Pantera Stays Bullish on Bitcoin

The largest digital currency hit a record high above $64,000 Wednesday, putting it on track to meet Pantera’s price prediction of $115,000 by August 2021.

Dan Morehead, founder, CEO and Co-CIO of Pantera Capital

- The rally we are seeing today is no different than past run-ups, except now there is unprecedented institutional backing, says Pantera CEO Dan Morehead

- Morehead doesn’t see rally stalling anytime soon

When valuing bitcoin, Pantera Chief Executive Officer and Co-Chief Investment Officer Dan Morehead said it all comes down to supply and demand.

The largest digital currency hit a record high above $64,000 Wednesday, putting it on track to meet Pantera’s price prediction of $115,000 by August 2021.

Morehead said the projection is based on data from previous halving cycles. The rally we are seeing today is no different than past run-ups, except now there is unprecedented institutional backing.

“On the demand side, we’ve had massive companies like Morgan Stanley and PayPal enter the market. That shifts the demand curve much higher,” Morehead wrote in April’s letter to investors. “At the same time, the supply of newly-issued bitcoin was cut in half last May—as part of the every-four-years halving of bitcoin issuance.”

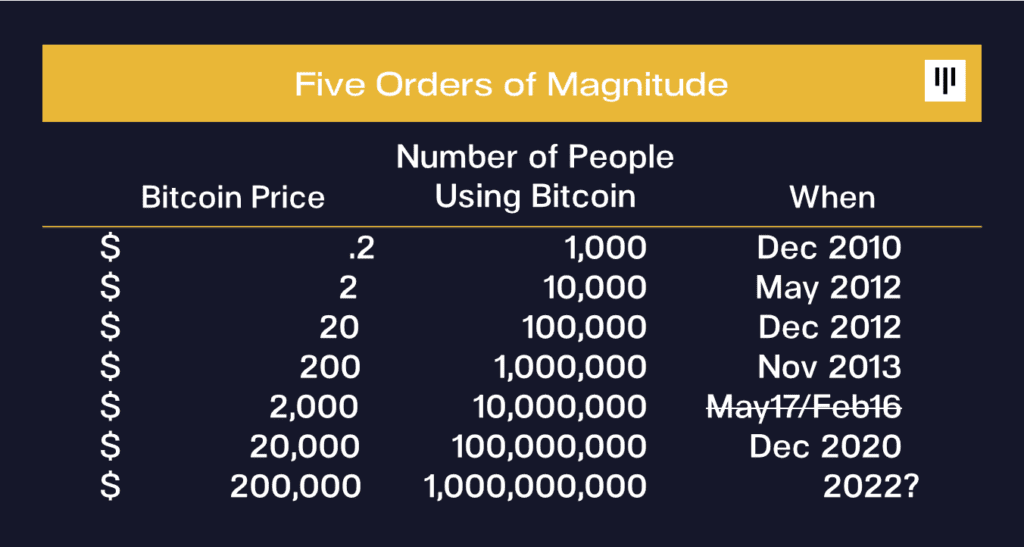

Morehead doesn’t see the rally stalling anytime soon. “For every million new users, the price of bitcoin rises $200,” Morehead wrote. “It happened every time except for February 2016, when the price was slow to hit.”

Source: Pantera

Source: Pantera

If the trend continues, Morehead wrote, bitcoin will reach $200,000 in 2022. That would be a 213% increase from bitcoin’s price today, which is on trend for the asset’s typical yearly return.

Beyond bitcoin

It’s not just bitcoin that is seeing tremendous growth, Morehead stressed. He is also confident that alternative coins ethereum and polkadot will continue to perform along with decentralized finance protocols.

Source: Pantera

Source: Pantera

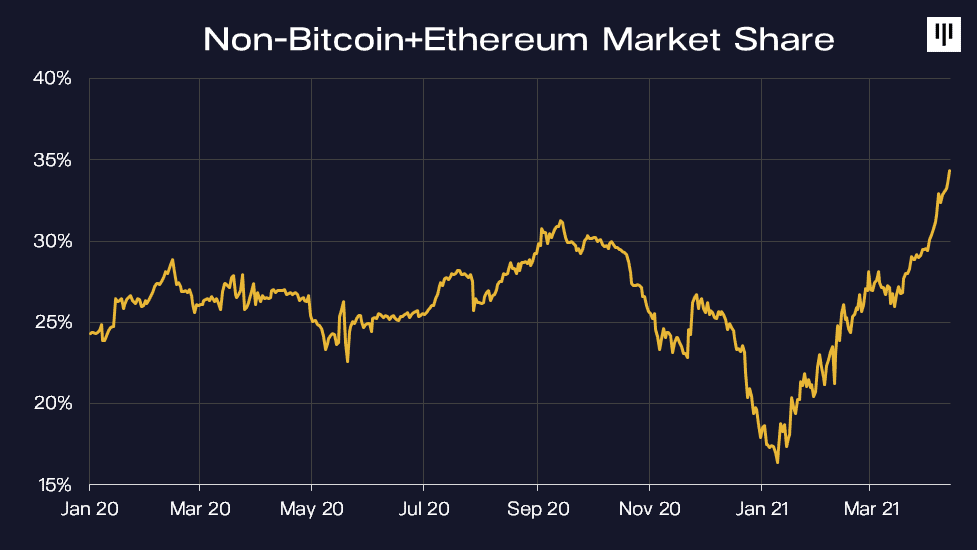

In January, Pantera reported that the market cap of bitcoin and ethereum was 84% of the overall market. All 5,000 other projects made up a combined 16%, but that is starting to change.

“The non-bitcoin and ethereum market share has more than doubled, from 16% to 34%, in the past three months,” Morehead wrote. “Watch this space. That’s where the largest gains are likely to be.”