CME: Why Institutions are Hyped about Ether Futures Trading

Being able to use cash-settled ETH futures as a hedging tool at this crucial time in the development of ether is likely to drive further institutional adoption of cryptocurrency.

Chicago Board of Trade; Source: Shutterstock

key takeaways

- New ETH futures provides a vehicle for institutions to gain access to the second-largest cryptocurrency by market cap and daily volume

- Overall, ether futures contracts provide an additional tool for investors to hedge their digital asset risk.

CME Group helped pave the road for institutional investors to gain broader exposure to crypto with their launch of Bitcoin futures in late 2017. And in February 2021, CME Group again continued its crypto journey with the launch of ether (ETH) futures.

This new financial product comes at an opportune time, providing a vehicle for institutions to gain access to the second-largest cryptocurrency by market cap and daily volume, and is set to help fuel the next wave of institutional adoption and participation.

What are ether futures?

First, a brief description of how ether futures trading works.

A few key facts about these contracts:

- One contract is for 50 ETH

- Contracts trade under the ticker ETH

- Prices are based on the CME CF Ether-Dollar Reference Rate

- Ether futures contracts trade on CME Globex Sunday through Friday from 5:00 PM to 4:00 PM CST

- Expiration is on the last Friday of the contract month

- Contracts are cash-settled in USD

The ether futures price ticks in increments of one-quarter index point. With one contract being worth 50 ETH, this means that a one tick movement would be equal to $12.50. Contracts are block eligible, with a minimum size of five contracts.

These futures are also eligible for exchange for physical (EFP) transactions – privately negotiated transactions where two parties agree to trade a futures contract for an equivalent spot market position or vice versa.

Overall, ether futures contracts provide an additional tool for investors to hedge their digital asset risk.

Why ether futures trading in 2021?

It once seemed reasonable to assume that institutional appetite for ETH would remain weak for some time, and that an ether futures launch was far in the future. The main reason being that the value proposition for bitcoin is easy to digest—digital gold 2.0.

Ethereum, on the other hand, requires a more in-depth explanation when it comes to smart contracts, dApps, DeFi, stablecoins and more.

And yet, institutions might actually have an easier time perceiving the value of the Ethereum network than they did the value of the Bitcoin network, according to Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products.

McCourt described how the growth of decentralized financial products (DeFi) on Ethereum might be demonstrating its value to financial institutions:

“There’s a continued focus and interest on the Etheruem network as a technology, if you look at the number of DeFi projects that have come online, when you look at the growth in stablecoins that are tied to the network…I think it’s easier, for lack of a better word, for institutions to see the potential utility of the Ethereum network and, therefore, ether that powers the network,” he said.

Given this broader scope of potential use cases that have been made apparent through the development of things like DeFi and stablecoins, some investors could be getting into Ether futures trading as a way to gain exposure to the underlying technology rather than just aiming for short-term profits:

“I think it’s not just the investment or trading motivation that you see around bitcoin, it’s also the interest in the network and what it means for their potential day-to-day or future operations,” added McCourt.

One implication of this might be that if large institutional investors can see the potential in ether and are willing to expose themselves to it, then ether futures trading could be the beginning of a much broader wave of acceptance for crypto in general.

McCourt also mentioned that growing customer demand was the main factor in CME Group’s decision to launch an ether futures contract.

Institutional demand already looks strong

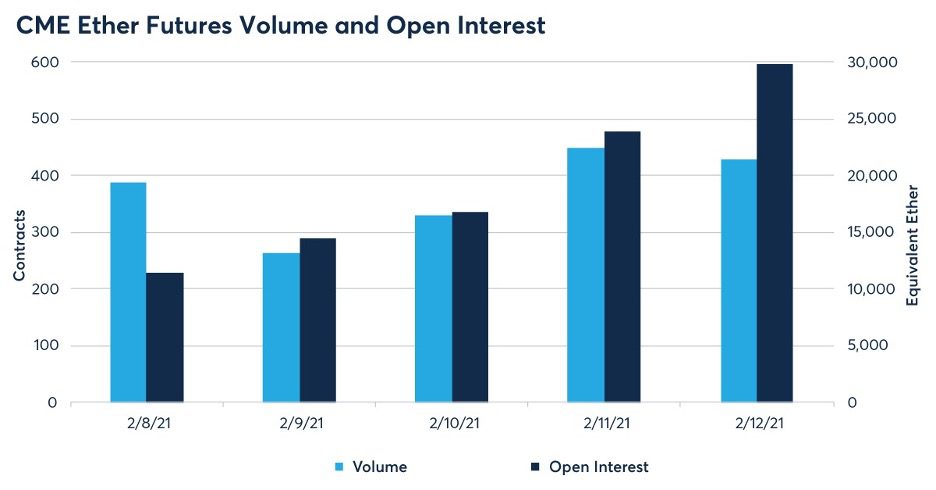

Some evidence for this demand lies in the amount of open interest for ether futures contracts on the CME. But, why is open interest an important metric for gauging the pace of institutional adoption?

McCourt said, “Open interest is a great proxy for institutional adoption because it’s measured at the end of the day. It’s the number of contracts that are held open in accounts, and therefore holding that risk or that exposure overnight; they’re not trading in and out throughout the day…holding a position overnight is more synonymous with institutional behavior.”

