Playing With Your Pension

“How many 22nd-century bureaucrats did it take to change a light panel? We’ll have a sub-committee meeting and get back to you with an estimate.” – Peter F. Hamilton, Great North Road Financial pundits love to blame central banks for the […]

Image from PPIC

“How many 22nd-century bureaucrats did it take to change a light panel? We’ll have a sub-committee meeting and get back to you with an estimate.” – Peter F. Hamilton, Great North Road

Financial pundits love to blame central banks for the lack of yield available in debt and equity markets, but unfunded pension allocation is the real suppressor of global yield.

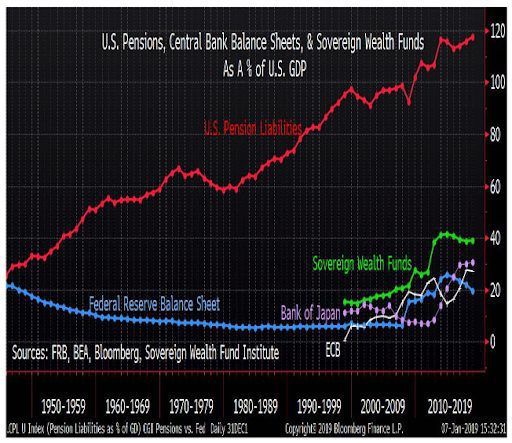

The size of unfunded pension liabilities surprisingly dwarfs global central bank balance sheet expansion [Pictured Below from Reynolds Research, 2019]. While the Central Banks do create the policy and add liquidity (via bond purchases), the unfunded pension flows are the real elephant in the room that sop up the majority of debt supply.

Unfunded pensions are hardly the sexiest topic in the investing universe today. These titanics of slow moving capital are relics in a world rife with investment ADHD. Words like beta and gamma are thrown around amongst asset managers and allocators to create some intriguing financial-ego pricing power (or lack thereof). But underneath all these financial charades, unfunded pensions are perhaps the biggest driver for the rally into extremely risky assets like crypto, albeit indirectly.

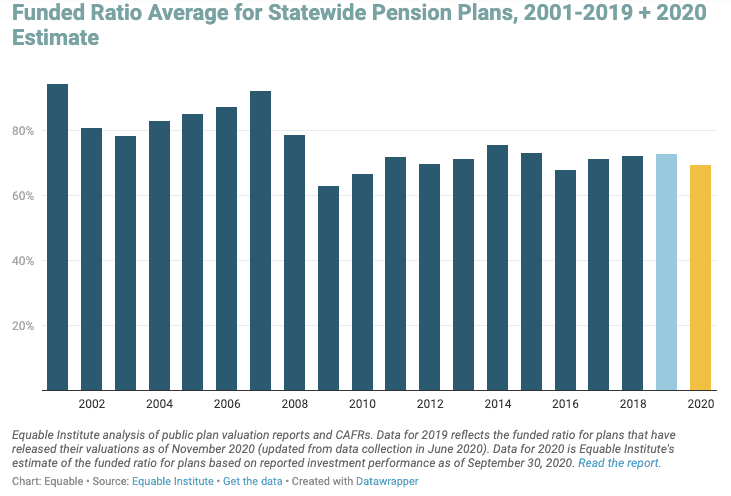

According to Equable, a bipartisan non-profit seeking to educate employees, retirees and policymakers, “The aggregate funded ratio for statewide plans collectively is near its lowest point in modern history” [Pictured Below].

Teachers, firefighters and police officers are definitely concerned, but investors should be as well. Pensions get their revenues from state taxes and then allocate those revenues across a swath of asset classes. California Public Employees’ Retirement System (CalPERS) has a $400 billion fund that holds 49% equity, 30% Fixed-Income, 12% Real Estate, 8% Private Equity & 1% in cash.

As taxes are collected in California, a portion of those dollars gets automatically allocated across these asset classes. This systematic allocation has created massive imbalances in markets, as it has been replicated across nearly every state pension, whose cumulative assets measure in the trillions.

The supply of capital from an aging world demographic is actually way more than the investable universe right now. Through that lens, it should be no surprise that bond yields are negligible and risk asset valuations are sky-high.

The “Yield-To-Worst” of the Barclays Aggregate Corporate Bond Index hit new lows recently [pictured below], which is the lowest possible yield from purchasing a bond apart from the company defaulting. In aggregate, pensions are 69% funded, but won’t be able to make up that gap when corporate bonds give you a whopping 1.8% nominal yield.

If your average unfunded state pension has a 30% allocation to fixed-income and a 7.5% annual return-bogey, then the answer lies further out on the risk-spectrum.

As long as Jerome Powell and Congress provide liquidity to the marketplace and hold a credit crisis at bay, it might not be far-fetched to believe that digital assets will become the next frontier. As unfunded pensions adjust their allocations away from meager yields in corporate bonds, alternative asset classes will be potential beneficiaries.

If unfunded pensions are 120% of U.S. GDP, that is around a $25 trillion shortfall. At this rate, that hole will most likely need to be filled by policy makers. Meanwhile, the market cap for Bitcoin climbs inexorably higher at around $600 billion.

At a 10,000 foot level, this may be the biggest arbitrage in history from bureaucratic institutions to free-thinkers.

This take comes from our Daily Newsletter. Get premium market insights every evening at 7 PM EST. Sign up now.