Data Round Up: What Jobless Claims, GDP Mean for the Fed

Weekly initial jobless claims and gross domestic product growth rates were released Thursday as economists and consumers await Friday’s core personal consumption expenditures data.

Source: Shutterstock

- Following Federal Reserve Chairman Jerome Powell’s mildly hawkish remarks last week, all eyes are jobless claims and GDP numbers

- Ongoing state benefits continuing claims decreased by 144,000 in the week ended June 12 to 3.4 million.

Following Federal Reserve Chairman Jerome Powell’s mildly hawkish remarks last week, all eyes are on economic data. Weekly initial jobless claims and gross domestic product growth rates were released Thursday as economists and consumers await Friday’s core personal consumption expenditures data.

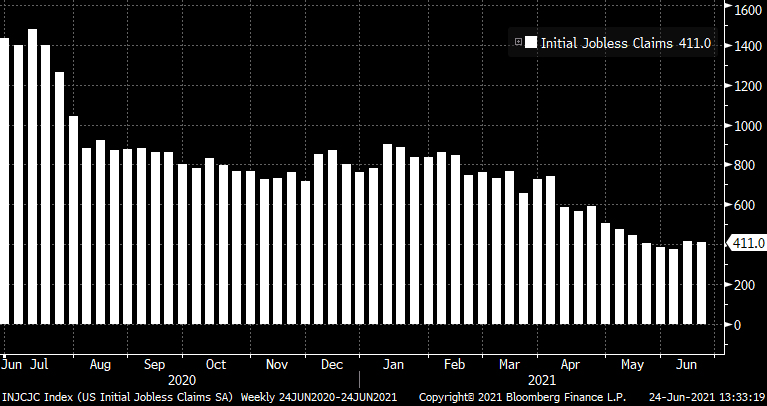

Fewer Americans, but still more than anticipated, submitted unemployment benefit applications last week, showing that the labor market is slowly inching toward recovery. Initial claims for regular state unemployment programs fell by 7,000 to 411,000 in the week ended June 19, Labor Department data showed. Economists had predicted 400,000 initial jobless claims.

Jobless claims have fallen considerably since the start of the year as vaccine distribution picks up and businesses across the country return to full capacity. Even as the unemployment rate remains elevated, companies are struggling to fill a record 9.8 million job openings.

Source: Bloomberg

Source: Bloomberg

Many businesses have resorted to offering incentives and perks for new hires. McDonanld’s implemented a program that gifts new employees a free iPhone if they stay on for six months. American restaurant chains like White Castle and Chipotle have raised hourly wages in an attempt to lure employees.

The debate over whether or not enhanced unemployment benefits are discouraging laborers from returning to work rages on. Many states, including Missouri, Mississippi and Iowa put a stop to enhanced programs in an effort to fill labor shortages. When questioned about the topic during his congressional testimony Tuesday, Powell declined to side one way or another, but did admit that benefits may be playing “some role” in labor issues.

Ongoing state benefits continuing claims decreased by 144,000 in the week ended June 12 to 3.4 million.

Gross domestic product data was also released Thursday. The American economy grew at a rate of 6.4% last quarter, unchanged from estimates released in May, according to data from the Commerce Department. Some economists say this may be the strongest year in seven decades.

Economists predict that economic growth has continued to surge in the current quarter, ending this month, citing vaccinations and reopening efforts. Consumers armed with nearly $3 trillion in economic support are ready to resuming spending activity, which has increased since December.