Investment Pros Jump Into Bear Market With New Crypto Hedge Fund

James Ho and Vincent Jow created Modular Capital in an attempt to support the space’s growing use cases

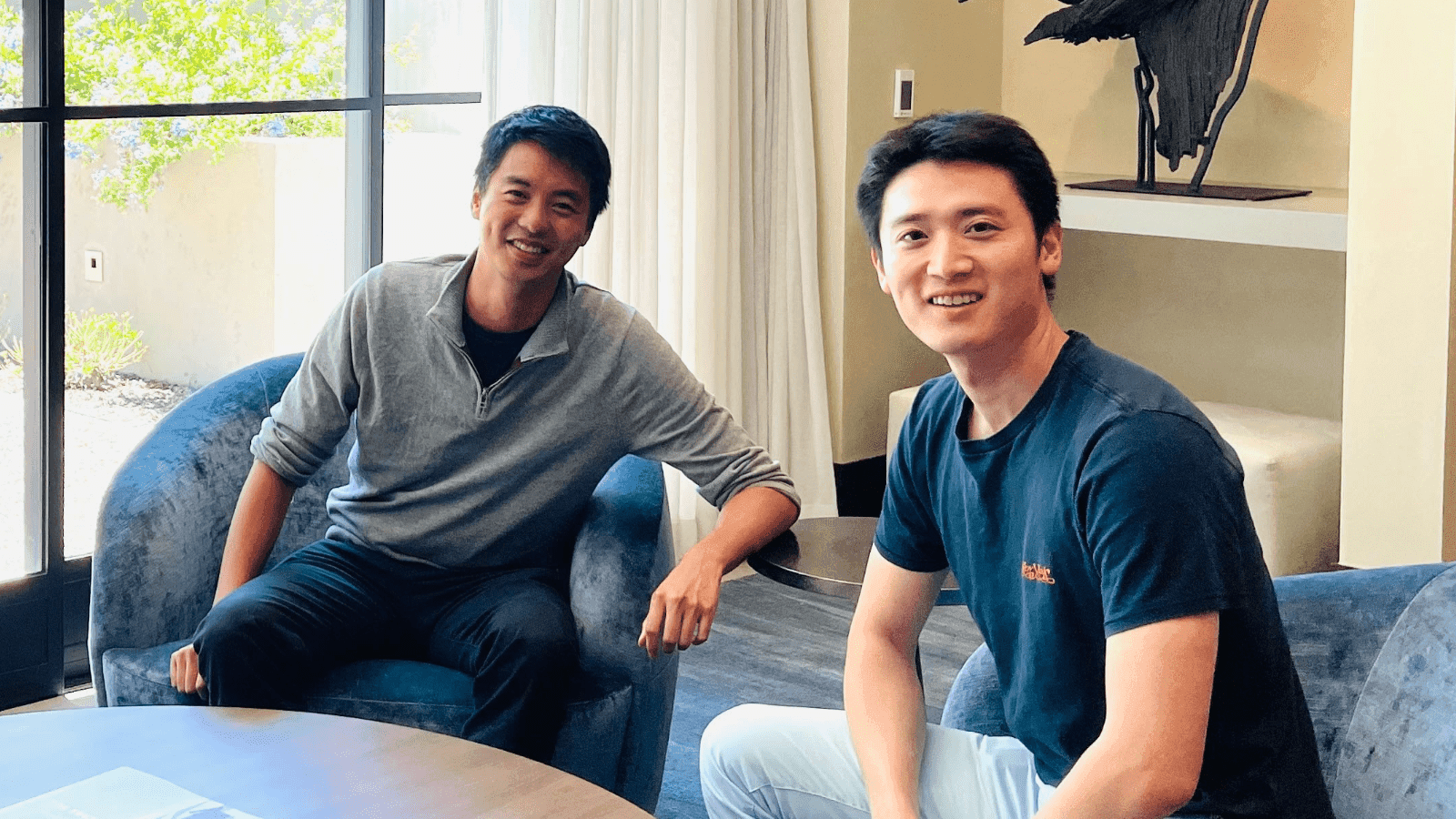

Modular Capital co-founders James Ho and Vincent Jow | Source: Modular Capital

- Recent industry pains will make the crypto ecosystem more resilient, co-founder James Ho says

- The firm raised $20 million from Multicoin Capital, ParaFi Capital, Road Capital and LedgerPrime, among others

Two investment professionals have teamed up to create a crypto hedge fund as they dive into the bear market of an industry that co-founder James Ho said he believes will be “one of the most transformative technologies” of his career.

