CFTC Steps Up Crypto Enforcement, Sues Exchange Gemini for ‘False’ Statements

Gemini “made false or misleading statements” to the CFTC in 2017 in the bitcoin futures contract evaluation, according to the agency

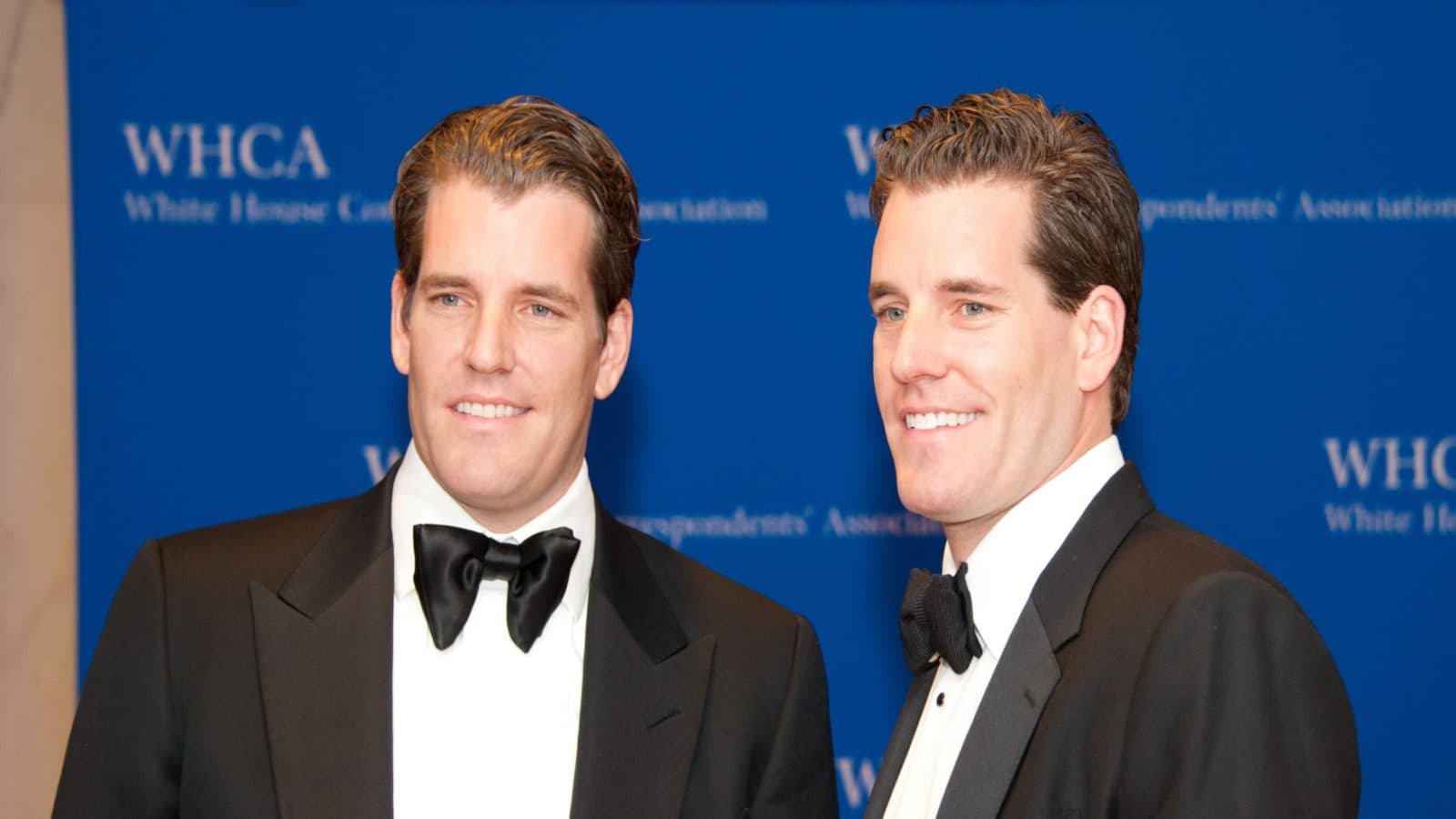

Cameron and Tyler Winklevoss, co-founders of Gemini | Source: Shutterstock

- The CFTC filed a complaint against Cameron and Tyler Winklevoss’ Gemini for making false or misleading statements in the bitcoin futures contract evaluation in 2017

- Earlier Thursday, Gemini said it would lay off 10% of its workers due to the crypto market downturn

The Commodity Futures Trading Commission sued cryptocurrency exchange Gemini Thursday in the regulator’s latest escalation against what it considers bad actors in the digital assets industry.

In a lawsuit filed in the Southern District of New York, the CFTC claimed the company’s founders, brothers Cameron and Tyler Winklevoss, in 2017 “made false or misleading statements” to the watchdog during the exchange’s application for bitcoin futures contracts — which the CFTC said could have been susceptible to market manipulation.

In a statement, the CFTC said it will seek disgorgement of ill-gotten gains, monetary penalties and injunctions relating to registration and trading and against further violations of the Commodity Exchange Act.

“This enforcement action sends a strong message that the Commission will act to safeguard the integrity of the market oversight process,” said Gretchen Lowe, the CFTC’s acting director of enforcement.

Earlier Thursday, Gemini said it would lay off 10% of its workforce due to the crypto market downturn.

In a statement, a Gemini spokesperson said the company has been a “pioneer and proponent of thoughtful regulation since day one,” adding the exchange looks forward to “definitively proving this in court.”

Bitcoin futures contracts began trading on the Cboe Futures Exchange at the end of 2017 based on Gemini’s auction price for bitcoin.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.