Ethereum’s Shanghai Upgrade Is Not the Finish Line

Just because the upgrade was a success doesn’t mean that work on democratizing Ethereum can stop

sirtravelalot/Shutterstock modified by Blockworks

Ethereum’s Merge was a feat of decentralized engineering. More than 10 teams developing nine clients across continents and time zones coordinated a network upgrade involving thousands of nodes in countless configurations.

But just because the upgrade was considered a success for Ethereum’s democratization doesn’t mean that we can ignore the remaining issues.

My fear is we will see withdrawals empower incumbent whales and staking protocols to spin up more validators with their accrued rewards, instead of empowering more new stakers. We are already seeing more inflows into the Beacon Chain than withdrawals out. More validators are coming.

The Shanghai upgrade can democratize Ethereum further as more users take part in protocol security, but only if the Ethereum community makes it easier to stake from home or stake with diverse and ethical providers.

The success of the Shanghai upgrade

The Shanghai upgrade is the Merge’s logical conclusion, completing proof-of-stake’s first iteration for the Ethereum protocol and unlocking millions of staked Ether.

The switch to proof-of-stake has in many ways democratized access to Etheruem’s security model. This has super-charged the crypto-enthusiastic, as eager users are now able to quite literally secure the network and take part in governance. Their time and crypto have been locked up on the Beacon Chain, in liquid staking protocols, and in many other applications requiring economic security like DeFi.

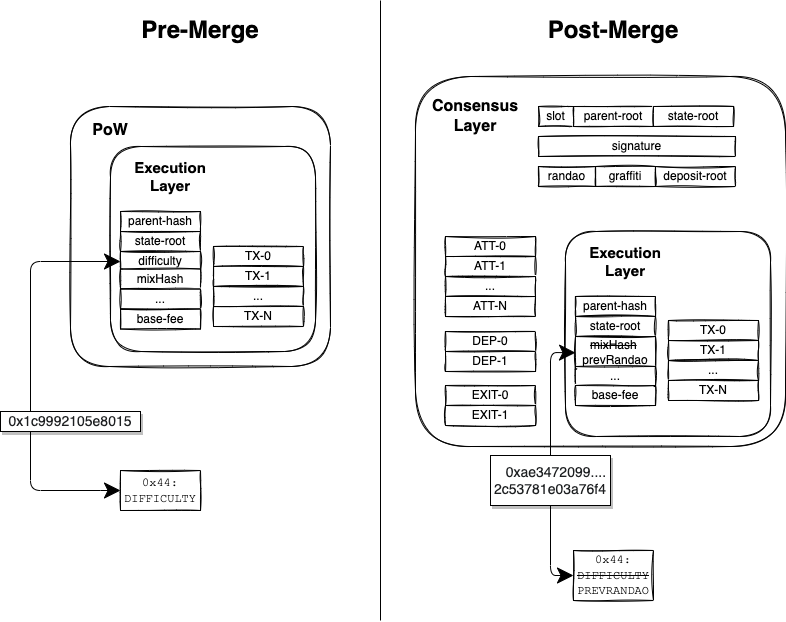

Ethereum’s old proof-of-work model only rewarded those (often businesses) with the most electricity and mining power. The proof-of-stake model instead rewards all validators roughly equally — but who controls those validators is key to Ethereum’s continued success.

Read more: The Beginner’s Guide to Consensus Mechanisms

Incentivizing solo-staking and more unique participation versus just more validators will keep the network democratized and resilient to capture.

Thankfully, the Shanghai upgrade changes the calculus and opens the first lock around centralization of validators. Withdrawals create liquidity for all staked ether. Users have a chance to move their stakes. Someone with ether locked on an exchange staking service can stake from home; someone heavily invested in an organization controlling an outsized portion of stake like Lido can move to a different service that maximizes decentralization over profits. Or users can go where the numbers go up. Choices.

More unique stakers means decentralization, not just more validators. When a single entity or group can reasonably predict they will propose the next handful of blocks from validators they control, it creates potential for a variety of exploitative tactics. Multi-block arbitrage sandwiches, re-orgs with exclusion of transactions, and censorship are all concerning. Reward smoothing allows the largest pools to aggregate block rewards and MEV across validator pools to provide the best rewards and to incentivize more user deposits.

Now, the ether is unlocked and liquid. But moving stake often incurs a large switching cost and a new validator has a 32 ETH-sized barrier to entry. Liquid staking has the lowest switching cost, but can detrimentally centralize control of validators. Solo-staking or staking from home has the most outsized impact on securing the protocol but incurs the highest switching cost.

Post-Merge stakers filled the role of miners, but running Ethereum clients is not easy. Stakers now have to run two clients, make sure they can communicate, stay in sync, and process blocks — all within repeating 12-second slots. Daunting.

Source: Ethereum Foundation

Source: Ethereum Foundation

While the hardware to run a proof-of-stake node is orders of magnitude cheaper (under $1,000) than proof-of-work, it needs to come down.

Over time, we need a diversity of solutions to lower both hardware costs and the 32 ETH deposit.

Everyone staking wants the price of ether to go up, but with appreciation of price, the moat around solo-staking becomes wider. Today, it would cost around $64,000 to purchase 32 ETH for a deposit on the Beacon Chain! Hardly democratized prices, which runs the risk of recreating proof-of-work capital dynamics for Ethereum.

What is to be done?

Core Developers and the Ethereum community have been working hard to close the gap. Client software is constantly improving.

Users have nine Ethereum clients to choose from, each with pros and cons and different hardware requirements. They can run a minority execution client like Hyperledger Besu, Erigon or Nethermind. This is still terribly complex software, but it is slowly gaining tooling and resources to make its instantiation much easier at home. Component costs for staking machines are coming down (thanks Moore’s law) and research is being done into lowering hardware requirements on a few fronts, lowering barriers to entry for solo-staking.

A variety of technical resources on how to stake are cropping up alongside useful tools. EthStaker has risen to be a huge resource for solo-stakers and expanding proof-of-stake participation. Protocols like Rocketpool use a mix of solo-stakers and protocol infrastructure to bring ether requirements down to run validating nodes (including the 32 ETH entry fee). Wallets such as MetaMask aggregate staking providers on behalf of users and lay out APY, diversity risk, and more to give choice to ether holders.

We aren’t out of the woods, but the Shanghai upgrade has catalyzed discussions into who and how we view staked ether and staking providers.

As Shanghai creates network choice by removing the locks on proof-of-stake participation, the Ethereum community has to address these choices and provide meaningful options with both technology and knowledge.

As we continue to add constructs to staking like MEV and re-staking, we have to ensure diversity incentives are represented. I would love to see more incorporation of diversity metrics into the scores we give providers on repositories like the Rated Network Explorer.

Shanghai will improve choice and democratization on Ethereum, but only if we continue to remove technical and financial barriers to participation and — as usual with crypto — take a deep look at incentives.

We can’t afford to skew incentives to favor a handful of whales like we do in today’s Web2 internet; we are building something new.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.