Cryptos Decline as China Doubles Down on Regulations: Markets Wrap

Cryptocurrency markets fall on news that the People’s Bank of China would restrict access to international crypto exchanges.

Source: Shutterstock

- Bitcoin and ethereum toppled, shedding roughly 6% and 8% on-day, according to Messari

- In a sea of losses, $LUNA jumped 10%, as of press time

Majors cryptos slid on Friday following news that China would widen its ban on crypto transactions.

The People’s Bank of China (PBOC) announcement posted on their website today, but originally issued on September 15, seems to be a restatement of Chinese officials’ ongoing stance on the digital asset class. It states that “all crypto-related transactions, including services provided by offshore exchanges to domestic residents, are illicit financial activities,” according to Bloomberg.

Bitcoin and ethereum topple on the news, shedding roughly 6% and 8%, as of press time.

The PBOC news comes as the world’s most indebted real estate developer, Evergrande, faces serious financial woes due to its debt which is the equivalent to 2% of China’s gross domestic product.

Despite the sea of losses on the news, Terra ($LUNA) hiked for the second day in a row, jumping 10%.

DeFi

- Terra ($LUNA) is trading at $39.44, up 9.8% and trading volume at $2,610,677,160 in 24 hours.

- Uniswap ($UNI) is trading at $19.8, declining -8.6% with a total value locked at $4,173,572,361 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 33.8% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $42,240.64, declining -5.68% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,900.32, down -7.89% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.068, declining -2.37% at 4:00 pm ET.

Insight

“China has been known to go to extremes with either very assertive statements and prosecutions to complete radio silence. This time the point was made very clear that China will not support cryptocurrency market development as it goes against its policies of tightening up control over capital flow and big tech,” George Zarya, CEO at BEQUANT, said. “For the institutional crypto industry, it won’t change much as those who could leave already left and those who couldn’t have either closed or gone under the radar. The retail market most likely has gone under the radar and will continue to support market volumes.”

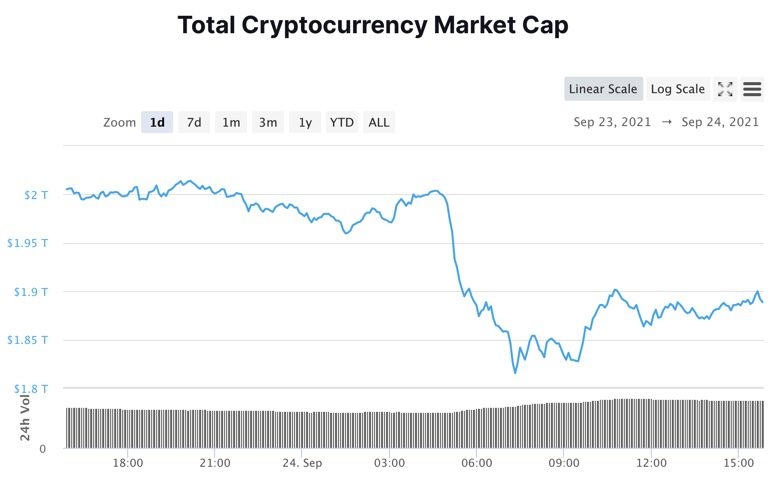

Total crypto market cap over the past day Source:CoinMarketCap

Total crypto market cap over the past day Source:CoinMarketCap

Equities

- The Dow rose 0.15% to 34,815.

- S&P 500 was up 0.17% to 4,456.

- Nasdaq declined -0.04% to 15,046.

Currencies

- The US dollar strengthened 0.24%, according to the Bloomberg Dollar Spot Index.

Commodities

- Brent crude was up to $78.05 per barrel, rising 1.04%.

- Gold fell -0.09% to $1,748.2.

Fixed Income

- US 10-year treasury yields 1.456% as of 4:00 pm ET.

In other news…

The White House announced its nomination for Comptroller of the Currency as Saule Omarova, Blockworks reported. Omarova, a professor at Cornell Law School, has previously advocated for larger government oversight of Wall Street and cryptocurrencies.

That’s it for today’s markets wrap. I’ll see you back here on Monday.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.