Viktoriia_M/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

The past three days on the timeline have been strictly focused on the bid for USDH, a ticker on Hyperliquid.

As background, the USDH ticker, currently reserved, is set to be released through an onchain validator vote with the goal of launching a Hyperliquid-first and compliant USD stablecoin. Validators will vote on which team may purchase and deploy the ticker, using the same onchain mechanism as delisting votes. Teams interested must submit proposals in the USDH Discord forum, including their address, and the approved team will still need to participate in the spot deploy gas auction.

In the longer term, spot quote assets will become permissionless, starting with testnet, with staking and slashing requirements to be announced. The USDH ticker does not carry special privileges and will exist alongside multiple stablecoins within the Hyperliquid ecosystem. Voting for the ticker is based on stake, with proposals due by Sept. 10 at 10:00 UTC, validator intent to be declared by Sept. 11 at 10:00 UTC, and the final vote to occur on Sept. 14 between 10:00-11:00 UTC.

As of today, nine validators have announced who they intend to vote for, with six voting for Native Markets, two for Paxos and one for Ethena. The remaining 10 validators, who hold approximately 58% of stake, are unassigned (86.76M HYPE). Native Markets is currently in the lead with 30.8% of voting share, while Ethena and Paxos combine for 11.6%.

In terms of benefits for Hyperliquid and HYPE, there are a few things to consider. Firstly, it is interesting to see that incumbents from large teams (Ethena, Paxos etc.) are battling out to gain dominance within Hyperliquid by giving up a large percentage of their revenue.

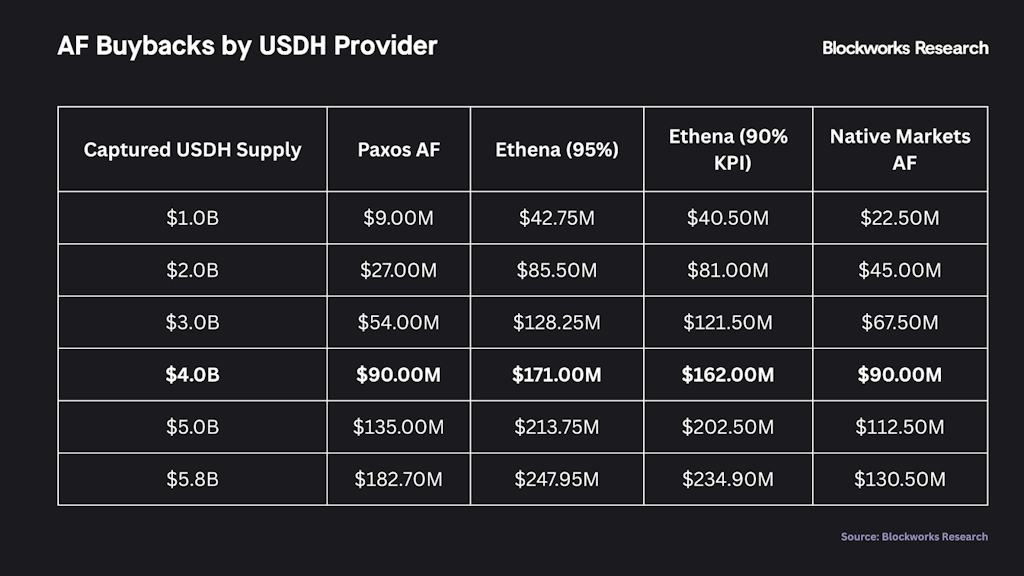

Context regarding the three most relevant proposals:

- Paxos: Milestone-based. Starts at 20% AF when <$1 billion, rising to 70% at >$5 billion, capped at 70%.

- Ethena: 95% passthrough to AF/HYPE, KPI could drop to 90% with 5% to an Ethena entity.

- Native Markets: 50% of reserve yield streamed to AF, remaining 50% for growth across HIP-3, builder codes and DeFi frontends.

For Ethena, the lowest contribution to the Assistance Fund would still be more than $40 million per year, even in the conservative KPI scenario. At full scale, its contribution rises to nearly $250 million, making it the strongest provider of direct economic value among the three. For Paxos, the lowest level of contribution is around $9 million per year at small scale, while its highest contribution tops out at roughly $183 million once it reaches the largest market share bracket. Native Markets, with a fixed 50% allocation, is currently the leader based on declared intent. Its range runs from about $23 million per year at the low end to around $130 million at full capture.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.