Ho and Vincent Jow are the co-founders of Modular Capital, they revealed Monday, a company set to invest in liquid tokens, DeFi protocols and other segments of the crypto space.

Ho most recently worked as a principal at Altimeter Capital, where he focused on public and private investments in the fintech and crypto sectors. Before that he spent about four years at The D.E. Shaw Group, investing in industries such as fintech, payments, media and telecommunications.

Prior to co-founding Modular Capital, Jow was making similar investments at New York-based Holocene Advisors since 2017.

More crypto use cases have emerged in recent years, Ho told Blockworks, noting the growth of DeFi (decentralized finance) and the underlying protocols in the sector that he said have begun to resemble real businesses.

“All of that was really interesting to us in terms of thinking about how you have this rich, growing ecosystem that we think is in its infancy,” Ho said. “We think crypto is going to be a whole lot bigger when we look out five or 10 years right now.”

Modular Capital raised $20 million from backers including Multicoin Capital, ParaFi Capital, Road Capital and LedgerPrime.

The fund’s focuses

Modular Capital is set to include between 10 and 20 core positions in its portfolio, and DeFi — or decentralized open finance, as Ho calls it — will be a key focus.

“I think in many ways you’ll be building the traditional financial stack on rails that are more modern and more trustless,” he said, “especially as you move to a world that starts to look more multipolar and less US-dominated.”

The firm will also seek to invest in primitives that allow applications to build richer experiences for users, such as layer-1 and layer-2 blockchains or various Web3 infrastructure tools.

Ho said the firm will also monitor the role of NFTs, which he expects will be incorporated into various experiences to unlock certain capabilities for owners.

“Obviously basic profile pictures and JPEGs have been the first foray into that over the last year, but I think you’re going to see a lot more interesting things around music, content, concerts, ticketing and gaming,” he said.

Launching into a bear market

The launch comes as the prices of crypto tokens have plummeted in recent months and companies in the space grapple with liquidity issues.

The bear market persists following the collapse of Terra’s algorithmic stablecoin and LUNA token in May, as well as the struggles of companies such as Three Arrows Capital, Voyager Digital and Celsius.

Modular Capital’s co-founders left their full-time jobs in March and have been planning the launch for several months, Ho said, noting that he and Jow didn’t expect to launch right into a bear market.

“I think the reality is crypto ran ahead of itself quite a bit,” Ho said. “By the end of last year you saw a lot of froth in the ecosystem — a number of things that were just heavily subsidized, didn’t have real organic demand, didn’t have real product market fit.”

But the industry has seen “a lot of that air come out of the ecosystem” in recent months, the co-founder added, noting that a bunch of protocols are now getting to more realistic valuations.

Modular Capital intends to initially be patient in terms of its pace of capital deployment and could seek to ramp up exposures over the next three to nine months.

“We are not trying to guess the month-to-month, or even quarter-to-quarter, price action for most of these protocols,” Ho explained. “We’re generally looking to think about [whether] these become real, durable businesses over the course of several years.”

As crypto has been learning the lessons of traditional finance “on speed run” recently, Ho said, rules around uncollateralized lending will likely become more rigid and investors will be more skeptical about algorithmic stablecoins.

“I think a lot of these [events] will continue to strengthen and make the ecosystem more robust,” he said. “There are probably still some more shoes to drop over the balance of the year, but I think in general the market definitely has re-set quite a bit for us to kick off our fund.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.