Venture capital funding tops $2.8B in June

Blockworks Research data shows that VC spending is back on the rise after a slow May

Rrraum/Shutterstock modified by Blockworks

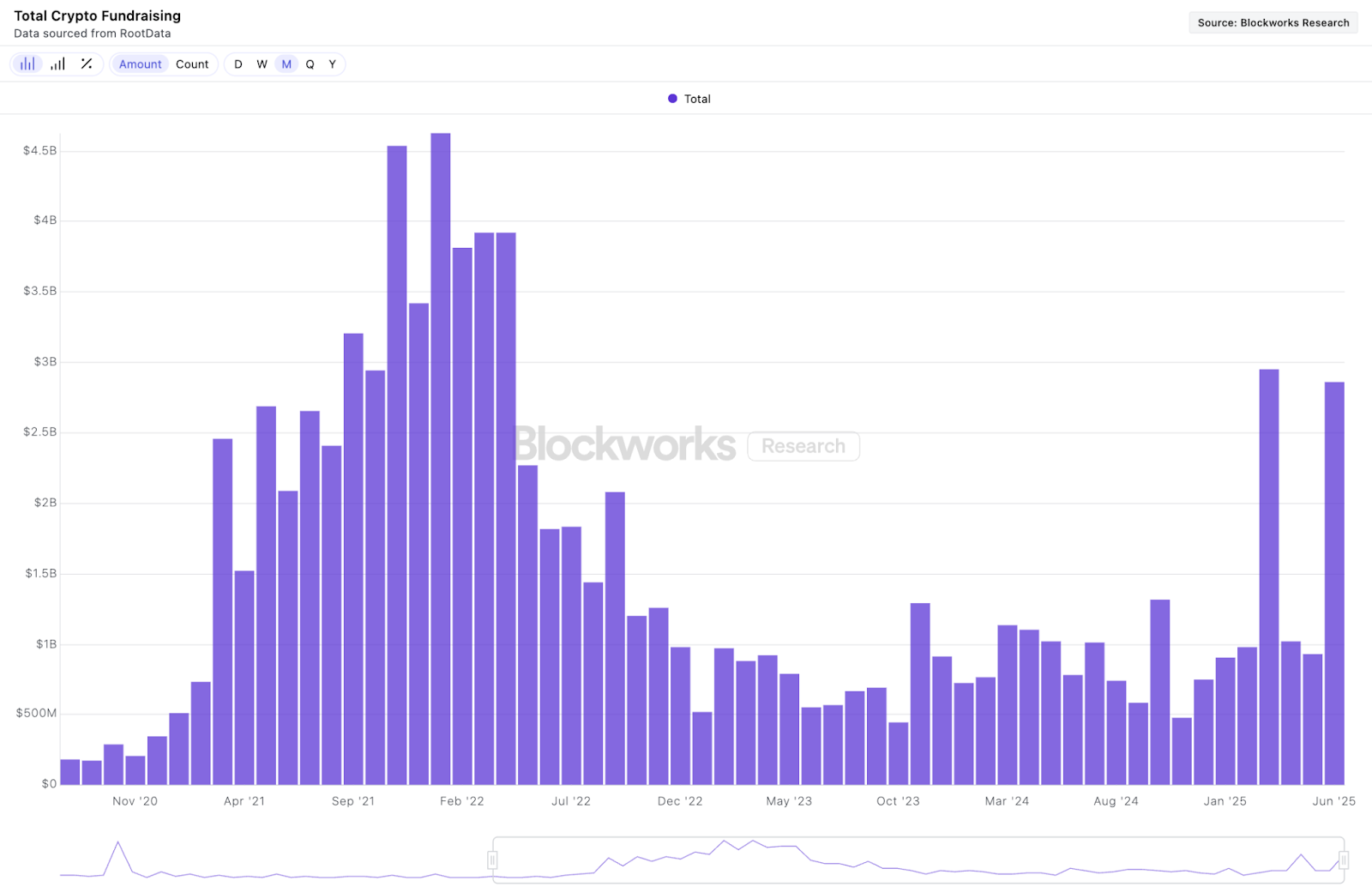

I’ve got some good news for you: Venture capital fundraising seems to be bouncing back after a slow May.

