New token trading opportunities on the horizon

The market is down, but at least there are new tokens to buy or sell

whitehoune/Shutterstock modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

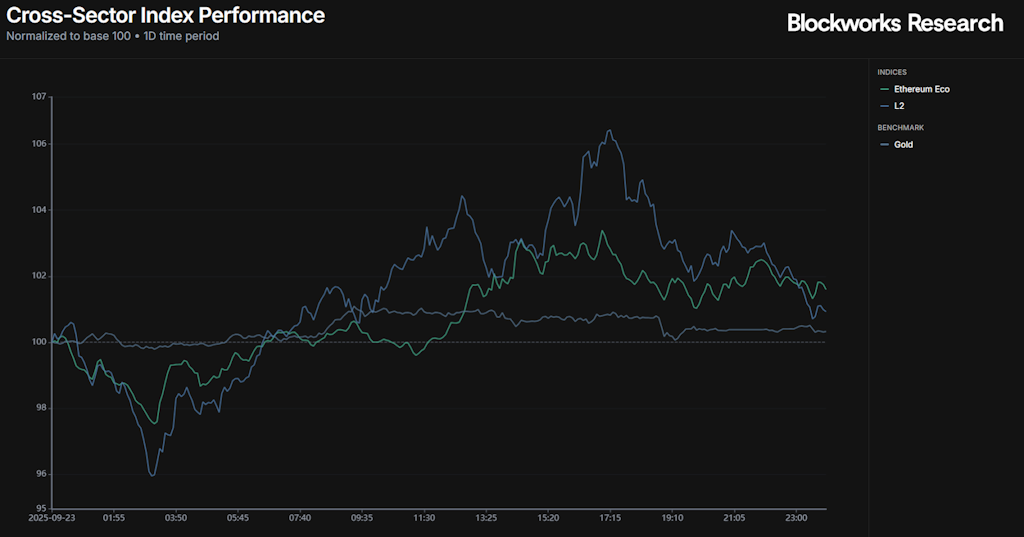

In a sea of red, only a few of our indices registered positive returns in yesterday’s session, namely Ethereum Eco and L2s. Notably, Ethereum Ecosystem and L2 tokens were among the hardest hit in the selloff on Monday, so perhaps we’re seeing some resistance forming. Meanwhile, gold continues to go from strength to strength, hitting yet another all-time high of $3,770.

On Monday, approximately $1.7 billion in leveraged positions were liquidated as crowded longs unwound en masse. BTC plunged nearly 3%, while ETH and SOL suffered sharper declines of 6-7%. Markets have attempted to stabilize over the past two days since, but that liquidation event seems to have become a defining catalyst in subsequent trading windows, reshaping positioning, sentiment and structural dynamics in its wake.

In the aftermath, Tuesday unfolded as a reactive consolidation period. The majors (BTC, ETH and SOL) largely held near support zones, absorbing the shock without collapsing entirely. The intense deleveraging removed much of the “weak hands,” thereby lowering the risk of further cascade-style moves unless a new catalyst emerges. But momentum has clearly cooled as trades over those two days lacked directional conviction, reflecting the market’s digestion of the prior day’s stress.

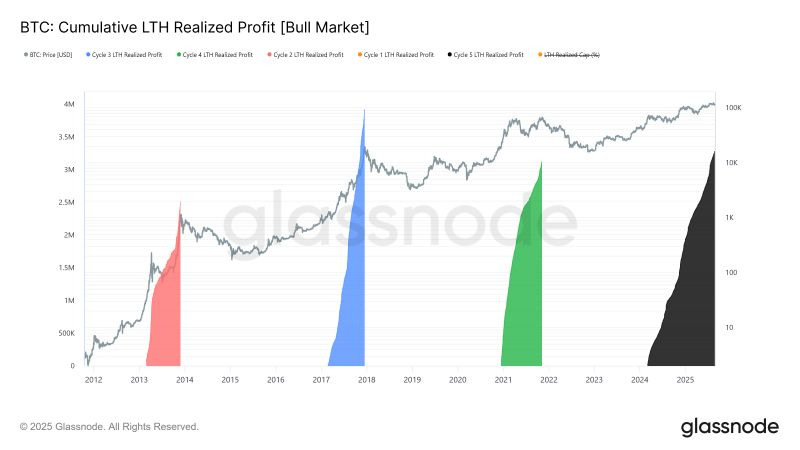

Zooming out, the cumulative profit realized (in BTC terms) by long-term holders so far this “cycle” has mimicked previous instances but over a longer period of time. Long-term holders have realized 3.4 million BTC, a historically large figure, highlighting just how significant their distribution has been in this cycle compared to prior ones.

