Rangebound markets, resilient onchain lending

Crypto lags behind TradFi benchmarks, but trends in stablecoins, deposits and loans point to durable multi-year growth

J A A C K/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

While crypto prices have shown a modest recovery in the short term, negative breadth and relative underperformance to TradFi benchmarks on the monthly suggests a prevailing bearish environment.

Zooming out, we look at the secular growth trends within stablecoins and lending as durable sectors for multi-year growth.

Indices

Crypto markets remain rangebound after November’s harsh selloff. The past week has shown a modest recovery, with BTC at $90,400 now being 12% off of its recent correction low of $80,700. Over the trailing 24 hours, the AI and Modular sectors were the top winners, with TAO (+6.4%) and TIA (+6.2%) as notable contributors to this short-term strength. The Perp Index was the top loser, with DYDX (-3.1%) and HYPE (-0.6%) accounting for the sector’s weakness.

Zooming out to the monthly, the picture remains unfavorable. TradFi benchmarks like Gold, Nasdaq and the S&P 500 are all green over the past month, while every crypto index we track is measuring negative returns.

Breadth is decisively negative on the monthly for all crypto indices, with no safe haven provided. Notably, the Protocol Revenue index is the top performing among crypto sectors, suggesting relative strength in protocols with strong fundamental positioning.

Despite recent strength, it remains to be determined whether this rally is countertrend to a prolonged downtrend, or if the low is in for the rest of 2025.

Market Update

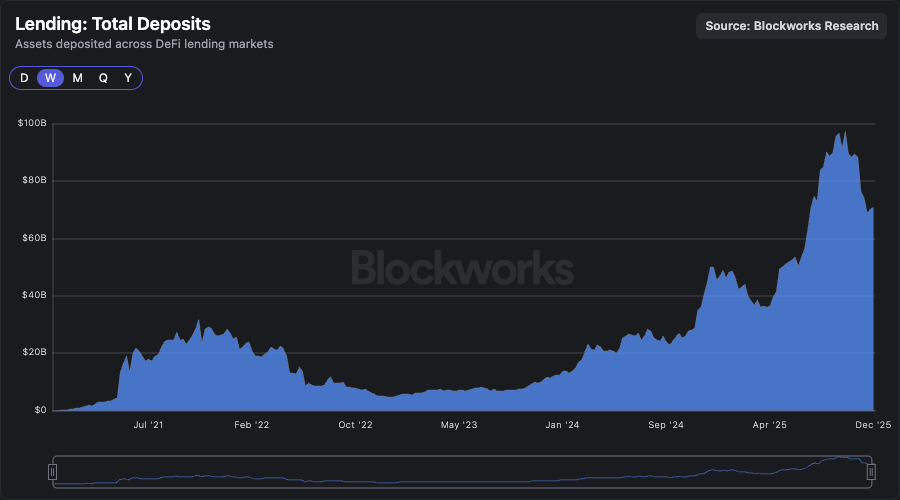

Amid the downtrend, don’t lose sight of the bigger picture, and take a moment to appreciate just how far we’ve come. At the bear market low, lending applications within DeFi accounted for just $5 billion in deposits, a rounding error within the larger financial system. In the years since, this figure has grown to $71 billion in deposits, having just previously tagged near $100 billion.

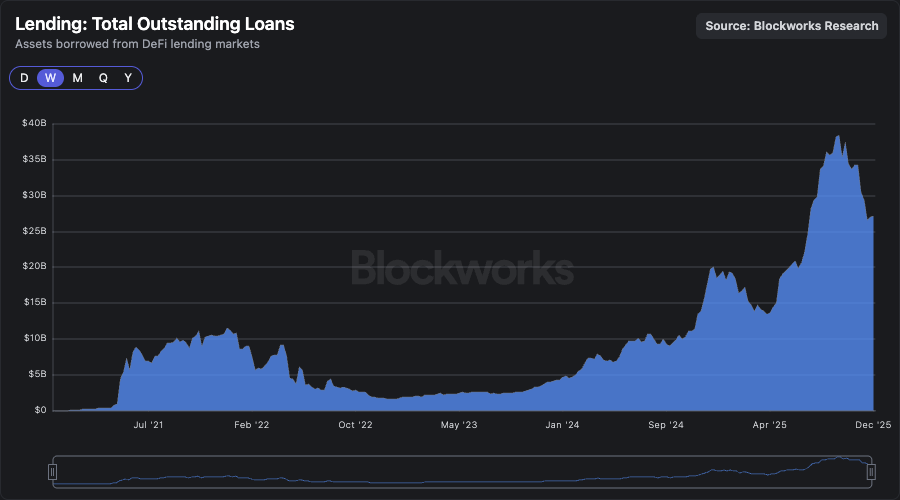

Similarly, loans outstanding on these applications amounted to $1.6 billion at the bear-market low. Since, active loans have risen to over $27 billion now, and recently passed $38 billion. These figures have grown to a scale worth paying attention to, not just for the crypto native. Variance can cut both ways, to the upside and to the downside, for both key metrics and spot prices. But 20x growth in topline metrics in just a few years suggests this sector is a long way off from its terminal growth rate.

Amid the drawdown in crypto prices, the aggregate stablecoin supply has retraced back up to its all-time high of $310 billion, after a brief period of -$10 billion in outflows.

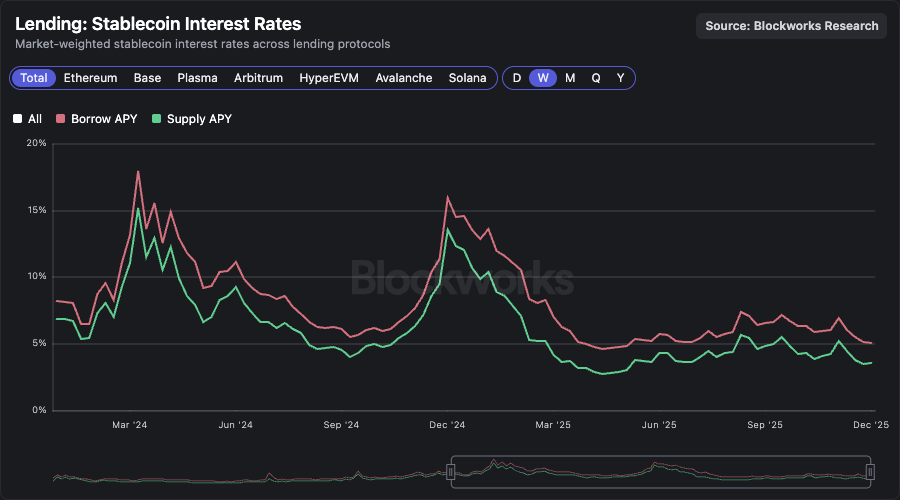

The growth in stablecoins is a trend that I would not bet against. Onchain money markets stand as primary beneficiaries of the growing stablecoin supply, purporting to be the primary applications for utilization. Stablecoin lenders seek yield, while borrowers look for leverage. While spot assets will remain volatile, this secular trend should remain a persistent and durable tailwind for DeFi applications.

Notably, continued growth in the stablecoin supply comes amid very modest onchain yields. Benchmark supply rates on lending applications are reading 3.6%, a discount to SOFR at 3.9%. Growing depth in onchain stablecoin liquidity may continue to dampen the upside in supply rates, and absent a material risk premium to legacy rates, growth in stablecoin utilization on money markets may falter.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.