Stablecoins accounted for 90% of salaries paid in crypto in 2024: Pantera survey

9.6% of crypto industry employees were paid in crypto, and most opted for USDC and USDT

robertindiana/Shutterstock and Adobe modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

At the end of last year, Pantera collected a decent batch of data, taking a look at just how folks in crypto are being paid.

Roughly 3% of people in the industry were paid in crypto in 2023, but that number shot up to 9.6% by the end of 2024. Interestingly enough, there was also a trend in folks opting to take their salaries in stablecoins.

Mind you, this was prior to stablecoins taking off (as we’ve seen and discussed) throughout 2025. So it seems that it’s not just institutions that’re buying into the stablecoin narrative.

Specifically, people opted to take their paychecks in USDC and USDT, the report noted.

“USDC (63%) and USDT (28.6%) collectively account for over 90% of crypto salaries, cementing their status as the go-to choices for payroll stability and liquidity,” the report said.

As you can see in the chart below, a far smaller number of folks opted to be paid in SOL and ETH.

Admittedly, this is data from 2024 (meaning it happened well before lawmakers were finalizing the stablecoin legislation in the US), but I’m slightly surprised that USDC outranks USDT by a decent margin.

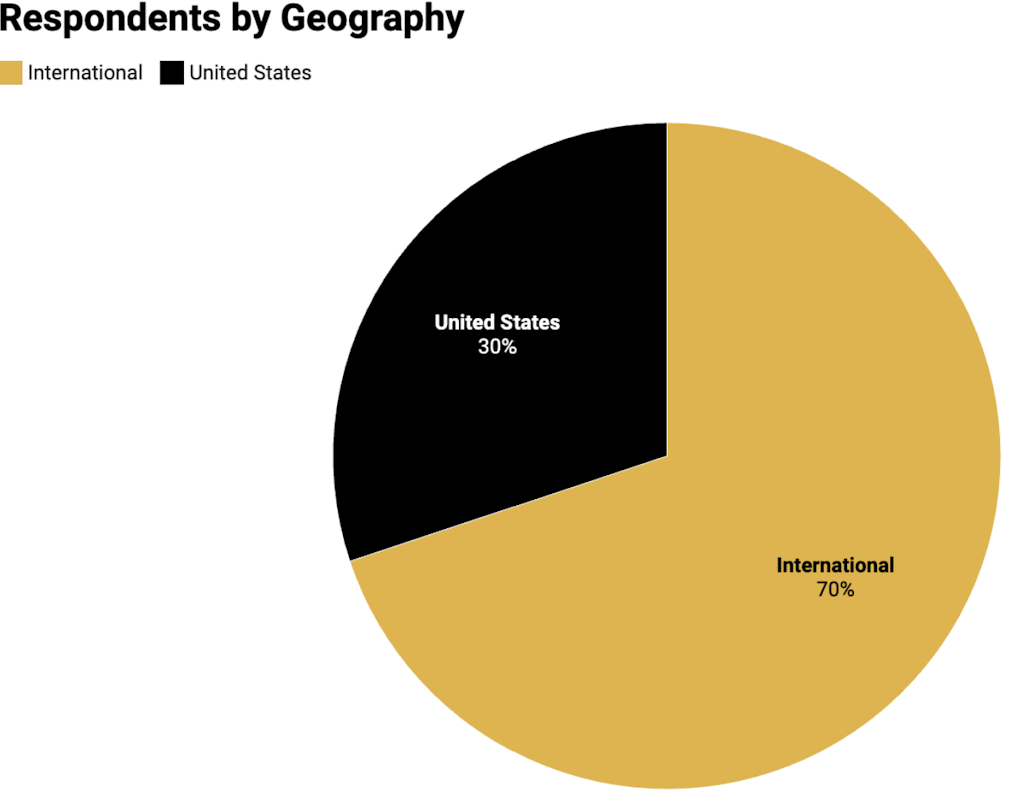

Especially since the respondents were largely international, as you can see in the chart below.

Source: Pantera Compensation Survey

Source: Pantera Compensation Survey

But there’s a reason for that, Pantera found.

“We initially thought this was due to our survey skewing more western. After digging in further, we found it very interesting that none of the major payroll providers in the space (Deel, Remote, Rippling) offer USDT for payroll,” the survey said.

The team at Pantera told me that the data was collected from a variety of projects around crypto.

“Our survey includes data pulled from dozens of geographically-distributed startups and information we gathered from hundreds of participants in the crypto community spanning a wide range of professions,” they noted.

And this came from around 1,600 folks in different sectors, including DeFi, CeFi, gaming, etc. Of that total sum, 47% of respondents were in senior positions, while 29% were in the middle of their careers. The smallest number of respondents, 24%, were junior employees.

“There’s still no reliable, comprehensive database for compensation in the blockchain ecosystem — so we set out to change that,” Nick Zurick, head of portfolio talent at Pantera, told me. “This survey is a first step toward bringing transparency to crypto compensation. Whether you’re a founder, candidate, or operator, we hope the data is valuable as you build and grow in the space.“

I point this data out because it shows the larger trend towards stablecoins. And now, as we head into the final months of 2025, I’ll be curious to see if we see an even higher tick up. But, alas, only time will tell.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.