CME Ether Futures Launch Quietly, But With Big Industry Implications

CME launched futures contracts for ether yesterday and though hype around the event was subdued, investors are enthusiastic about its role in breaking down barriers for institutional investors to the broader digital asset market. “It was a quiet first day but […]

VIA SHUTTERSTOCK

key takeaways

- Investors say even though ether futures launched on CME with less fanfare than the bitcoin futures saw a couple years ago, it’s a huge step for the market for digital assets

- CME’s Tim McCourt said customer interest in ether futures is much more specific than it was for bitcoin futures

CME launched futures contracts for ether yesterday and though hype around the event was subdued, investors are enthusiastic about its role in breaking down barriers for institutional investors to the broader digital asset market.

“It was a quiet first day but it’s a huge step for the digital asset market at large,” said George Michalopoulos, portfolio manager of the Leonidas Energy and Macro Strategies at Typhon Capital Management. “If we can do ethereum now, what’s to stop the number three coin from being introduced to the future?”

Futures contracts for ether bring more participants and more liquidity into the world of digital assets, he added. That makes ether a more serious, secure, legitimate and scalable asset class to invest in and takes away the custodial risks that come with physical coins.

“Having futures, having institutions interested in them and feeling protected because they can trade an instrument that is centrally cleared and held in their regular futures account rather than trading spot, is a part of the maturing process,” said Michael Pomada, president and CEO of Crabel Capital Management.

It could also open up different trading opportunities like relative value pegs between digital assets, Michalopoulos said.

“You’ll really get this diverse set of crypto instruments that are going to do a lot of things, including making more competitive playing fields for crypto assets to compete by having access to deeper pools of liquidity and interest.”

Ether is the second largest digital asset by market cap and daily volume, and the native token of the Ethereum blockchain network, which powers most decentralized finance (DeFi) applications and projects.

The contracts are cash-settled and priced based the exchange’s reference rate, which draws data from cryptocurrency exchanges Bitstamp, Coinbase, Gemini, itBit, and Kraken.

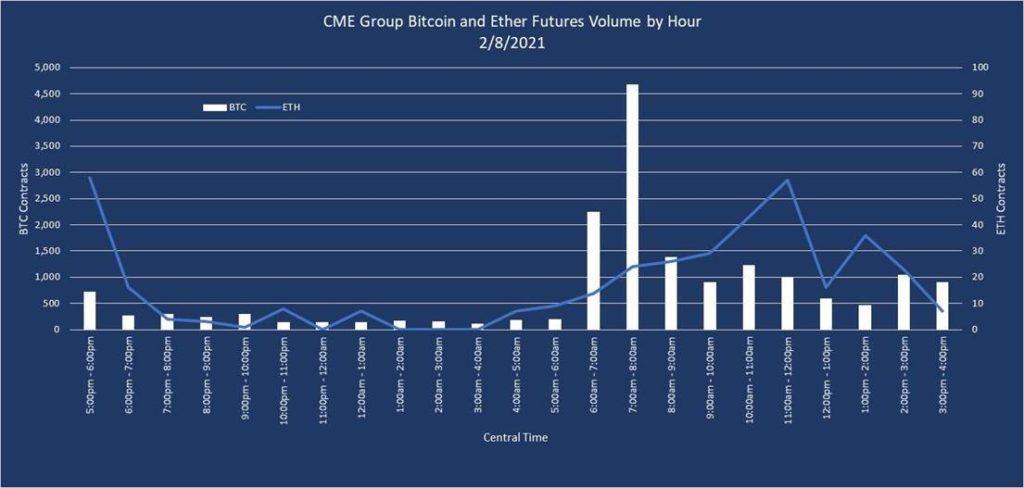

Source: CME Group

Source: CME Group

Initial trading began at 6:00 Sunday evening and CME registered 388 contracts, or 19,400 ether, by the end of the trading day, Tim McCourt, global head of equity index and alternative investment products at CME Group, told Blockworks. That includes a block of 20 contracts purchased by the digital wealth management company BlockFi. A single ether futures contract represents 50 ether. The digital asset passed its all-time high early Tuesday, breaking $1,800.

CME is trading about 137 ether futures contracts as of early Tuesday, McCourt said. It currently has 228 contracts of open interest worth 11,400 ether.

CME, or the Chicago Mercantile Exchange, the world’s largest futures exchange, listed bitcoin in 2017 and has become the largest market for bitcoin futures, with 19 percent, or $2.1 billion, of the $11 billion in open interest in bitcoin across futures markets internationally, according to crypto derivatives research firm Skew.

Growth and next milestones

Customers demanded ether futures no doubt because ether is the second-largest digital asset, but McCourt said while that’s one part of it, their interest in it is also more specific than it was for bitcoin futures a couple of years ago.

“The enthusiasm for ether is a little bit more pointed and there are some specific things about ether that they like around how ether is used on the network,” he said. “In bitcoin [futures], we were getting feedback that people just wanted to be involved in crypto. So the number one [asset by market cap] made the most sense. But it was very specific enthusiasm around ether that also manifested during our customer validation.”

McCourt added that clients have shown interest in various DeFi projects as well as stablecoin developments anchored in the ethereal network.

Bitcoin and other digital assets are still extremely young, but they’re becoming more mature and while it may have taken almost a decade to see the first bitcoin futures contracts traded, investors are warming to other digital assets and an accelerated pace.

McCourt said there are 110 traders or accounts in the CME market that hold at least 25 bitcoin futures, which are worth 125 bitcoin. The record average daily open interest in the fourth quarter was a little more that 11,000 contracts, about a 55,000 bitcoin equivalent and a 230 percent increase from the same time in 2019, according to McCourt.

Pomada suggested that eventually investors will be able to trade digital coin baskets that include more than just bitcoin and ether. CME customers have shown interest in the top five to 10 digital assets by market cap, according to McCourt. They’re also keen to see the CME create additional reference rates and real-time indices for other bitcoin and ether currency pairs.

“There’s still a lot of interest in other permutations of the bitcoin and ether ecosystem,” McCourt said. “But most of the feedback we get is around tracking the movement of the market capitalization table in terms of interest, which makes sense because most of the demand that is expressed to us is through the lens of what risk management capabilities clients need or how they can access certain markets.”