Looking ahead, markets appear to be entering a transition phase defined less by euphoria and more by recalibration. With leverage meaningfully reduced and long-term holders continuing to distribute into strength, the next leg will likely depend on fresh catalysts — be it macroeconomic data, regulatory developments or ETF/DATCO flows. Until then, participants may need to navigate a thinner, more tactical environment where positioning discipline and patience take precedence over chasing momentum.

New tokens and cash

Historically, I have been a big fan of allocating to tokens I think are interesting and of “low” risk (low here meaning that they may go down 50% as opposed to 80% over the course of a week). This has meant that I keep relatively low cash (sub 10%), while being fully exposed to BTC and alts (primarily alts).

This has been helpful in a few ways. Firstly, I find I am not as intrigued by the constant chase that I imagine many people go through. If I am already allocated to good tokens, I cannot chase every new launch, narrative or sector. Instead, if I find something really interesting, I can just rotate into it, primarily from another alt.

The concept of keeping consistently high exposure throughout the bull is unfortunately not as good of a strategy as it used to be. In 2021, you could rotate quite intensely with relatively low cash. Since everything went up all at once, you rarely missed out on opportunities, especially if you were very diligent with the cash you held on hand.

With return dispersion within crypto at an all-time high, it’s started to make more sense to allocate more heavily into cash while still keeping some good token exposure (for me, BTC, HYPE even though it’s painful these days, PUMP etc.). Cash gives you the optionality to go heavily into a good token at the beginning, where the majority of returns are, while keeping risk relatively low. In addition, holding a large percentage of your portfolio in a specific token can also affect your mindset by giving you the idea that these tokens should be set-and-forget, when in reality they can take sharp downturns. Instead, if you are allocating from cash-to-token-to-cash, you are always aware of how much you are potentially giving up.

The reason I have been thinking about this more and more is because:

- The market is down, making me reconsider why I am so heavily invested all the time.

- With recent launches, I have noticed that it’s much better to be aggressive in the early days, and then reallocate into cash during the run-up.

In regards to my second point, I am going to give two qualitative examples: ASTER, HYPE and PUMP.

If you did not have cash on hand during the ASTER, HYPE, or PUMP launches/early trading days, you are faced with the decision to sell an asset to instead acquire the newly launched asset. This complicates your decision-making process: Instead of saying “I will allocate my cash to asset,” you now have to think about which asset you will sell to allocate, if you’re selling the bottom of the asset you are selling, if it’s better to wait instead, etc.

There are obviously nuances to these situations. HYPE launched at a very low valuation and was mostly airdropped to retail users, with funds/institutional capital receiving no allocation. Funds/institutional capital instead had to allocate, meaning there was no immediate negative price action following the launch.

With PUMP, there was a large ICO and public sale, also offered to institutions, which took advantage of the 50% profit at launch and decided to sell. The token traded down, but is now up 2x since the lowest point, and up around 50% from the public sale.

With ASTER, the token had a large, vocal backer who understood how to play the game (CZ) and heavily controlled supply.

I’m writing about this because there are plenty of tokens and chains that are deciding to launch over the next few weeks/months. To start us off, XPL will be launching Thursday at 8 am ET. We’ve all seen and heard rumors of Monad, MegaETH and Fogo launching in the fall as well. Each of these tokens will have its own nuances, similarly to the way HYPE and PUMP both had their own nuances:

- Some of these tokens will have had large public sales or airdrops, and therefore may see volatile (to the downside) price action in the early days.

- Some of them you may not think are good tokens.

- Some of them may be very supply controlled or have limited institutional allocation.

In any of these cases, it might make sense to decide in advance what you will rotate in from, if the time comes to buy (again, depending on what you think is the right time). However, the past year has shown that the market rewards those who are able to make some form of a decision, without falling into one of the following traps:

- This token is down since launch, therefore it is a scam (relevant only if it is a good token).

- I am already allocated into X, why would I buy Y.

- What should I sell to buy? What if it pumps after I sell?

The token is the strongest tool a protocol or chain has at its disposal (incentives, airdrops and token price appreciation are much more relevant than a lot of people give credit for). They can be used to siphon away users from competitors, increase attention to the product, or make more revenue. Protocols are constantly thinking about the best time to launch their tokens. With relevant token launches coming up, we believe that more and more chains and protocols will be launching their own tokens as well. It’s likely a good time to prepare in advance.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.