Latest in Crypto Hiring: MoonPay Adds Range of Senior Execs

Another 21Shares pro jumps ship to competing crypto ETP issuer Valour

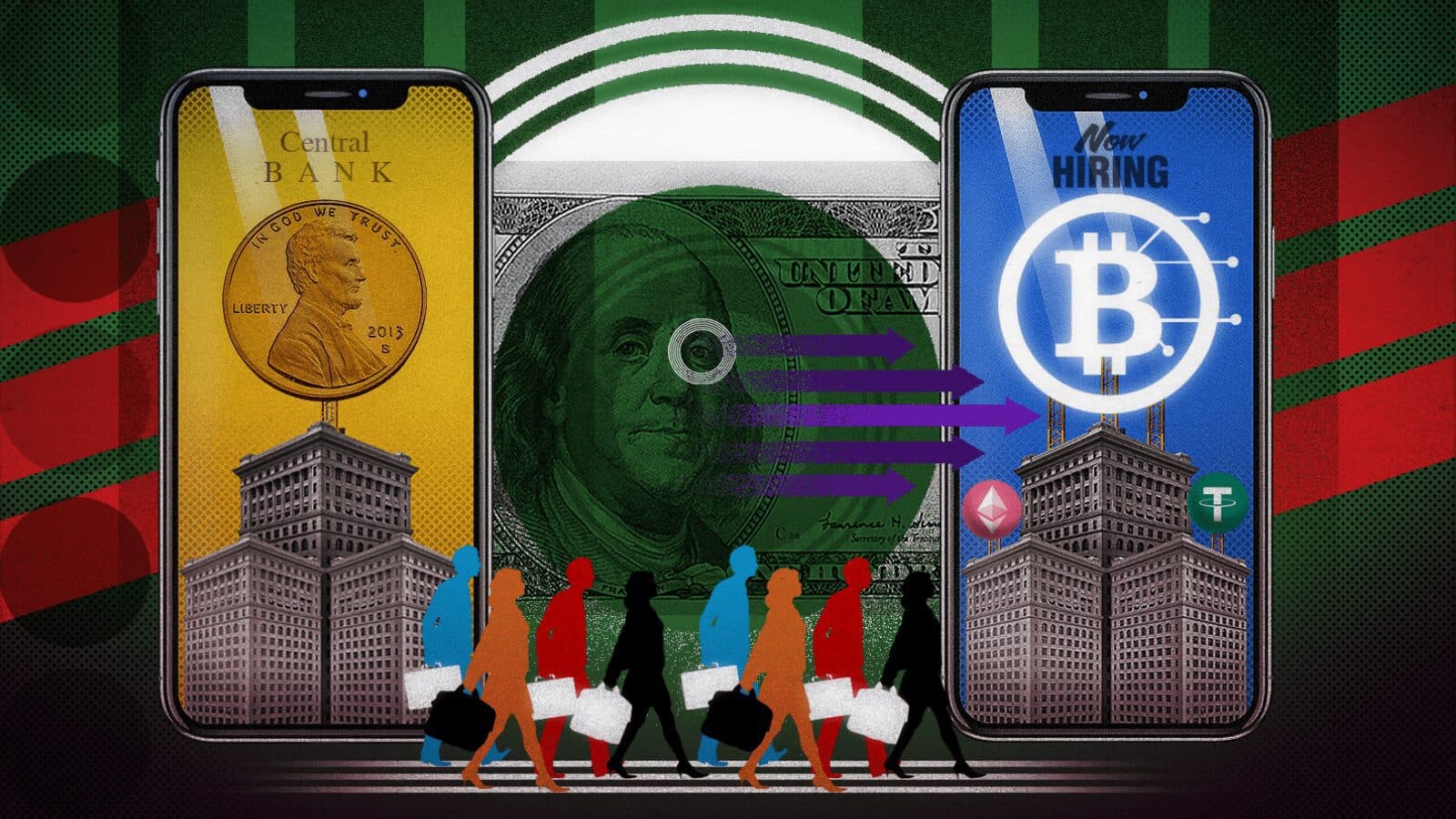

blockworks exclusive art by axel rangel

- MoonPay’s new executives bring experience from Block, Coinbase and others

- OpenSea became the latest to announce job cuts as crypto downturn lingers

Crypto payment service MoonPay has filled several C-suite and senior management roles, including the addition of Jim Esposito as chief operating officer and Akash Garg as chief technology officer.

