After Monad’s TGE, can the chain turn hype into long-term conversion?

The data paint a complicated picture about user activity and the Monad ecosystem

Ann in the uk/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Markets continued to claw back losses from Monday’s selloff, with BTC, the S&P 500, and the Nasdaq up 2.52%, 0.22%, and 0.05%, respectively, yesterday. Even safe haven gold has given back some gains and is down -0.12% on the day as risk appetite improves.

The uptick came after a surprise decline in private sector employment. Private employers shed 32,000 jobs in November, compared with expectations for job growth. This pushed the odds of a rate cut next week to 85%, up from 80% a week ago. Microsoft dragged on the Nasdaq, falling more than -2% after reports that the company has lowered AI software sales quotas due to softer than expected demand.

Across crypto sectors, most indices finished in the green except Gaming, which fell -1.65%. Gaming has been one of the weakest performers this year and is down -77% year to date. Memes, typically the most reflexive sector during market rebounds, also lagged with a modest 1.24% gain. The index was weighed down by PUMP and PENGU, which fell -2.54% and -1.80%, respectively, on the day.

On the upside, the AI sector led the market with a 7.46% gain. TAO continues to drive the index higher and climbed 7.6% ahead of its halving next week. L1s followed with a 6.45% move, powered by ETH and BNB, which make up 63% of the index and were up 6.6% and 5.2%, respectively.

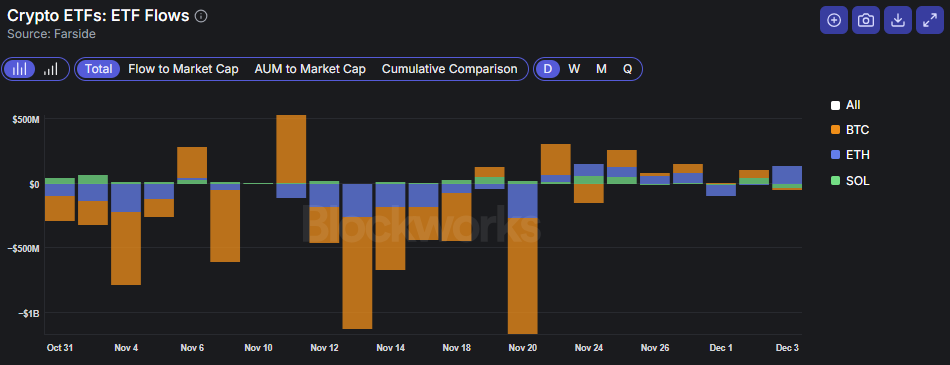

Flows tell a more cautious story. After five days of inflows, BTC ETF flows turned negative again with a modest -$14.9 million in outflows. ETH ETFs, however, saw a strong rebound with $140.2 million of inflows after two days of declines earlier in the week. Even so, flows have yet to show real conviction when set against the -$4.4 billion in net outflows seen across November.

Market Update: Monad

Now that we are about one and a half weeks past the Monad TGE, it is a good moment to step back and assess how the chain is actually performing post launch. After a strong initial rally, MON has cooled off and is down -28% on the week, leaving it up a modest 16% from its ICO price. On the ecosystem side, DeFi TVL continues to climb and now sits at $277.5 million.

A large portion of that TVL is concentrated in AUSD. Around $144 million of the $277.5 million sits inside Agora’s stablecoin, which is being farmed across various protocols to earn ecosystem incentives. Upshift holds $73 million and is deploying AUSD across DeFi protocols such as Morpho, Uniswap and Euler. Morpho currently offers 4.5% APY on AUSD and 5.98% on USDC, with most of the yield coming from MON incentives rather than organic borrow demand. Incentives are an acceptable way to jump start early liquidity, but the real test will be whether Monad can attract DeFi applications that generate sustainable, organic yield once the incentive fire hose tapers off.

Looking at native apps, Nad.fun has been the breakout leader in both accounts and transactions since day one. It is Monad’s native memecoin launchpad, but its staying power is not guaranteed. Only two tokens launched there have crossed the $1 million market cap mark. Even Chog, the chain’s first community token, is down more than 65% from its highs and sits at $4.5 million today. Not exactly the early momentum you would want for a vibrant meme ecosystem.

Other homegrown projects are gaining traction. FastLane has become the primary LST on Monad. Pinot Finance is emerging as an alternative DEX to Uniswap. Lumiterra, an MMORPG, has quietly put up strong usage numbers and ranked third by accounts and second by transactions yesterday.

On the chain level, activity looks promising for a network this early. Monad generated $100,000 in fees over the last seven days, placing it ahead of chains like Avalanche and Ton. Daily transactions and active addresses have been hovering around 2.2 million and 117,000, respectively. These are respectable metrics for a chain that just came out of the gate.

But one data point stands out. WormholeScan shows that 75% of the assets bridged into Monad have already flowed back out to other chains. That is an early sign that users may be farming and rotating rather than sticking around.

For Monad, the next phase is all about conversion. Can the chain turn early speculative inflows into sticky liquidity and real economic activity? The charts above are the ones I’ll be watching closely to see whether this ecosystem can turn early hype into lasting traction.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.