Consensys CEO Joe Lubin hints at future LINEA perks

The Ethereum co-founder suggested LINEA holders would be eligible for other airdrops in cryptic tweet

Consensys CEO Joseph Lubin | DAS 2025 New York by Mike Lawrence for Blockworks

This is a segment from The Drop newsletter. To read full editions, subscribe.

The TGE for LINEA has begun — and Consensys CEO Joe Lubin is hinting that more tokens are coming.

LINEA is the token for Consensys’ existing Ethereum L2 zk rollup of the same name. The token comes roughly two years after the Linea blockchain’s mainnet launch.

But LINEA isn’t the chain’s native gas token — it’s using ETH for that. LINEA also isn’t a governance token, either, which might lead some to ask: What is it for?

LINEA’s market cap was higher than $560 million at launch. That’s already been sliced down to $360 million as of Thursday morning — a 36% plunge in less than a day.

For better or worse, a token’s price history tells a story. While that story can certainly be manipulated or subject to macroeconomic pressure, token price fluctuations can also be an indicator of interest over time.

Lubin is now telling traders why he thinks the LINEA token is worth hanging onto: You may get a lot more tokens.

“Just holding Linea will open up further rewards opportunities, mostly in other tokens,” Lubin wrote late Wednesday night. “MetaMask and Linea are cooking somETHing together to make this happen.”

He added: “If we notice, at some date in the future that you’ve held n LINEA tokens for m days, that just might lead to another token landing in your account.”

Does this mean MASK is coming?

Lubin previously confirmed a MetaMask token was part of the bigger plan back in 2022, though that hasn’t materialized yet.

Now that the US regulatory outlook has changed, it’s possible that dream may be revived.

MetaMask recently announced its own stablecoin, mUSD, which will exist on Ethereum and Linea.

While we’re speculating, Lubin’s comments could alternatively mean some kind of yield could be in the works, whereby holding LINEA in your fox wallet results in other tokens (like ETH or mUSD) being earned over time.

But the way his comment was phrased — with other tokens just “landing” in your wallet one day — sounds more like he’s describing future airdrops across one-time events and not a steady earning mechanism.

Hence my speculation that a fox token (that’s not a stablecoin) could be coming.

Lubin’s comments didn’t appear to inspire a surge of buyers to drive LINEA’s price back up. Since his post, LINEA’s price has more or less remained stable around $0.02 with a $360 million market cap. The dangled carrot of future rewards might have prevented further selloffs, though.

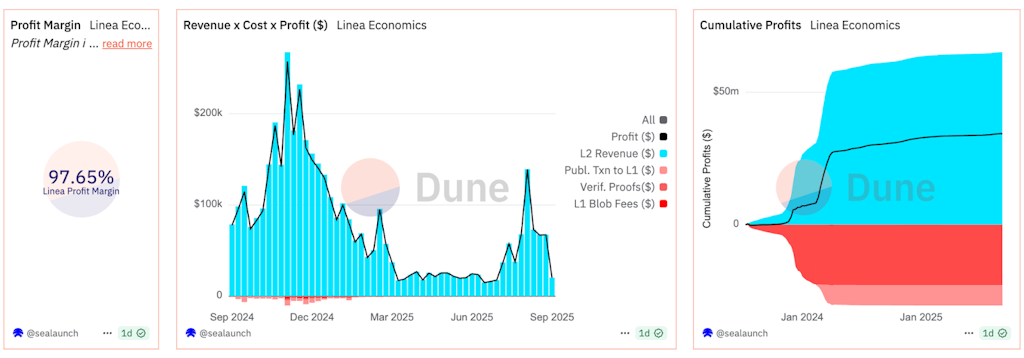

Image: A look at Linea’s profitability as a chain.

Image: A look at Linea’s profitability as a chain.

As a chain, Linea is profitable for Consensys. It’s seen over $65 million in L2 revenue so far, with a profit of over $34.3 million after subtracting costs for proofs and other fees, according to SeaLaunch data on Dune.

It’s still much smaller than Base and Arbitrum from a profits standpoint, but it’s still in the game.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.