MiCA isn’t a safety net, EU securities chief warns

MiCA’s guardrails aren’t as sturdy as the traditional finance ropes, according to ESMA chair Verena Ross

Gints Ivuskans/Shutterstock, modified by Blockworks

Europe’s Markets in Crypto Assets (MiCA) legislation, designed to oversee digital assets, doesn’t guarantee a risk-free crypto environment.

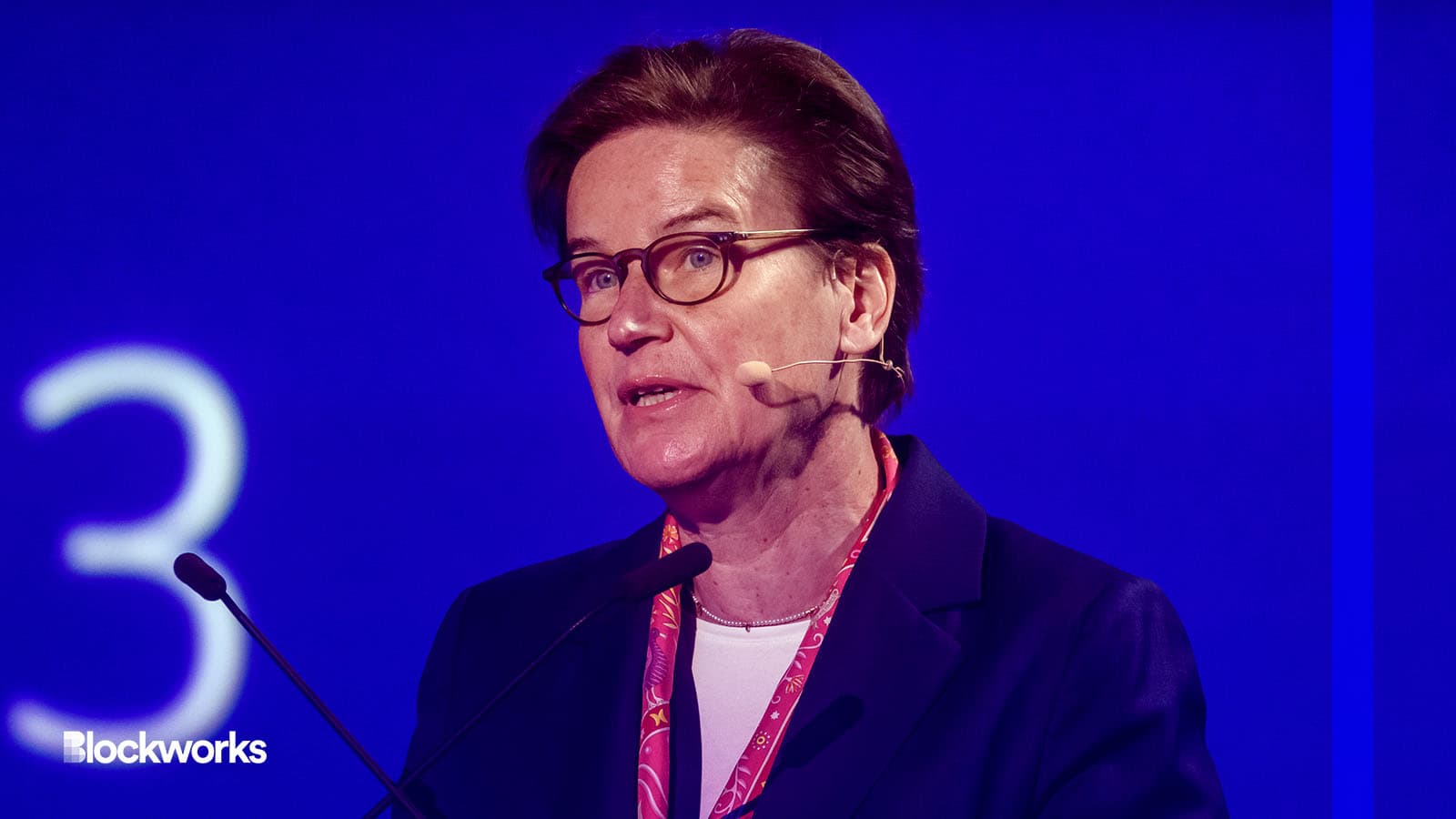

That’s according to the head of the European Union’s top securities regulator, Verena Ross.

Ross, chair of the European Securities and Markets Authority (ESMA), said that MiCA will set up a standard set of rules for crypto across the EU, covering areas that current financial rules miss.

Still, she pointed out in an interview published Wednesday that even with MiCA’s introduction, crypto remains inherently risky.

“Consumers need to be aware that MiCA does not provide the same protection as for traditional financial products,” she said.

However, Ross acknowledged the significance of the new regulation.

She contends that the legislation will markedly transform the present landscape, which varies from anti-money laundering protocols to more evolved standards akin to MiCA.

Approved in April, MiCA will bring forth rules concerning oversight, consumer protection, and environmental measures for cryptoassets. This regulation is set to be a standard for the global crypto industry, with other regions likely to observe and follow suit.

Ross also noted that the law would introduce new crypto guidelines — transparent product details, equitable market operations and enhanced stability — all aiming to safeguard consumers and ensure legitimacy.

Consumers will be better informed about products and their associated risks, she said.

Though MiCA offers a detailed structure for digital asset issuance and trading, it was crafted before the happenings of 2022, which brought up new risks and factors to consider.

Some also believe that MiCA is overly strict in areas like the prohibition on algorithmic stablecoins and mandates for companies providing cryptoasset custody.

All parts of the MiCA rules are expected to be in place for crypto businesses in the EU by the end of 2024.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.