Is the ‘mirage’ of reassuring economic data ending?

Tariff front-running may have caused an artificial bounce in economic data earlier this year

JooLaR/Shutterstock and Adobe modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Economic data is rolling over.

After an artificial bounce in economic data due to tariff front-running, the underlying economic data is beginning to roll. What comes next?

A couple of months ago on the Forward Guidance Roundup, we discussed the idea of an economic “mirage” forming, driven by the front-running of incoming tariffs.

The argument went like this:

Since the threat of tariffs was dangled for so long before they went live, companies were able to import as many goods as they could beforehand.

Because of this, net exports cratered, since that metric is computed as imports − exports, which mechanically leads to a lower GDP calculation. This is why we saw a very negative GDP print last quarter despite the actual economy being mostly fine.

This also led to a major acceleration in the trade balance:

Since companies had front-run all their imports, this dynamic reversed, where imports were minimal once the tariffs were actually implemented.

This led to a huge positive reversal in GDP nowcast:

Mechanically, this reversal in the other direction has trickled through the economy and led to a strong bounce in the soft data:

We’re now beginning to see early signs that this mechanical bounce in growth is beginning to head back lower.

In the labor market, although the topline data like the unemployment rate hasn’t increased, leading labor indicators are continuing their march higher:

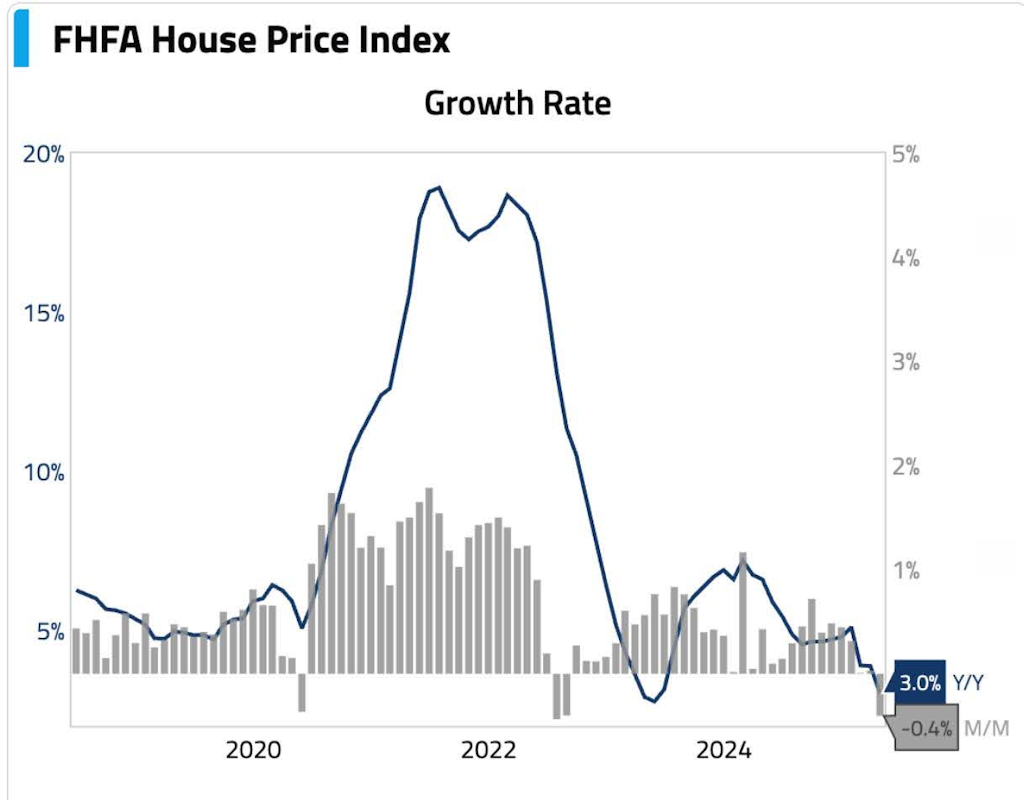

Further, it looks like the housing market is beginning to deteriorate after being frozen in place for the last year:

Overall, with the FOMC committed to being as late to restart rate cuts as possible, the risks are building up.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.