Crypto funding tops $6B in July: Blockworks Research

DATs contributed to the increase in funding in July, which topped levels not seen since 2021

CashGuy/Shutterstock modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

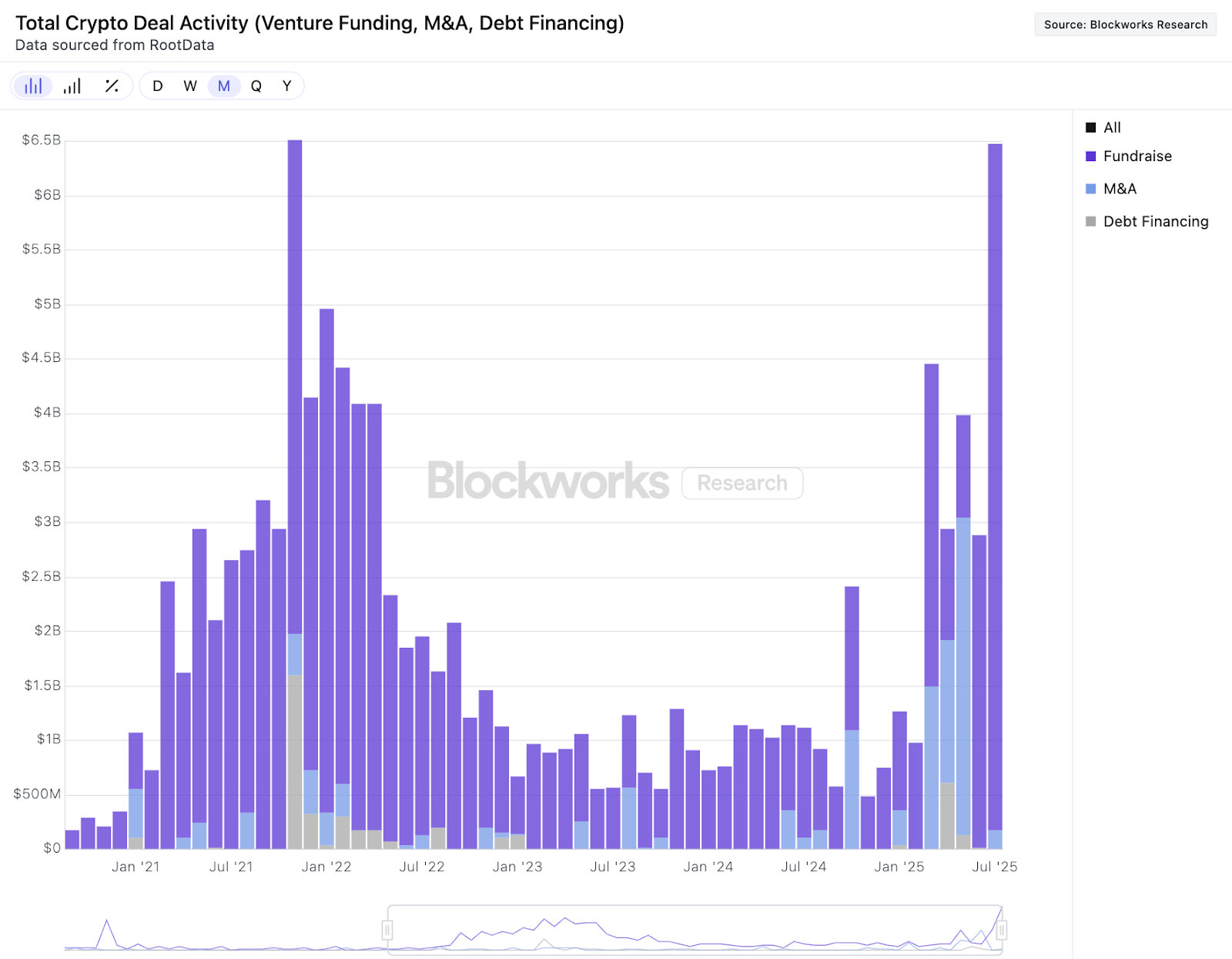

In July, we saw over $6 billion go into funding, a pretty big increase in comparison to June, according to Blockworks Research data.