According to Blockworks Research data, there was roughly $2.8 billion raised last month.

Source: Blockworks Research

Source: Blockworks Research

If you remember from the last time we took a look at this data, VC funding topped off around $594 million in May. A dip from April, and quite a decline from March (which saw $2.9 billion in funding).

As you can see in the chart above, even last month’s impressive numbers don’t top March, but they did come pretty close.

The biggest rounds last month came from Kalshi (raising $185 million in a Series C), Digital Asset ($135 million), and Zama ($57 million). If you want to include private token sales, then World Liberty Financial joins the list after the UAE bought up $100 million of WLFI and a16z bought up $70 million worth of EigenLayer’s tokens.

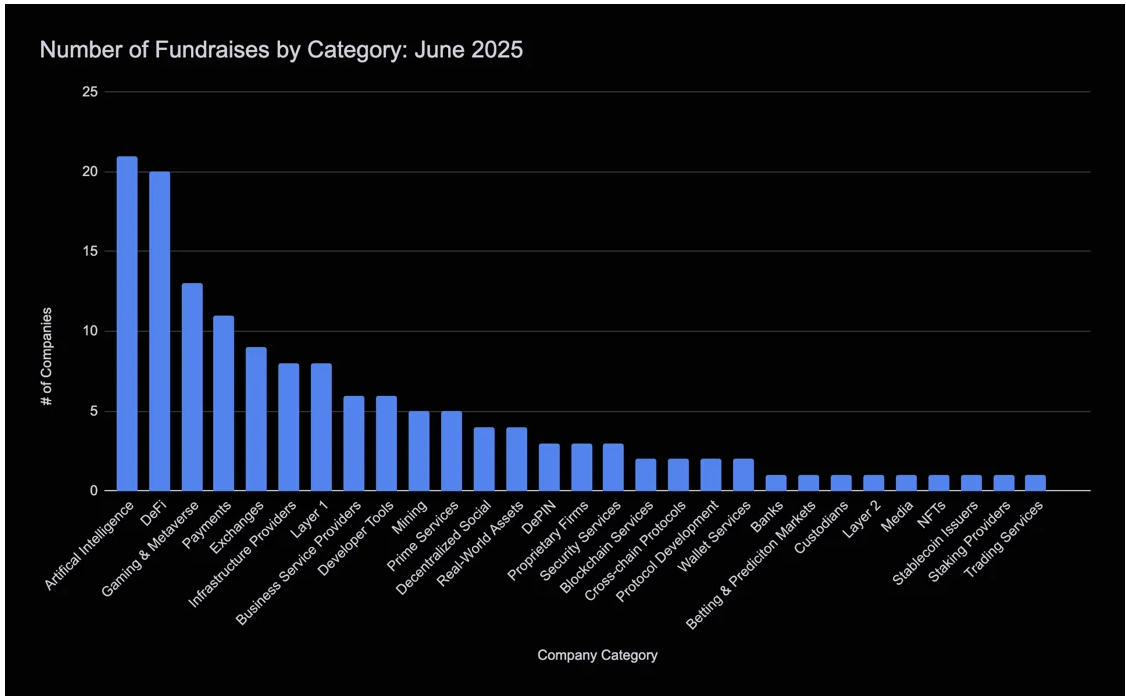

Per Tie Terminal data, 21 projects with a focus on artificial intelligence raised roughly $116 million last month.

