Ether Burn Hits $1.1B After EIP-1559 Activation

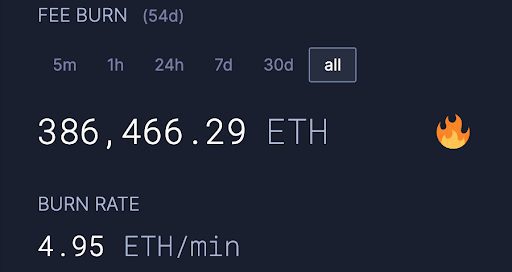

Approximately 386,466 ETH, or about $1.1 billion, has been burnt at the time of publication, according to ultrasound money’s tracker.

Source: Shutterstock

- ETH Burn Bot tweeted that the annualized issuance of ether was slightly in a deflationary period at negative 0.59% at 2pm ET, down from a positive 0.27% just an hour earlier

- As of Monday, gas prices were at a level of 138.46, up 60.93% from 86.03 on the year-ago date, according to data from YCharts

Over $1 billion of ether has been burned since the August 5th implementation of EIP-1559 — hitting another milestone for the cryptocurrency.

Approximately 386,466 ETH, or about $1.1 billion, has been burnt at the time of publication, according to ultrasound money’s tracker.

This milestone follows the activation of EIP-1559 in early August as part of the London Hard Fork, which moves transaction fees that once went to Ether miners now are destroyed through the issuance of burn blocks.

On Tuesday, a separate tracker on Twitter called the ETH Burn Bot tweeted that the annualized issuance of ether was slightly in a deflationary period at negative 0.59% at 2pm ET, down from a positive 0.27% just an hour earlier.

Although ether is slightly in a deflationary period currently, it is expected to face greater deflationary periods more often once the Ethereum blockchain transforms into a proof-of-stake system in 2022 as a part of Ethereum 2.0.

A deflationary period for ether occurs when the amount of ether burned exceeds the issuance amount so the Ethereum blockchain goes into a deflationary cycle through issuance of deflationary blocks, Blockworks previously reported.

As of Monday, gas prices were at a level of 138.46, up 60.93% from 86.03 on the year-ago date, according to data from YCharts. Ethereum is trading at $2,885.87, down 3.3% on the day as of 4:28 pm ET on Tuesday, according to CoinGecko.