Look at the itty-bitty June bar in comparison to July

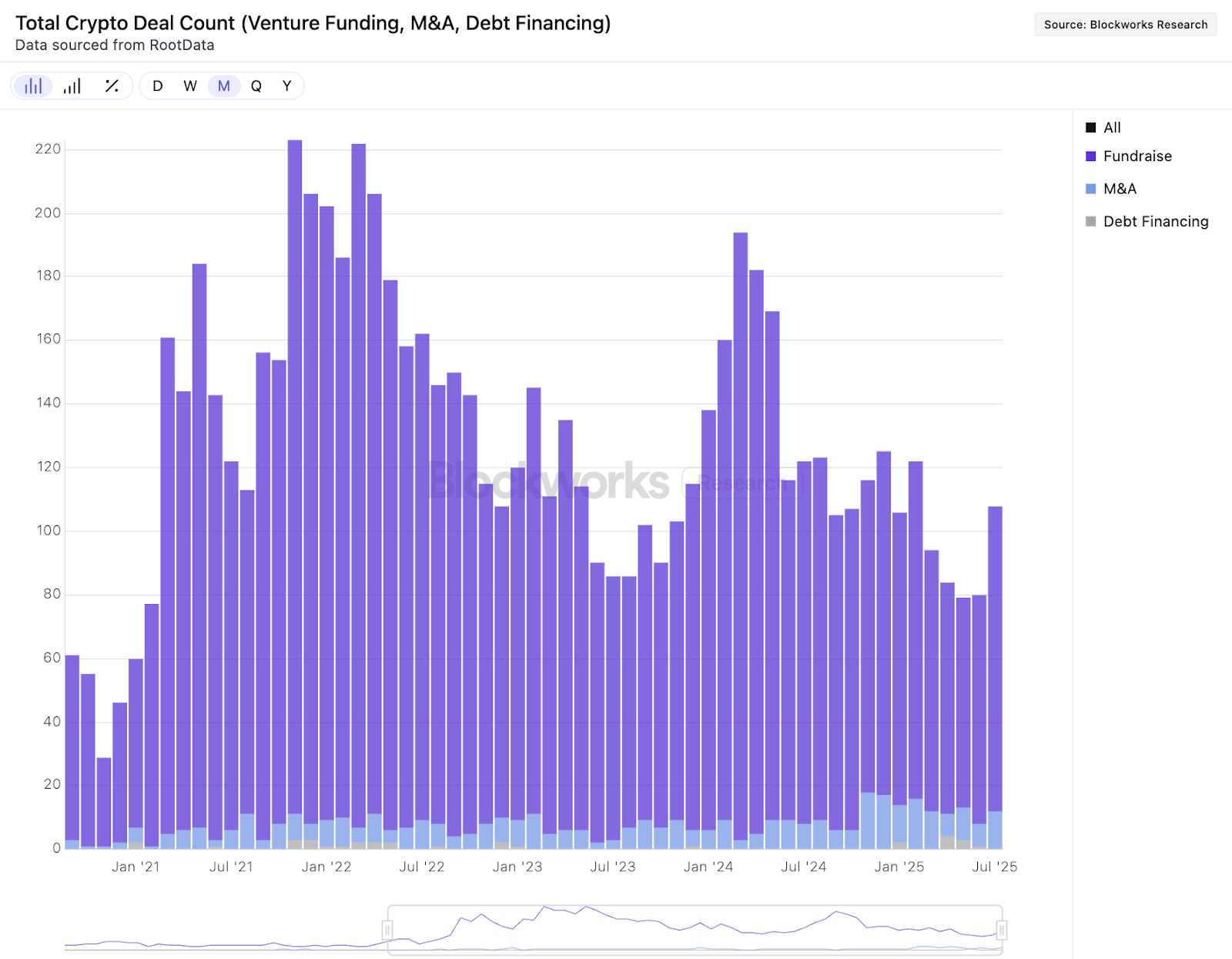

Of that $6 billion, roughly $177 million came from M&A activity. To break that down further: 96 raise announcements were made in comparison to just 12 M&A announcements. Both June and May saw 10 or fewer M&A announcements, it did pick up ever so slightly.

