Lido debuts simplified Earn vaults with Veda and Mellow

A new Earn tab on stake.lido.fi surfaces curated vaults, for one-click blue-chip strategies

WindAwake/Shutterstock and Adobe modified by Blockworks

Lido has launched Earn, a new tab on stake.lido.fi that surfaces curated strategy vaults aimed at making it easier, and comparatively safer, to put staked ether to work.

The first listing, GG Vault (GGV) by Veda Labs, offers one-click access to “blue-chip” DeFi strategies using ETH, WETH, stETH, or wstETH. A second listing, the Decentralised Validator Vault (DVV) implemented by Mellow, is also live, while an additional Core Vaults product is slated to go live in mid-September.

Lido says vaults must clear the same security bar as its core protocol, according to Jakov Buratović at the Lido Ecosystem Foundation.

“To appear in Lido Earn…all production contracts must be audited by reputable firms before listing, with any material findings addressed,” Buratović told Blockworks.

Live vaults maintain automated alerts to spot any issues, and “if necessary, onchain pause or kill mechanisms can be triggered to halt the vault operation,” he said. While the foundation works to minimize risk for depositors, Buratović notes, they disclaim any liability for potential losses.

Fees are straightforward at launch. “Specifically for GGV, there is a 1% platform fee split between Veda and the Lido DAO, consistent with rates seen in other DeFi vaults,” Buratović said.

On the UX side, users receive an ERC-20 deposit token which accrues value, similar to wstETH — the non-rebasing form of stETH which is widely used in DeFi. Withdrawals are made in wstETH and, for now, Lido is not optimizing for secondary markets of the vault tokens.

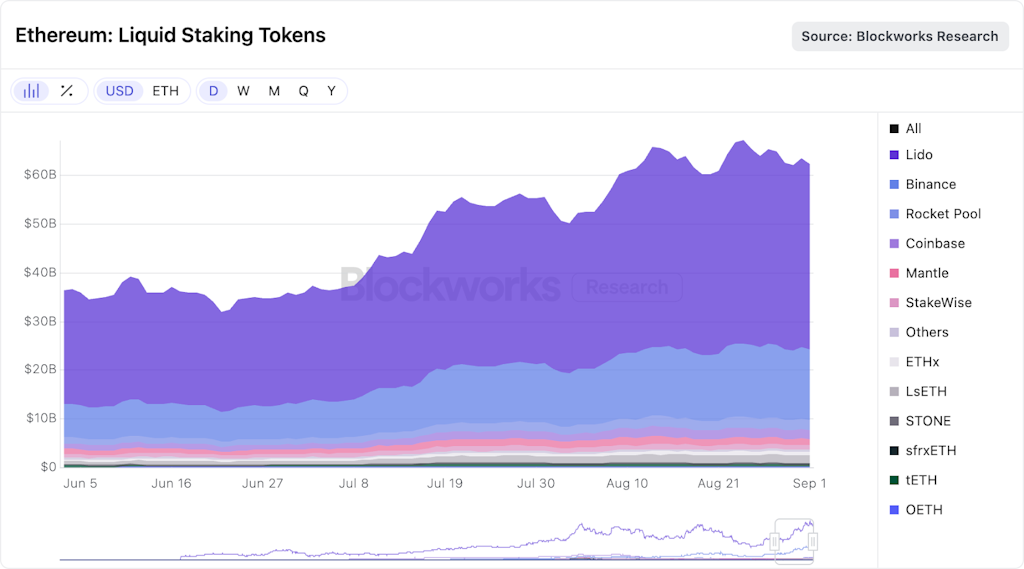

The liquid staking provider currently has about $38 billion in ETH deposits, representing nearly 61% of staked ether, according to Blockworks Research’s latest data.

Source: Blockworks Research

Source: Blockworks Research

The Mellow alternative

The second strategy listed in Earn, DVV, is built on Mellow’s modular vault architecture and introduces a different approach — this time centered on validator decentralization. Each strategy is boxed into an isolated “Subvault,” designed to prevent unintended interactions.

“Each Subvault is an isolated module with its own rules. It can only hold a limited number of shares, accept deposits in a predefined set of assets, and execute a restricted list of calls,” Mellow founder Nick Stoev told Blockworks.

Control over these vaults is initially shared between Mellow and Lido via a 5-of-8 multisig. Price reporting and redemption processes, meanwhile, are structured to resist manipulation.

“If the report is flagged as suspicious, it must be explicitly accepted by an authorized acceptor in a separate transaction before being processed,” Stoev said.

Redemption requests are handled in batches, and everyone in a batch receives the same price.

“Redemption requests are queued and processed in batches at the next oracle update,” Stoev noted, “and all requests in the batch receive the same price.”

That price is fixed at the time of the oracle report, not during the final withdrawal.

“Liquidity settlement occurs in a separate step: It may be immediate after the price report or staged.” The batch price is fixed, but settlement can be configured between 1 day and 2 weeks.

Even for addresses with fast-lane permissions — a whitelisted set of entities that are granted privileged access to faster deposits and withdrawals from Mellow’s vaults — access is constrained by pricing rules.

Additional Core Vaults strategies will go live later this month. Some of these will touch centralized exchanges, in which case asset custody is protected through Copper’s MPC-based ClearLoop integration “or equivalent infrastructure,” Stoev said. Thanks to MPC, “no single party ever controls the private key; transactions require joint cryptographic authorization,” he added, describing a design meant to keep assets segregated and avoid rule out rehypothecation.

For stETH holders, Stoev confirmed the vaults adhere to Lido’s core design guardrails.

“Subvaults anchored to stETH interact directly with the Lido protocol and comply with the ‘no harm to stETH users’ constraint,” he said.

With GGV and DVV now live and Core Vaults arriving in mid-September, Earn brings Lido users a new way to access DeFi and validator yields, off-loading most of the effort while keeping safety and simplicity top of mind.

Correction Sep. 4, 2025 at 6:57 am ET: Clarified that DVV is live today while Core Vaults is launching later.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.