DCG Authorizes Additional $500M for GBTC Buyback

The share purchase authorization does not bind Digital Currency Group (DCG) to acquire any sort of shares but rather increases the available ceiling.

Source: Shutterstock

- Grayscale Bitcoin Trust parent Digital Currency Group now authorized to purchase up to $750 million in GBTC shares

- GBTC’s AUM is now at $36 billion, and the company says its still on-track to converting it to an ETF

Grayscale’s parent company, the Digital Currency Group, announced Monday that it had upped the GBTC buyback authorization to $750 million.

DCG noted in a statement that it had already purchased $193.5 million worth of shares of GBTC. In mid March DCG announced that it had authorized a $250 million buyback, which some called a prudent move to shore up liquidity.

“This is due to the illiquidity and difficulty to perform daily redemptions. ETFs don’t have that problem, as they create and redeem daily, forcing trading closer to NAV,” Steven McClurg, Chief Investment Officer of Valkyrie Investments explained to Blockworks at the time.

To be sure, this share purchase authorization does not bind DCG to acquire any sort of shares. Instead it increases the available ceiling. DCG plans to use cash on hand to fund the purchases.

Blame Canada

The GBTC premium remains stuck in a rut largely because of the success of multiple Toronto-listed bitcoin ETFs. Capital that was once destined for GBTC instead has gone north, attracted by the ETFs’ liquidity and quick redemption.

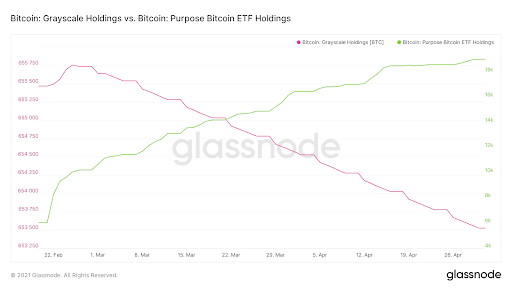

Data from Glassnode shows that there hasn’t been fund inflow into GBTC since the beginning of March, while the Trust’s bitcoin holdings have dropped significantly just as the holdings for the Purpose Bitcoin ETF have taken off.

Source: Glassnode

Source: Glassnode

The GBTC premium is currently at a -13.5% discount. The last time it posted positive was at the beginning of March. It hit an all time low of nearly 19% at the end of April, according to YCharts.

But according to 13F filings, quarterly declarations made to the SEC by fund managers, reviewed by Blockworks, GBTC remains popular with fund managers. Only four of the roughly 40 funds that hold GBTC have closed their position in the last quarter while five reduced their holdings.

The waiting game

For its part the SEC has delayed a decision on approving the first US-listed bitcoin ETF until June. There are currently 11 applications pending, according to Bloomberg Intelligence. By law, the SEC has a maximum of 240 days to make a decision about an ETF application which puts a decision date to mid-June at the latest.

But further competition abounds. In late March, the Brazilian Securities and Exchange Commission (CVM) announced that it had approved Brazillian-based digital asset manager QR Capital’s application for a bitcoin ETF to be listed on the São Paulo-based B3 Stock Exchange. It’s expected to begin trading by June 2021.