Sotheby’s Set to Auction 104 CryptoPunks Valued at $20M to $30M

All 104 CrypoPunks will be bundled together in a single-lot sale

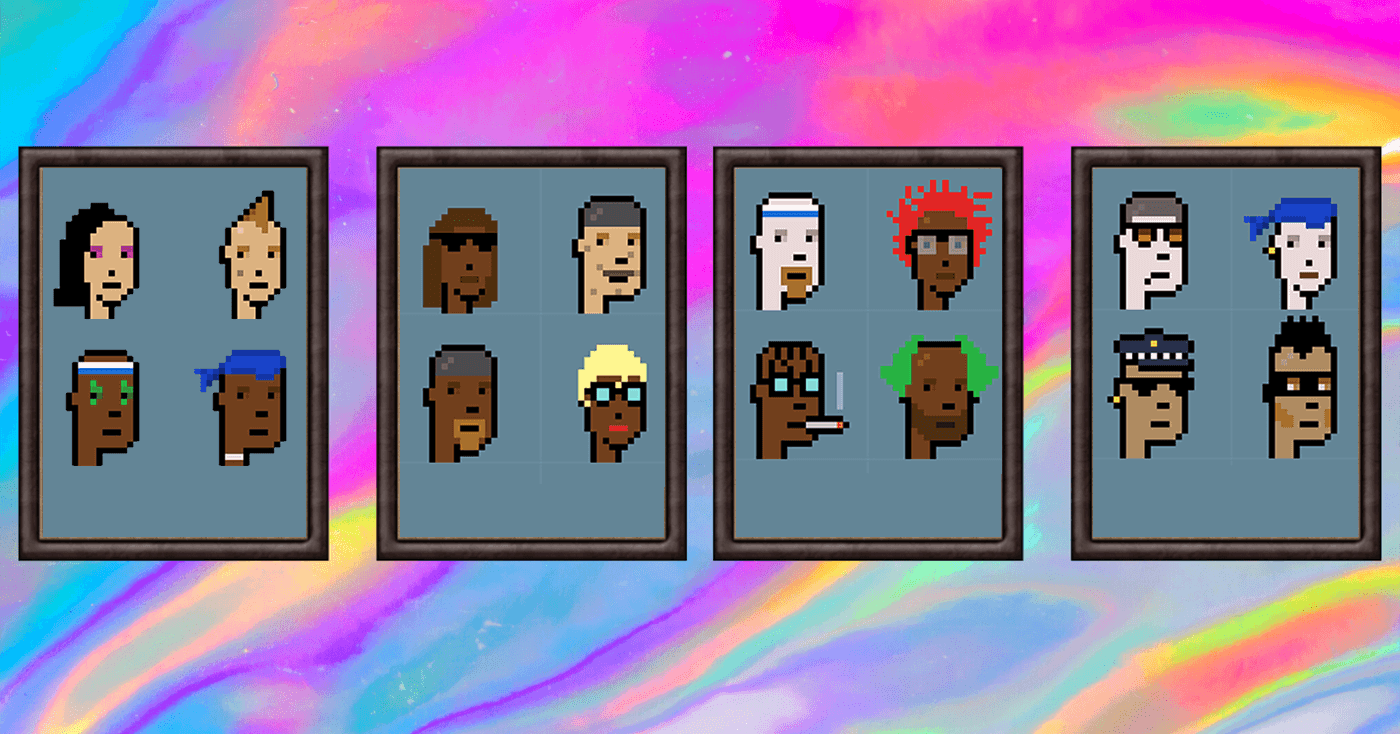

Some of the Sotheby’s CryptoPunk collection

- Sotheby’s previously sold one CryptoPunk NFT for $11.8 million in June 2021

- The auction house sold $100 million worth of NFTs in 2021, according to its annual report

Sotheby’s will auction 104 CryptoPunks Feb. 23, the New York auction house said Tuesday. The NFTs carry an estimated value of $20 million to $30 million.

Michael Bouhanna, Sotheby’s co-head of digital art, described the sale as a “first-of-its kind” and “monumental” in part due to its focus on CryptoPunks.

“CryptoPunks are the original PFP series that created the template for other NFT projects that have followed, and which helped propel NFTs to the global stage as one of the most recognizable visual styles that have become synonymous with the digital art movement,” Bouhanna said in a statement.

The group of CryptoPunks set to be auctioned was originally acquired together in a single transaction by the anonymous collector “0x650d.” CryptoPunks, which were released in 2017 by studio Larva Labs, currently have a floor price of $210,374 each, according to crypto data provider NFT Price Floor.

For the evening auction, Sotheby’s will accept cryptocurrencies like bitcoin and ether, as well as fiat currencies. All 104 CrypoPunks will be bundled together in a single-lot sale.

However, this isn’t Sotheby’s first foray into blockchain-based digital collectibles.

Sotheby’s launched an NFT (non-fungible token) marketplace called Sotheby’s Metaverse in October 2021, making it the first auction house to start such a platform. Sotheby’s earlier sold CryptoPunk #7523 for $11.8 million in June 2021.

The auction house dubbed its performance in 2021 as “the strongest total in [the] company’s 277-year history,” in an annual report, in part due to its $100 million of NFT sales.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.