Crypto Index Primed for Launch as Financial Adviser Interest Grows

Offering made available to financial advisers through Onramp Invest’s platform and custodied by Gemini

Source: Blockworks

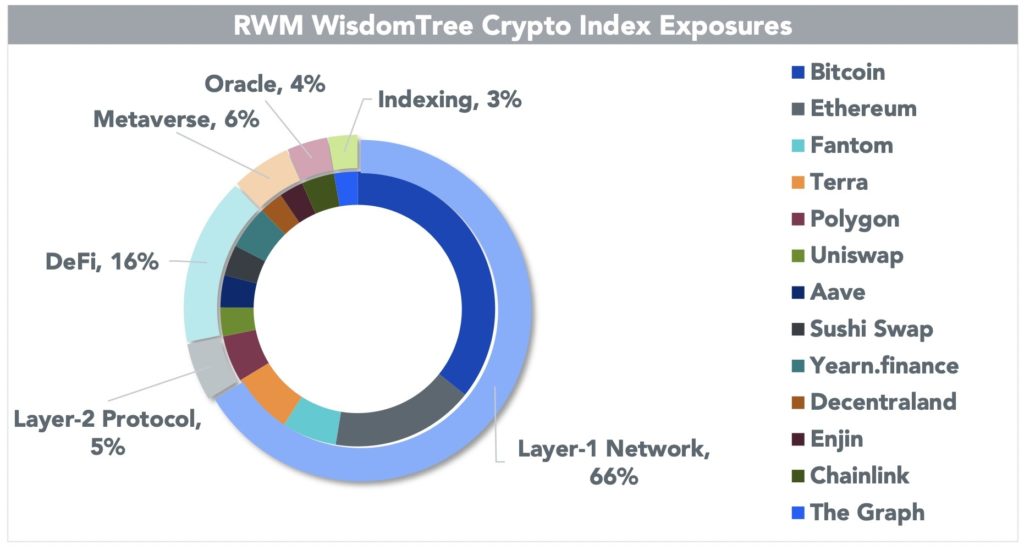

- The index comprises 13 cryptoassets, with bitcoin and ether making up a combined 53%

- Separately managed accounts are the best way to get diversified crypto exposure in the US, WisdomTree CIO says

A crypto index devised by WidsomTree Investments and Ritholtz Wealth Management is set to become more widely available next week as more financial professionals have indicated interest in the space.

The RWM WisdomTree Crypto Index (RTREE) — available via a separately managed account (SMA) — was made available to Ritholtz clients in December.

In the time since, Ritholtz has opened, funded and invested client cash as it fine-tunes operations, according to Michael Batnick, the wealth management firm’s managing partner.

“There’s a lot that needs to go into making sure that advisers can get comfortable here, because a lot of people are wary of crypto in general,” Batnick told Blockworks. “So, any sort of funkiness or glitch in the matrix and people will get very nervous.”

Roughly 200 advisers have expressed interest in the index, Batnick added. And Ritholtz is in talks with several multibillion-dollar registered investment advisers (RIAs) about the offering.

The index will become available to all advisers on March 1 through Onramp Invest, which supplies the SMA architecture, rebalancing technology and adviser support. Crypto platform Gemini is its custodian.

Ritholtz and WisdomTree will split a fee of 50 basis points from new investors, while Gemini and Onramp will split a one-time transaction fee of 70bps.

WisdomTree Chief Investment Officer Jeremy Schwartz said during a virtual event Tuesday that the index aims to offer exposure to bitcoin and ether, while capturing potential upside in altcoins.

Bitcoin and ether currently account for 36% and 17% of the index, respectively. Allocations to 11 other coins — Terra (LUNA), Uniswap (UNI), Chainlink (LINK), Polygon (MATIC), Decentraland (MANA), Fantom (FTM), The Graph (GRT), Aave (AAVE), Enjin Coin (ENJ), Yearn.finance (YFI) and SushiSwap (SUSHI) — range from 3% to 7%.

Source: WisdomTree

Source: WisdomTreeThe plan is to review exposures monthly. Avalanche (AVAX), which Gemini doesn’t support, is an asset WisdomTree could add in the future, Schwartz said.

Looking to fill a void

The launch comes on the heels of financial advisers increasingly looking to invest client funds in crypto. A survey by Bitwise Asset Management and ETF Trends last month found the percentage of financial professionals investing client funds in crypto rose from 9% to 15% over the past year.

An additional 14% said they will “probably” or “definitely” buy crypto this year, according to the research.

“I believe in holding the underlying but in a package that is very similar to what advisers are used to,” Onramp Invest CEO Tyrone Ross Jr. said during the virtual event. “You shouldn’t be scared or worried about custody or cold wallets or hot wallets or anything like that. Let’s take that away.”

Though WisdomTree has launched exchange-traded products (ETPs) that offer diversified crypto exposure in Europe, the SEC has not yet allowed spot crypto ETFs in the US. Schwartz called bitcoin futures ETFs, which the SEC approved in October, “suboptimal” products.

“We saw…from our experience that the SMA is probably going to be the best structure for a long period of time — for sure if you want this diversified exposure,” Schwartz said.

The index is set to launch as crypto markets have dipped recently. Bitcoin is down about 25% since Ritholtz began testing the index, and some altcoins are down even more.

“Obviously it’s not ideal,” he said. “I wish that it had gone the other way, but by no means does this change how we feel about allocating money here.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.