Equities dip as Fed sees two rate hikes in 2023; Treasury yields rise, and the dollar strengthens: Markets Wrap

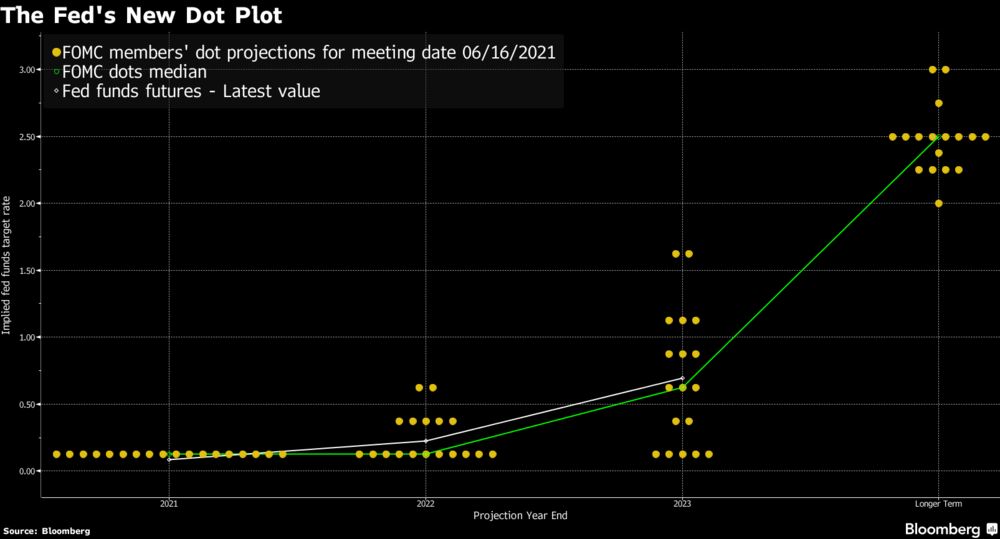

Chair Jerome Powell announced that officials had begun discussing when to scale back $120 billion in monthly bond purchases, and released a ‘dot plot’ indicating two more interest rate hikes in 2023.

Blockworks exclusive art by Axel Rangel

- Chair Jerome Powell announced that officials had begun discussing when to scale back $120 billion in monthly bond purchases

- Equities fell on the news, with the Dow shedding -0.77% to $34,033.67 by market close

The Federal Reserve disappointed investors that were seeking assurance that tapering is still far off as they wrapped up their two-day FOMC policy meeting today. Chair Jerome Powell announced that officials had begun discussing when to scale back $120 billion in monthly bond purchases, and released a ‘dot plot’ indicating two more interest rate hikes in 2023.

- Equities fell on the news, with the Dow shedding -0.77% to $34,033.67 by market close. The S&P 500 and Nasdaq weathered similar declines of -0.54% and -0.24%, respectively. Projections indicated that key Fed fund rates would remain unchanged, although the Fed increased its 2022 PCE forecast from 2% to to 2.1%.

- The Fed’s ‘dot plot’ also indicated that 13 of 18 officials favored at least one rate increase by the end of 2023, versus seven following the March FOMC meeting.

“The dots are not a great forecaster of future rate moves just because it’s so highly uncertain,” said Powell in a press conference on Wednesday afternoon. “There is no great forecaster.”

Insights

Luke Gromen, founder at Forest for the Trees LLC, weighed in on the highly-anticipated FOMC gathering in a recent interview with Blockworks. “In the short run, I think whether inflation is persistent is heavily a function of the Fed. Beyond that, I think political realities and the US fiscal position make it highly likely that inflation will run hot for an extended period of time.”

Two-year treasury yields hit 0.213%, the highest in a year on Wednesday afternoon.

In other news

Bank of America’s most recent Global Fund Manager survey indicated that 38% of respondents think the Fed will start signaling tapering at their annual economic symposium in Jackson Hole later this year.

Fixed income

- U.S. 10 Year Treasury is up .082% at 1.581%, opening at 1.496%

- Crypto markets traded lower at the onset of the day, possibly anticipating hawkish sentiment from the Fed. Messaging from officials during the FOMC did not have a significant impact on assets after the initial dip, however.

Crypto

- Bitcoin is currently trading around $38,851.04 as of 5:00 pm ET, down 3.77% over the past 24 hours

- Ether is trading at around $2,405.93 as of 5:00 pm ET, falling 5.25% over the past 24 hours

- ETH:BTC dropped over 1.6% to 0.062179 as of 5:00 pm ET

- VIX is up 6.4% t0 $18.15 at 5:00 pm ET

Commodities

- Oil (WTI) opened at $72.45 per barrel and fell .67% to $71.64

- Gold is up .27% at $1,861.40 / oz as of 4:00 pm ET

We’re watching out for…

- Norway’s and Switzerland’s rate decisions on Thursday

- The Bank of Japan’s monetary policy decision on Friday

That’s it for today’s market wrap. I’ll see you back here tomorrow at the same time.