Bitcoin blows past $60k, on track for best monthly candle since Dec. 2020

Bitcoin is putting up some of its best numbers in years as it inches closer to retesting record highs

Shutterstock AI Generator modified by Blockworks

If bitcoin’s price holds on for the next day and a half, February will mark its best month in more than three years.

Bitcoin (BTC) has exploded by 43.2% over the month to date, swelling from $42,560 on Feb. 1 to briefly touch $64,000 this afternoon, before retracing to $60,950 as of 1:15 pm ET.

If bitcoin rides out the month at comparable prices, its February candle would almost eclipse a 47% candle set in December 2020 — the early stages of the previous bull market.

February would also be the second largest green monthly candle since May 2019.

Bitcoin was lost in the doldrums of a bear cycle at the time, opening the month below $5,300 to finish past $8,500 — a 62% jump. Crypto exited its winter phase over the following year.

The crypto market looked far different in 2019.

There were no BlackRock or Fidelity spot ETFs hoovering up bitcoin faster than they’re mined, the SEC had not yet sued Ripple Labs over XRP (the third-largest crypto at the time behind Ethereum), and there were only $3 billion in tether in circulation — now there’s close to $100 billion.

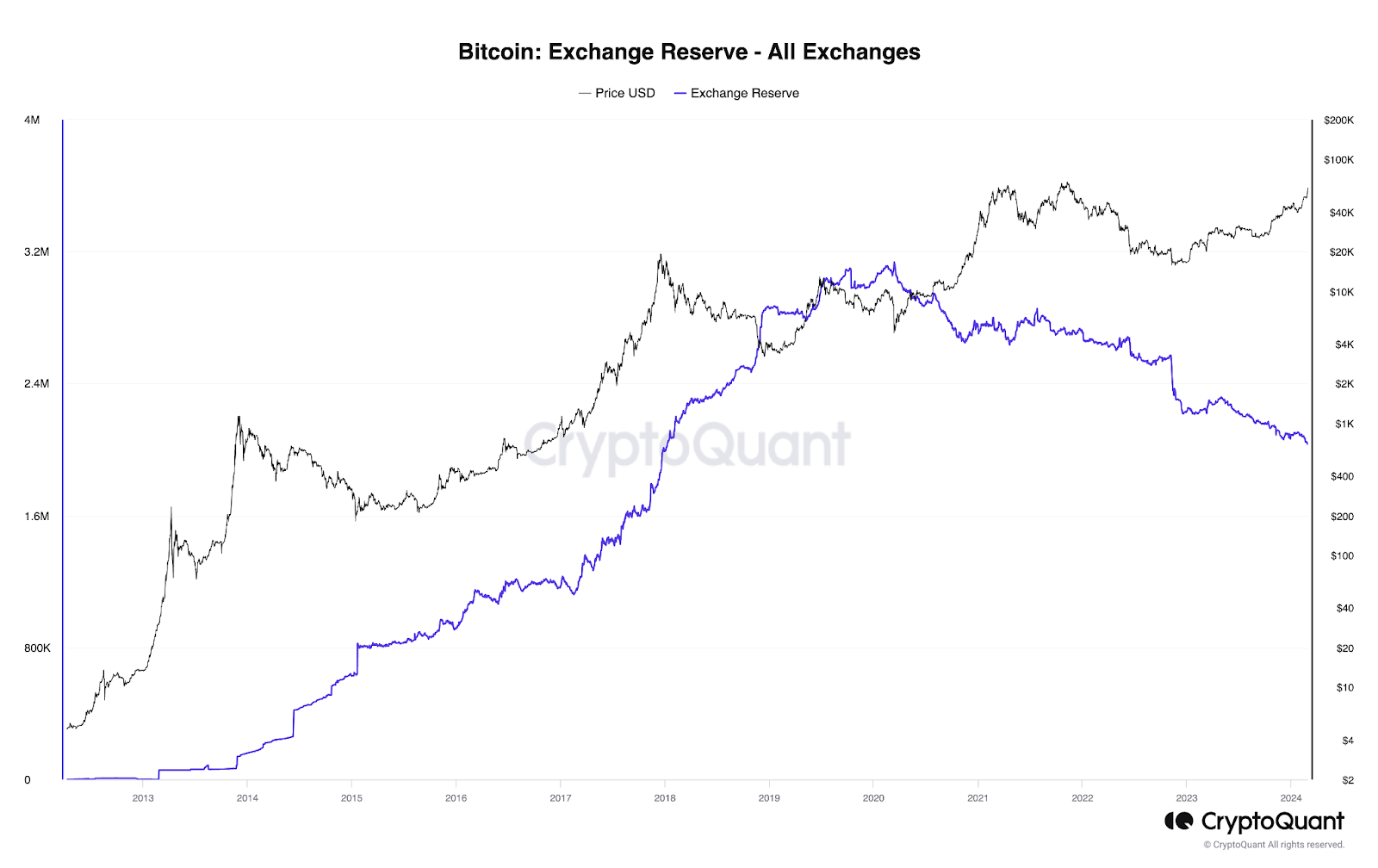

Another major difference was the number of bitcoin on crypto exchanges: Investors kept around 3 million BTC on trading platforms. That’s the most in bitcoin’s history per CryptoQuant, which tracks exchange wallets.

Altogether, that BTC was worth about $26 billion at the time.

Bitcoin holders have been pulling their coins off exchange ever since. Now, exchange reserves are on track to dip below 2 million BTC, a level not seen since December 2017 — when bitcoin had just set an all-time high of $20,000.

The bullish side to exchange flows

The bullish side to exchange flows

While that’s still more than 10% of the circulating supply, one could easily add a one-third reduction in BTC on exchanges over the past five years to the seemingly bottomless pile of bullish factoids swirling around right now.

Read more: Bitcoin halvings may be bullish — but returns have shrunk every cycle

It’s worth considering though that bitcoin’s price has added six multiples across that period, from under $9,000 to $62,000.

So, the dollar value of all bitcoin kept on exchanges right now is about $123 billion — its highest point since April 2022. With so much dollar value locked up in bitcoin markets right now, the only real guarantee moving forward is volatility.

The less bullish side

The less bullish side

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.