The end of the petrodollar

“Dear future generations: please accept our apologies. We were rolling drunk on petroleum.” – Kurt Vonnegut The Decoupling Could it be happening before our eyes?! “Norwegian industrial giant Aker has established a new firm called Seetee to invest in the Bitcoin […]

Image source: norskpetroleum.no/

“Dear future generations: please accept our apologies. We were rolling drunk on petroleum.”

– Kurt Vonnegut

The Decoupling

Could it be happening before our eyes?!

“Norwegian industrial giant Aker has established a new firm called Seetee to invest in the Bitcoin ecosystem. They have already purchased 1,170 BTC worth $58 million for its treasury with plans to add more.”

The superficial headlines of this purchase do not do it justice.

This is not another small corporate purchase like Michael Saylor.

To understand the ramifications of how big this is, we need to dig a bit deeper.

Who is Kjell Inge Rokke and Why Does He Matter?

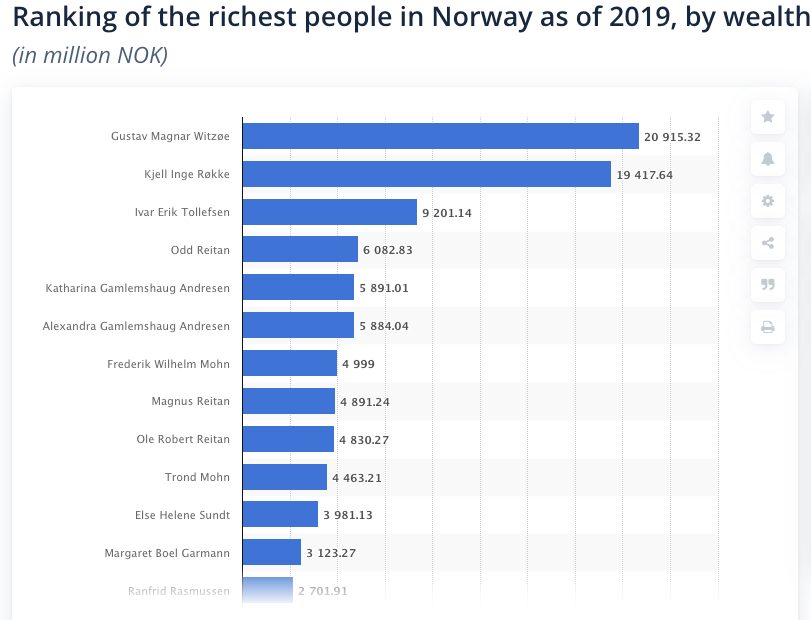

Rokke is the second richest person in Norway, chairman of Aker ASA and has a net worth of $5.4 billion.

Aker has a 180-year history as an industrial conglomerate in Norway and primarily owns oil and gas as well as renewable energy companies.

In his must-read letter today, Rokke’s said:

“Aker is part of the industrial establishment. As someone who started my career in the engine room of old fishing trawlers outside the coast of Norway and later in the Bering Sea in the United States, I’m immensely proud of what Aker has become, including the newly-formed industrial partnerships we have recently announced. But all large companies have one thing in common: they were once small. And many large companies are victims of their own success and end up small or defunct. I will do everything I can to keep Aker curious, innovative, and able to keep up with the times.”

What is Norway’s “Oil Fund”?

I’m going to take tangent here and hope to loop it all together at the end.

From the Norges Bank Investment Management website:

“In 1969, one of the world’s largest offshore oil fields was discovered off Norway. Suddenly, we had a lot of oil to sell, and the country’s economy grew dramatically. It was decided early on that revenue from oil and gas should be used cautiously in order to avoid imbalances in the economy. In 1990, the Norwegian parliament passed legislation to support this, creating what is now the Government Pension Fund Global, and the first money was deposited in the fund in 1996. As the name suggests, it was decided that the fund should only be invested abroad.”

So let’s get this straight…

The “Oil Fund” taxes Norway’s oil industry and then reinvests that money in corporations around the world.

This is what is referred to as petrodollar recycling and has been at the backbone of globalization for 50 years.

Today, Norway’s Oil Fund is the largest sovereign wealth fund in the world with over $1.3 trillion in AUM and it owns 1.5% of all the world’s listed public companies!

You wouldn’t expect this, but they are one of the “world controllers” who decide the value of entire asset classes.

If they decide to move into any asset, the Oil Fund has an immense impact.

This is the financial equivalent of LeBron James deciding what companies he wants to back.

LeBron’s brand has an immediate impact because of his social reach, just like the Oil Fund has on financial assets.

Bring it Back to Rokke

Rokke’s company is one of the top five largest in Norway and saw the development of globalization and the petrodollar system first hand.

I think what Rokke really sees today is a breakdown in globalization and a backlash against giant institutions.

This is why Rokke’s foray into bitcoin is so much more than just $58 million of investment.

In his letter he sites one other thing that I thought spoke volumes:

“Investors use bonds to diversify their portfolios. Norway’s entire sovereign wealth fund is designed that way and it has worked well in recent history. But what if equities and bonds fall concurrently, which they have done for long periods historically? Before the Federal Reserve stepped in with unprecedented measures, that was about to happen one year ago.”

Now this is me being a bit of a conspiracy theorist.

I have to imagine Rokke and Nicolai Tangen, the CEO of Norway’s Fund, are good friends.

A month ago the fund announced their final sale of investments into fossil fuel companies and hopes to become an international leader in climate change.

So…how long until Norway’s Oil Fund diversifies into bitcoin?

A Note on the 4th Turning

Rokke sites some usual suspects in his letter as well:

“Our collective knowledge was derived from the extensive and brilliant material produced by others. These include Saifedean Ammous, Andreas Antonopolous, Adam Back, Nic Carter, Christopher Cole, Ray Dalio, Michael Green, Hugh Hendry, Reid Hoffman, Lacy Hunt, Jack Mallers, Raoul Pal, Chamath Palihapitiya, Anthony Pompliano, Pierre Rochard, Michael Saylor, Elisabeth Stark, Erik Townsend, and Grant Williams.”

I’ve had the privilege of working for both Raoul and Grant at Real Vision and have spoken with many others on the list.

Nearly all of them have come to the conclusion that we are heading into a new paradigm of inflation, long volatility and a movement from Capital to Labor.

If the second wealthiest man in Norway with a courtside seat to globalization and petrodollar recycling is using their work as his rubrick, we should all take heed!

Lastly, if you don’t think we are living in the 4th Turning, I’d advise you to watch Prince Harry, Meghan Markle and Oprah dismantle a 1,200 year monarchy in 120 minutes on TV last night…ouch!

This take comes from our Daily Newsletter. Get premium market insights every evening at 7 PM EST. Sign up now.