To give you a better idea of the breakdown

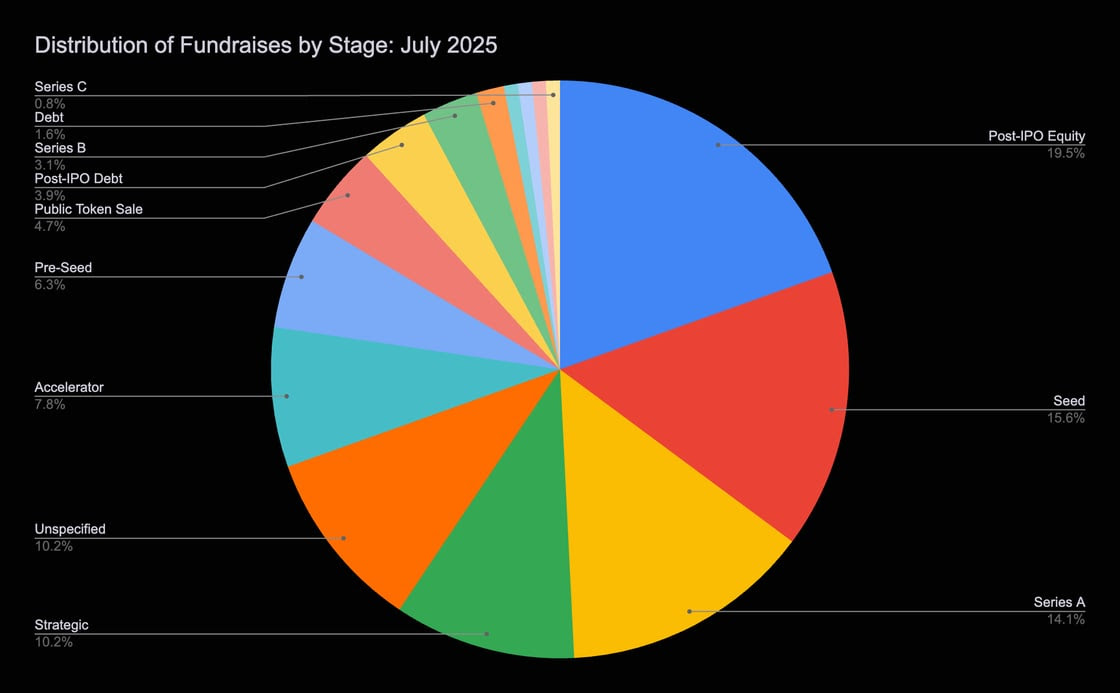

If we look at TIE data, which included Digital Asset Treasury company raises, then we can also gauge what stage of raises were the most popular last month.

Source: The TIE Terminal

With the rise of the Digital Asset Treasury companies, there is a decent amount of post-IPO equity being raised. But, excluding DATs, most raise announcements were either seed rounds or Series A rounds.

