Empire Newsletter: How 2 funds are dominating tokenized US Treasury products

Tokenized RWAs might not sound sexy, but there’s no doubting the demand

ded pixto/Shutterstock modified by Blockworks

Today, enjoy Empire on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

The value of tokenized US Treasury products has skyrocketed 1,000% since the start of this year, a Coinbase report revealed.

I think we can all agree that’s a crazy statistic, though maybe not that surprising. The two big giants in this space right now are heavyweights, to say the least. You’ve got Franklin Templeton’s onchain government security fund and then you have BlackRock’s BUIDL.

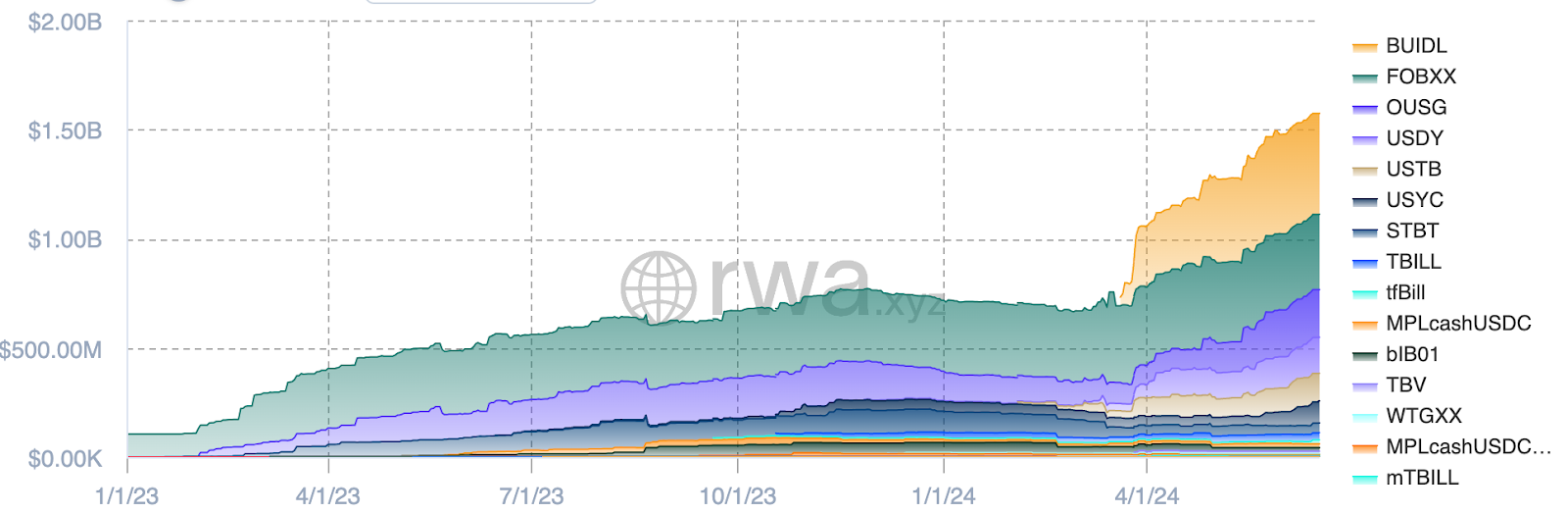

These tokenized products — which include the aforementioned funds — have reached a market cap of $1.29 billion. Per data from rwa.xyz, BUIDL has taken the lead here, sitting at $462 million (up roughly $80 million in May when it was at $382 million) but Franklin’s fund, aka the OG of the two, has $344 million (down roughly $16 million from last month).

That puts BUIDL at nearly 30% of the total group and FOBXX at nearly 22%.

This chart from rwa.xyz showcases the leaders of tokenized US Treasury products

This chart from rwa.xyz showcases the leaders of tokenized US Treasury products

Of course, there are some differences between the funds.

“They’re both money funds, we can speak to the differences in that the Franklin onchain fund, Benji, is a public security […] we’ve had to work in more close collaboration and cooperation with the SEC as it relates to the permissions that we are trying to gain in using public blockchain technologies in delivering services to clients,” Roger Bayston of Franklin Templeton told me.

The difference, to Bayston’s own point, is important to distinguish. Essentially, Benji has the SEC’s nod of approval to use public blockchains “in this transfer agency process and procedure.”

“Being on the public blockchains is going to deliver more utility to customers and clients than in the shadow record-keeping,” he said.

Coinbase noted that the primary users of BUIDL have turned out to be crypto hedge funds and market makers. Again, not really a surprise given that BUIDL has a $5 million minimum investment (David pointed this out earlier this month), but the appetite is clearly there.

Franklin Templeton is going a bit of a different route, or so it seems by the announcement they made earlier this month. The firm enabled investors to convert USDC to US dollars, which can then be put into FOBXX, their onchain tokenized money fund. They also don’t require a minimum investment.

“This is an exciting step in our continued journey to make the digital assets ecosystem more accessible to both traditional and blockchain-native investors. We are also building the framework for BENJI tokens to be interoperable with additional tokens in the not-too-distant future,” Bayston said separately in a press release accompanying the announcement earlier this month.

Tokenized RWAs might not sound sexy — and I’m on board with finding something else to call them other than RWAs — but there’s no doubting the demand, especially for funds backed by the heavyweights in the TradFi space.

We’ve previously discussed the appetite that institutions have for blockchain technology, and this is just one way to prove it.

Though between the aforementioned 1,000% increase and the fact that there’s been a roughly 39% increase of Fortune 100 companies launching onchain projects, I’d say not only are we back (putting the current market aside, duh) but honestly, we’ve entered brand new territory.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.