Source: Tie Terminal

Source: Tie Terminal

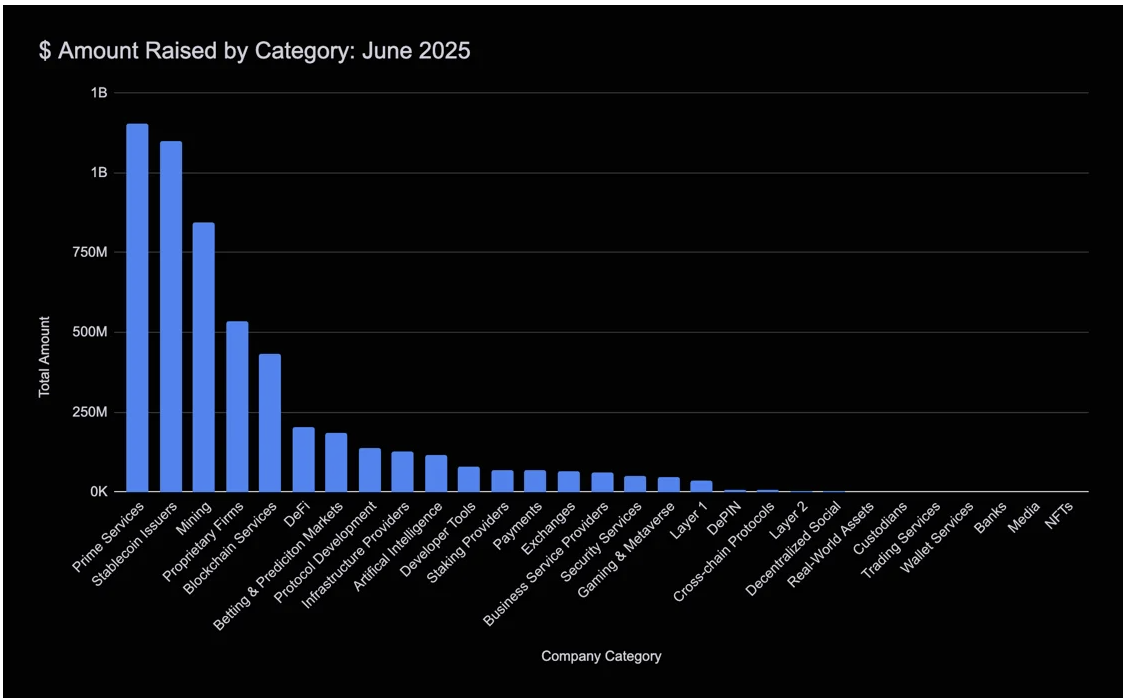

But while it had the most deals, it wasn’t the biggest category by amount raised…not by a long shot. Instead, that award goes to Prime Services, which is basically a fancy way to sum up firms offering a variety of financial services.

Source: Tie Terminal

Source: Tie Terminal

Five prime services projects raised a collective $1.15 billion in funding last month. So while AI is the hot narrative, and we are seeing folks put their money where their mouths are, clearly the bulk of the funding is still going toward projects that offer financial services.

Blockworks Research data also points to infrastructure still receiving a fair share of funding. Infra projects raised a whopping $881 million last month.

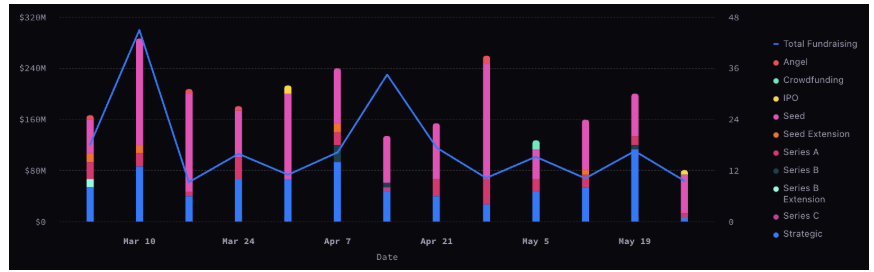

But the most interesting data — for me at least — actually comes from the breakdown of the funding. Not by category, but rather by type.

Looking back at Blockworks Research data, later-stage funding is on the rise. Pre-seed and seed rounds raised around $121 million, but Series B raised $127 million. And even later rounds, which go from Series C to F, raised $185 million.

Types of raises from May, per Tie Terminal data

Types of raises from May, per Tie Terminal data

On average, in May, the biggest type of raise came from seed rounds, so clearly there was a shift. While it’s notable, especially as crypto continues to digest Circle’s IPO, it’s a bit too early to read much into it. It is, however, a data point I plan to keep a close eye on next month.

Overall, though, this was exactly the rebound I was looking for after examining May’s data last month. It shows that there’s still a lot of strength in certain categories, while things like AI are seeing more of a pickup when it comes to VC attention.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.