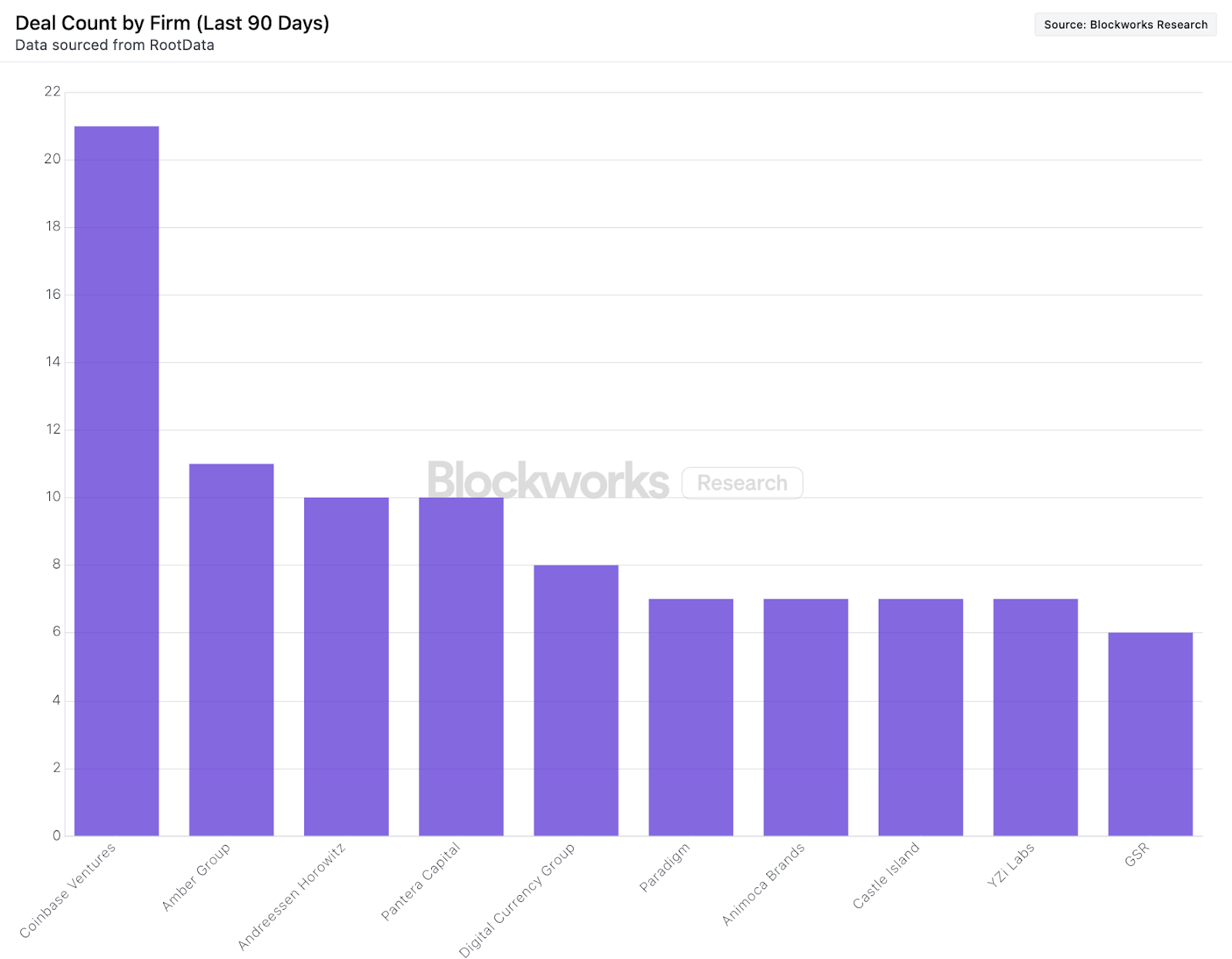

Let’s break down venture funding further: Coinbase Ventures was one of the most active investors in the last month, participating in 21 rounds.

To put all of this in perspective, June saw a bit of a comeback in funding after a very slow May, and it looks like July is yet again showing another pick up.

Last month also outpaced March, which had been the most successful month since 2021 based on Blockworks Research data, which goes to show how large the appetite is. Currently, DATs clearly reign supreme if we’re looking at total fundraising.

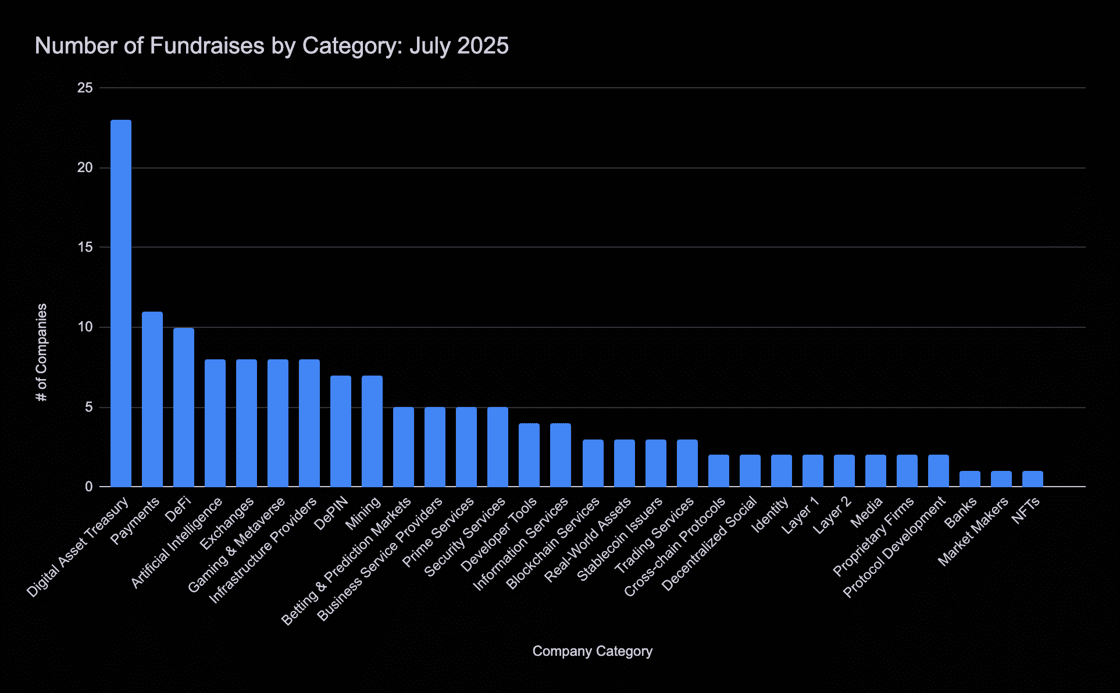

Source: TIE Terminal

Payments, however, also saw a decent amount of activity. As did DeFi (which was the second most popular category in June for fundraising).

Here’s my take: DATs are the hot item of the moment, and it shows in the data. However, I’m curious to see if they can continue this momentum into August (which, like the summer months, tends to be seasonally weak) or if we’ll see a slight decline next month.

But overall, the data looks pretty strong at this point, and we didn’t even really touch on just how successful crypto IPOs have been.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.