Esposito was formerly the head of operations for Block’s Cash App and the president of Cash App Investing. Garg previously worked as vice president of engineering at Block and was a CTO at Afterpay.

MoonPay is also bringing aboard Asiff Hirji, a president at Figure and ex-president of Coinbase, and an ex-operating adviser at a16z, as a senior adviser to the CEO; Garrett McManus as head of marketing; Tom Capone as head of MoonPay Studios; and Abhay Mavalankar as head of corporate development.

The executives are set to join a MoonPay team with roughly 300 employees. MoonPay is planning to double its headcount between now and the end of the year.

Peter Märkl is set to join Valour‘s asset management team next month as its general counsel, becoming the latest to jump ship from 21Shares.

Märkl is currently the head of legal for the crypto fund issuer. Prior to his role at 21Shares, he worked in the Zurich office of law firm Heuking, where he concentrated on the fintech and private banking business. Märkl also previously held management positions at UBS in Germany and Switzerland.

DeFi Technologies subsidiary Valour, a technology company seeking to bridge the gap between traditional capital markets and decentralized finance, has a range of crypto ETPs.

Märkl’s move comes after Marco Infuso, who also left 21Shares as its head of Germany, joined Valour to lead the global sales of the firm’s ETPs (exchange-traded products), the company revealed earlier this month.

Dina Ellis Rochkind joined the advisory board of crypto startup Earnity, a crypto platform and marketplace where users can share, buy, gift or create collections of crypto.

Rochkind has worked on every major piece of financial regulation over the last two decades, according to Earnity. She is a legal adviser to fintech, crypto and blockchain clients at law firm Paul Hastings.

In addition to working with senators and other members of Congress, she worked as deputy assistant secretary for consumer affairs and community policy at the Treasury Department from 2001 to 2002, according to her LinkedIn profile.

“Clear guidance and regulation will be critical to the evolution of the crypto industry,” Earnity CEO Dan Schatt said in a statement. “We are thrilled to be working with Dina, whose reputation for getting things done in Washington and reading the tea leaves on what is going on in DC, will further Earnity’s ability to provide valuable services and insights to its community of customers, professionals and the overall crypto industry.”

NFT Technologies appointed Adam De Cata as its new CEO after the company revealed Thursday that it is set to acquire blockchain, metaverse and NFT development studio Run It Wild. He replaces Mario Nawfal, who will continue working as a strategic adviser for the company.

De Cata founded Australia-based Run It Wild in 2021 and was head of partnerships at virtual reality platform Decentraland since March 2021, according to his LinkedIn profile. In the latter role, he was responsible for establishing the presence of brands such as Sotheby’s, Coca-Cola, ConsenSys and Bored Ape Yacht Club within Decentraland.

“They’ve established themselves as the only publicly-traded company focused on extending real-world utility and value in NFTs to mainstream adoption,” De Cata said of NFT Technologies in a statement. “As an industry, we are only scratching the surface of what can be achieved.”

ORIGIN Metaverse, a company focused on streamlining metaverse real estate NFT transactions, added Mo Kumarsi and Adam Russell to its team.

Russell and Kumarsi are co-founders of REV3AL — which offers artists, creators and intellectual property owners protection and authentication of digital assets in Web3 and the metaverse. They work as the company’s chief revenue officer and CEO, respectively.

Layer-2 blockchain infrastructure provider Bosonic hired Julie Briand as head of client success and Sarthak Jain as regional manager of institutional sales.

Briand, with experience in client onboarding and service, was previously responsible for several of the largest institutional clients while at Bank of America Merrill Lynch.

Sarthak joins Bosonic after selling institutional enterprise solutions in the UK and Europe for Bloomberg and, most recently, crypto exchange Binance.

In case you missed it, OpenSea CEO Devin Finzer revealed on Twitter Thursday that the NFT marketplace would be cutting its staff by 20%. The news followed similar announcements by Gemini, Crypto.com, BlockFi and Coinbase in recent weeks.

“The reality is that we have entered an unprecedented combination of crypto winter and broad macroeconomic instability, and we need to prepare the company for the possibility of a prolonged downturn,” Finzer wrote.

Meanwhile Fidelity Digital Assets, which laid out plans in May to double its headcount by the end of the year, remains on pace to hit those hiring goals, a spokesperson told Blockworks.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.