Ousted Crypto Lawyer Opens New Firm After Ava Labs Scandal

Court documents show Kyle Roche intends to continue operating as a lawyer in the crypto space following the Ava Labs scandal

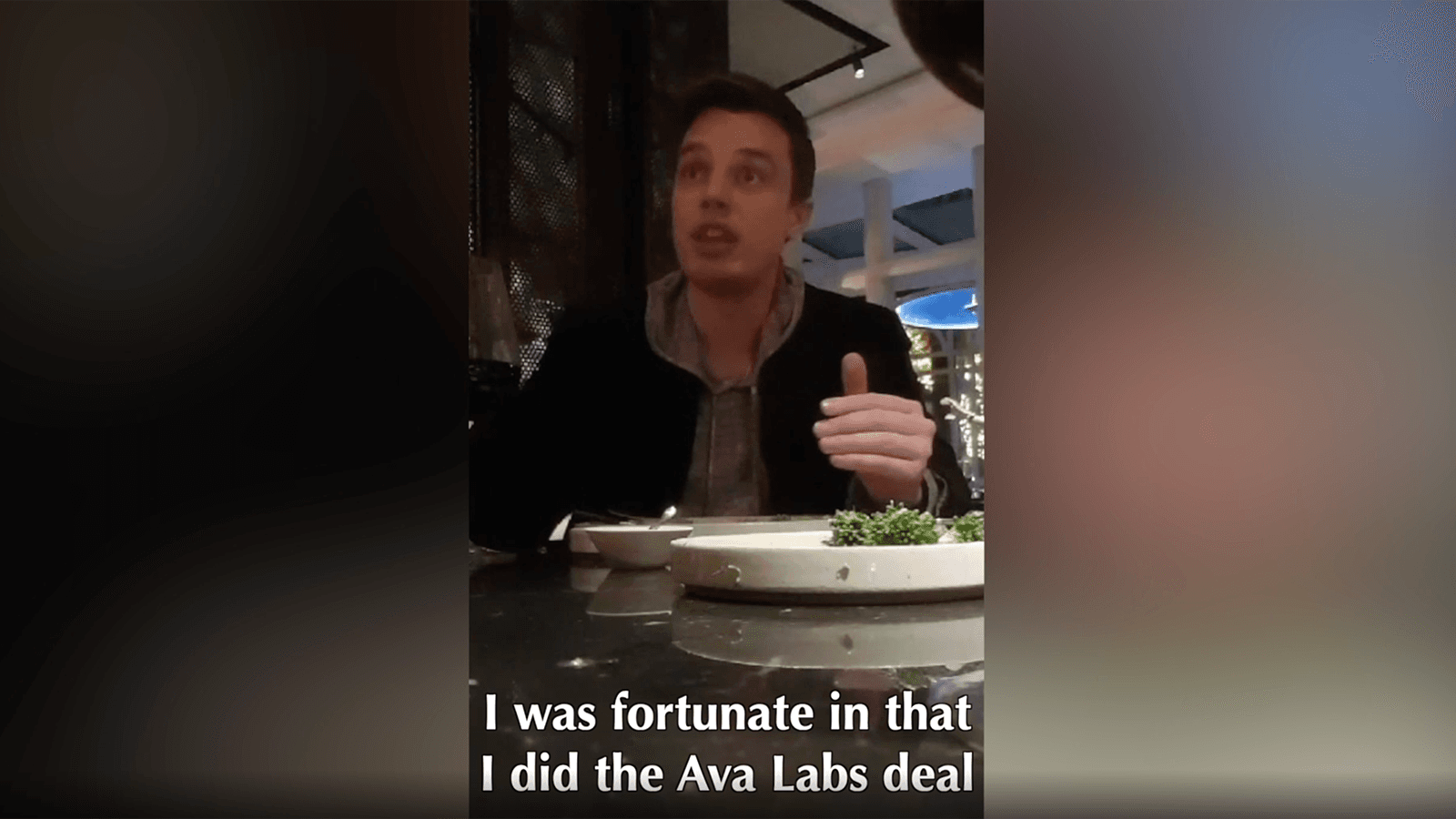

Source: CryptoLeaks

- Kyle Roche is now associated with a new law practice based in New York

- Roche will represent KeyFi CEO Jason Stone in an ongoing lawsuit against Celsius

Kyle Roche, the embattled crypto lawyer at the center of a high-profile exposé outing him for a secret pact with Ava Labs, was recently dropped by the law firm he co-founded.

Now, he’s single-handedly started a new firm — and working with an old client.

“I’ve established a new solo practice called Kyle Roche P.A.,” he told Blockworks in an email on Friday.

The lawyer is a legal representative for Jason Stone, CEO of staking software and strategies firm KeyFi, in an ongoing lawsuit against bankrupt crypto lender Celsius for alleged market manipulation.

At the time KeyFi’s complaint was filed, Roche was still a partner at law firm Roche Freedman.

A notice of change of firm filed Thursday shows updated contact information for Roche, who is now piloting his own professional association in New York.

“Please take notice that Jason Stone and KeyFi, Inc., hereby notify the court and all parties of record that Kyle W. Roche, who is admitted to practice in this court, is now associated with Kyle Roche P.A,” the attorney said in the filing.

Roche Freedman rebrands in wake of Ava Labs scandal

Confirmation of Roche’s new gig comes right after he was ousted from his old practice, where he no longer holds equity.

“We are focused on continuing to provide our clients with top quality representation and are proud of the firm’s accomplishments to date. We wish Kyle the best in his future endeavors,” a spokesperson for the firm told Blockworks.

That outfit, formerly called Roche Freedman, has now rebranded to Freedman Normand Friedland.

Roche’s role there came under severe strain following allegations he was involved in a secret pact with Ava Labs, the developer of the Avalanche blockchain.

Roche, working as a lawyer for Roche Freedman, allegedly agreed to pursue class-action lawsuits against Ava Labs’ competitors in order to gain sensitive information and divert scrutiny away from the crypto company.

In secretly recorded videos, Roche described himself as Ava Labs’ in-house crypto expert and claimed his skills were directly attributable to his pursuit of lawsuits against “half the companies in this space.”

Both Roche and Ava Labs have denied the allegations, claiming they are “categorically false.” Even so, Roche subsequently withdrew as an attorney from multiple lawsuits and Roche Freedman was booted from a class action against stablecoin issuer Tether.

It isn’t clear yet whether Roche is representing other companies, apart from KeyFi, as legal counsel. The attorney didn’t return Blockworks’ request for comment by press time.

This report was updated on Oct. 21 at 9:41 am ET to include Kyle Roche’s comment.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.