WonderFi Announces Closing of Bitbuy Acquisition, Overcoming Regulatory Hurdles

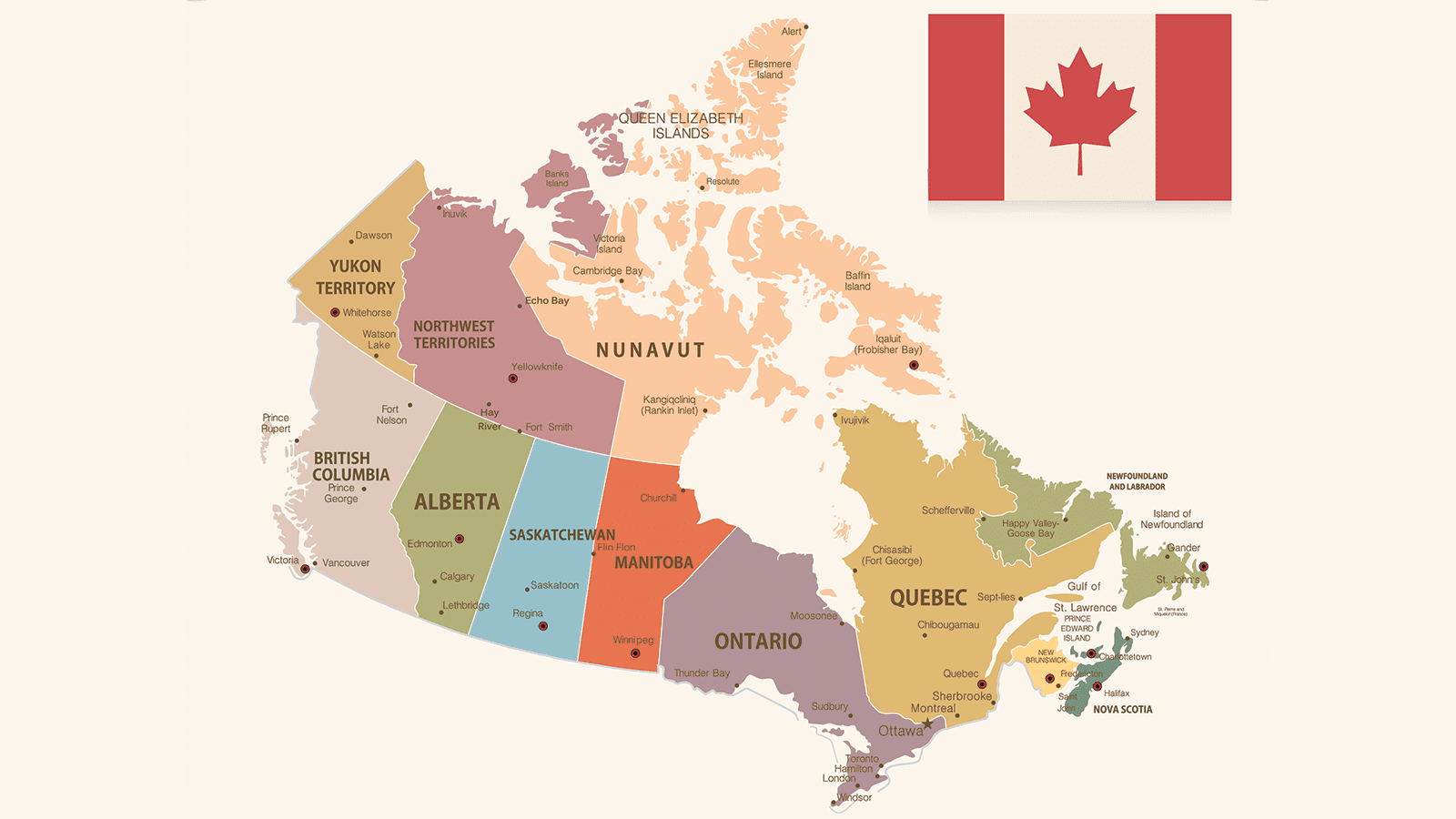

It is the first time in history that every securities regulator in Canada had to approve an acquisition, CEO says

Source: Shutterstock

- Months after the deal was introduced, WonderFi has announced the close of its acquisition of Bitbuy, the only regulated cryptocurrency exchange in Canada

- The process resulted in WonderFi’s product offerings being allowed to be made available in select Canadian provinces

Canada-based decentralized finance company WonderFi Technologies has closed its acquisition of First Ledger Corp, the parent company of Bitbuy Technologies, after a long regulatory battle.

WonderFi, which trades on the Neo Exchange in Canada, has agreed to pay $161.8 million in USD in cash and shares.

The deal was first announced in January 2022. It’s the first time in Canadian history that every provincial regulator had to approve a change of control where a publicly traded company, WonderFi, was acquiring an approved crypto entity, said Ben Samaroo, CEO of WonderFi.

There were three main regulatory considerations in relation to the acquisition, Samaroo said.

“One, a change of control occurrence of a newly approved marketplace and restricted dealer, two, a publicly traded company acquiring a company holding these approvals and three, the acquirer, WonderFi, engaged in DeFi, a high-growth emerging industry,” he said.

WonderFi was interested in the acquisition of Bitbuy because it provides an opportunity to combine a centralized exchange, Bitbuy, with WonderFi’s DeFi products.

“This is a very important transaction for WonderFi’s future,” said Kevin O’Leary, an entrepreneur and WonderFi advisor and investor, when the deal was first announced.

“When you think about customer acquisition, you want to make sure that you provide every opportunity to service that customer…you want to offer every service they want.”

Collectively, the two companies have raised over $100 million dollars over the past 12 months, making the combined entity the largest capital raised for any single crypto platform in Canada, according to WonderFi.

WonderFi’s DeFi products are not currently available throughout Canada, but Samaroo is hopeful that this regulatory process will open the door for greater compliance.

“As a result of this acquisition, the regulatory bodies in Canada prudently chose to take the opportunity to delve into the WonderFi product offerings,” he said. “The result of the regulatory exercise led to select provinces choosing to allow WonderFi’s products to be made available, while some of the other provinces elected to further review and develop their views on the new high-growth emerging industry.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.