Coinbase Users Across Georgia Milk Price Bug for 100x Profit

In Georgia, traders who profited from an hours-long price bug have found their bank accounts locked — and the exchange wants its money back

Source: Shutterstock

- Georgia-based traders told Blockworks they could sell crypto on Coinbase for 100 times their value elsewhere

- They’ve since had their bank accounts blocked as well as associated Visa debit cards

Coinbase is seeking to clawback funds from bank accounts after discovering swathes of traders in Georgia had cashed out crypto for 100 times the intended market rate.

Coinbase users across the European nation were able to exploit an erroneous foreign exchange rate on crypto pairs denominated in the Georgian Lari (GEL), according to one source familiar with the matter and several Georgian traders who spoke to Blockworks under condition of anonymity.

A snafu at a third party provider led to an outsized exchange rate due to a misplaced decimal point for up to seven hours. This allowed no more than 900 Georgia-based traders to sell various crypto for GEL, and, in some cases, net thousands of dollars more than should’ve been allowed.

“In late August, prices for cryptos denominated in Georgia’s national currency had been rated at GEL 290 instead of GEL 2.90. The missed decimal point had been due to a ‘third-party technical issue,'” a Coinbase spokesperson told Blockworks.

Some trades, which should’ve netted around $150, were executed on Coinbase for $15,000, with proceeds withdrawn to personal bank accounts, users told Blockworks.

The average salary in Georgia is around $4,200 per year, meaning certain Coinbase users profited more than three times their national average. Estimates from a Georgian trading community that Blockworks spoke to places losses for Coinbase between $14 million and $140 million, although Coinbase refuted that claim.

Shortly after withdrawing related funds from Coinbase, Georgians said they received notification from their financial institutions advising them their bank accounts and associated Visa debit cards had been frozen.

“Hello, we have marked your transactions with Coinbase as suspicious and we’re locking all your accounts and cards,” one bank’s blanket text message to customers reads. “Please be aware that Coinbase may request clawback of the funds. Sorry.”

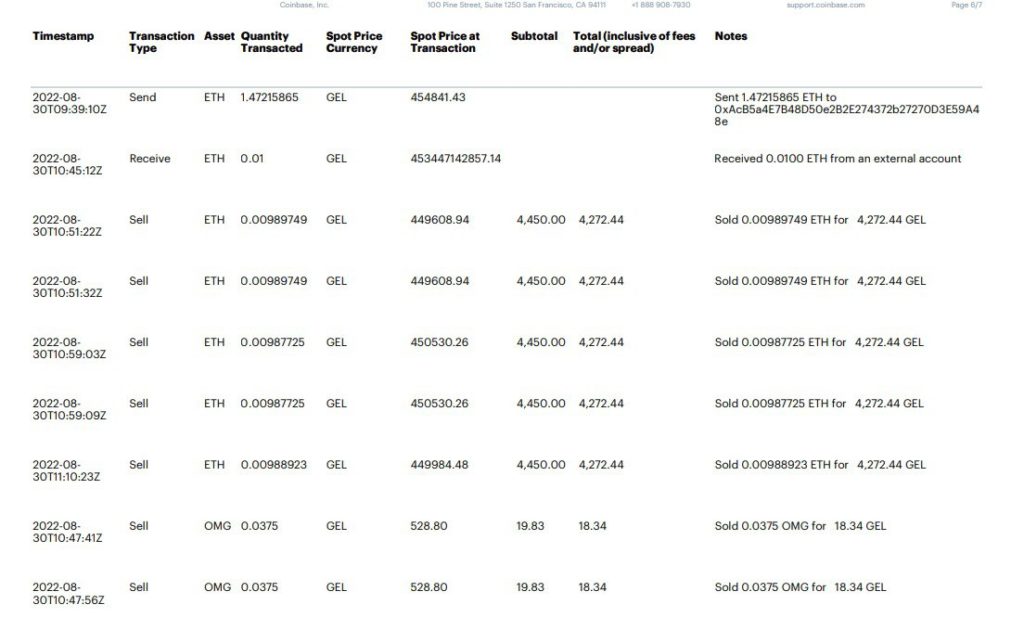

Image shows trader sold five lots of 0.01 ETH ($15.25) for 4,272 GEL ($1,525) each on August 30

Image shows trader sold five lots of 0.01 ETH ($15.25) for 4,272 GEL ($1,525) each on August 30

At least two domestic banks are said to have been involved in the freezing of funds, though not at the direction of Coinbase, one source close to the matter said. One local bank declined to comment, citing Georgian privacy laws.

“A very small number of users (0.001% of our total users) were able to erroneously trade and withdraw a small non-material amount of funds,” a Coinbase spokesperson wrote to Blockworks in an email. “Upon detection, we fixed the issue and are taking action to retrieve the improperly withdrawn funds.”

Coinbase traders in Georgia profited in multiple ways

Coinbase, a publicly listed exchange incorporated in Delaware, reserves the right to clawback or reverse transactions found to have been paid out in error, according to its terms of service as laid out in its User Agreement.

But funds unrelated to the trades have also been frozen, meaning traders have now found it impossible to buy groceries and pay rent with their non-crypto related income, they said.

Georgia, which borders on Russia to the north and Turkey to the south, is not currently featured on Coinbase’s list of supported countries which details how users can engage with their platform. Coinbase told Blockworks it would provide a full list of supported countries though, as of press time, it has not yet been received.

The crypto exchange, one of the most-used in the world, also has three tiered levels of trading restrictions with level one the most restrictive for users. That only allows for a person to send and receive crypto to their Coinbase wallet once a phone number has been verified for Know-Your-Customer (KYC) purposes.

Level two access, meanwhile, allows users to purchase crypto only after they have supplied a valid photo ID, such as a passport or driver’s license. Level three lets users send and receive crypto on the blockchain and requires users to verify personal information including proof of address, per Coinbase’s website.

According to one of the traders Blockworks spoke to, fiat deposits are currently not allowed in Georgia, though transfers, sending and receiving crypto as well as fiat withdrawals are.

Traders explained that methods of profiting from the price bug ranged from arbitrage between exchanges — transferring crypto purchased on another platform before selling it via Coinbase for 100 times profit — to simply selling crypto bought on Coinbase and withdrawing it in fiat.

“[There were] multiple levels of failure from Coinbase,” one of the Georgian traders said. “They had no checks. Even worse, when they detected unusual activity, which they should have detected, they failed to act on it for over seven hours.”

David Canellis contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.