as if you can take the intermediaries out and there’s no regulation, there will still be regulation with the market participants, and they will be left to come up with a regulatory system on their own.”

When asked if he sees the CFTC or Securities and Exchange Commission implementing a market surveillance system in crypto, Berkovitz said different officials will be involved in that discussion. He encouraged all interested parties to reach out to the CFTC with questions or comments.

“We’re an open agency, so please contact us,” he said. “We are actually here to build markets safely.”