Nic Carter Shares Insight on Dollars, CBDCs, Blockchains and Bitcoin

“You have a situation where the network of the dollar is becoming impaired due to the excessive politicization of it,” he said

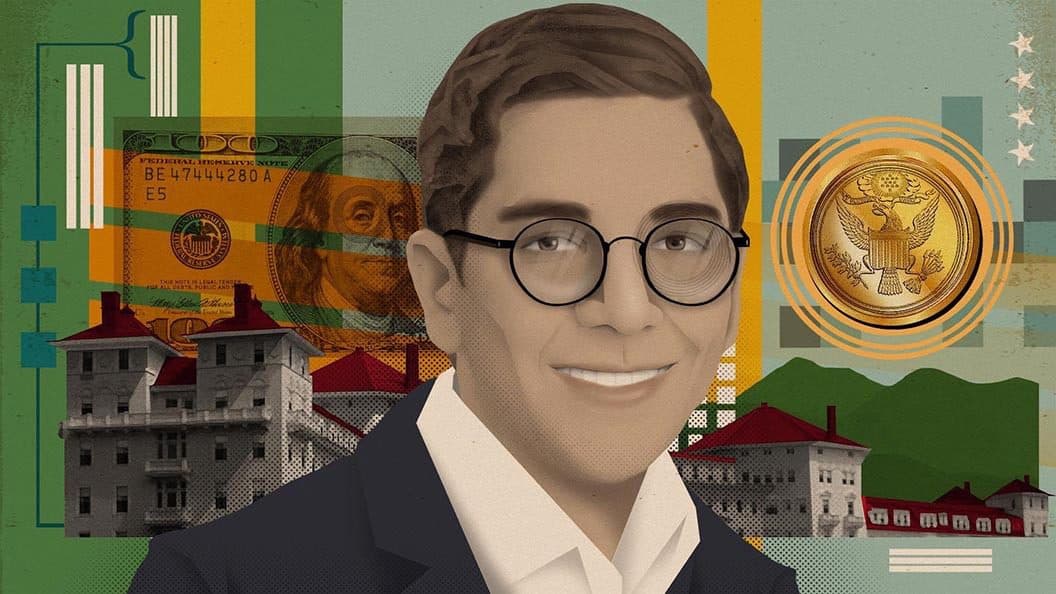

Nic Carter; Blockworks exclusive Art by Axel Rangel

- Everyone still wants dollars, but tens of millions of people prefer them in stablecoin format because it’s unencumbered. It’s an open transactional network, among other advantages, Carter said

- “We’ve achieved recognition that bitcoin is not going away, regardless of whether you dislike it and it is an important part of the macro conversation,” he said

Nic Carter, a general partner at Castle Island Ventures and co-founder and chairman of Coin Metrics, joined Blockworks for an interview at Bretton Woods: The Realignment after speaking on multiple panels during the conference.

In this interview, Carter discussed themes from the conference and shared some insight on:

- The dollar system

- US sanctions and politicization

- Blockchain applications

- Liberalizing access to dollars

- Central bank digital currencies (CBDCs)

- Altering the nature of social media across the internet

Watch the full interview with him below.

Are you a UK or EU reader that cant get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.