While there is limited data available at this time, open interest has been growing. (See chart below.) The upward trend could be seen as a strong signal of institutions engaging in Ether futures trading for the sake of gaining exposure to ether, according to McCourt.

Source: CME Group

Source: CME Group

“The trend is also important. Growing open interest really is one indicator of a successful, healthy ecosystem,” he said.

While the upward trend in open interest seems strong, it’s still far from driving the spot market for ETH, although this could change going forward, according to Dave Olsen, Vice President and Global Head of Institutional Distribution at BlockFi.

When asked about the relationship between ETH futures and the ETH spot market, Olsen said, “based on the open interest right now, we’re far away from futures driving spot price.” He also noted that, “in a year or so, that could develop.”

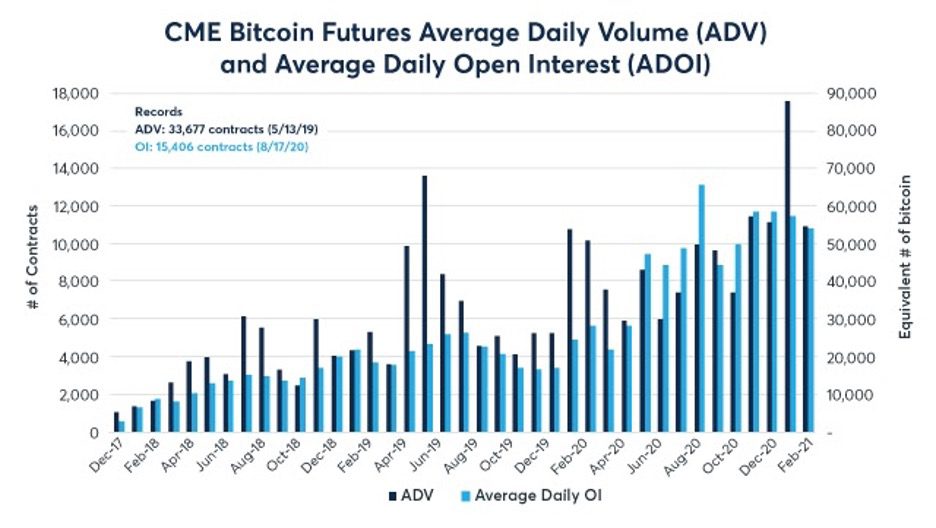

The rise in open interest for bitcoin futures also looks strong, and there’s a lot more data to confirm this as evidenced by the chart below.

Source: CME Group

Source: CME Group

If these trends continue, it’s safe to say that ether futures trading could help usher in the next big wave of institutional involvement in the crypto space.

A shifting landscape

It’s important to note that the landscape looks quite different today than it did in 2017, when CME bitcoin futures first launched.

Bitcoin and cryptocurrency in general have gained greater credibility over the last three years, according to McCourt. He said this change has shown up in the questions that institutional investors are asking their brokers or advisors, “What they’re trying to address today is, ‘how should I allocate to cryptocurrency?’ or ‘how much should I invest?’ And that’s a very different question than back in 2017, when it was more along the lines of, ‘what is bitcoin?’”

In other words, investors who were just becoming aware of bitcoin’s existence a few years ago are now focused on how best to incorporate digital assets into their portfolios.

The vehicle of choice for institutions

For institutions, derivatives like CME ether futures make the most sense. Gaining exposure to digital assets this way comes with all the familiarity institutions have to traditional derivatives products and none of the hassle of learning to navigate a new spot market. CME is a regulated US exchange, which provides firms with the certainty of working with a regulated derivatives exchange.

Continuing with the theme of today’s market being much different than that of 2017, McCourt also noted that some of the players getting involved in ether futures trading come from a more orthodox financial background:

“Early on they were more crypto-focused institutions, they were perhaps players that worked at traditional firms that went out and started crypto trading desks, crypto investment funds, etc. More traditional institutions are now getting involved,” he said.

This is yet more evidence for the idea that crypto has begun to branch out into the financial world at large and is no longer limited to a subculture of tech enthusiasts and early adopters.

Ether futures trading going forward

CME Group’s ether futures launch appears to be ushering in the next wave of institutional adoption into the crypto space.

The addition of this product comes during a time of many exciting developments in cryptocurrency that have only just begun, such as the growth of decentralized finance, a wave of wider adoption for bitcoin and beyond, and the Ethereum 2.0 upgrade and resulting move to proof-of-stake consensus, just to name a few.

Speaking of Ethereum 2.0, the timing of this ether futures launch could be ideal for institutions looking to hedge long positions. In fact, Sui Chung, Chief Executive at CF Benchmarks, said, “Roughly 3% of all ETH in existence is now locked into smart contracts. Once it’s locked up, you can’t sell it. If you’ve got a lot of ETH locked up in that contract, the futures are a very convenient way to hedge that price risk. With a futures position, you can negate the risk of the price falling. That is what futures were designed for.”

Being able to use cash-settled ETH futures as a hedging tool at this crucial time in the development of ether is likely to drive further institutional adoption of cryptocurrency. On this point, both Chung and Olsen concurred. When asked the question, “will ether futures help to continue the trend towards institutionalization of crypto that we’ve seen in bitcoin?”, they both responded: “Yes, absolutely.”

While it’s still early days, readers should be wise to keep their eyes on the growth and institutional participation in CME ether futures.