Cryptos, Stocks Rally as Fed Raises Rates by 0.75% for Third Straight Month

Powell was guarded when asked about what might come in November — markets are still betting on a 75 bps increase at the next FOMC meeting

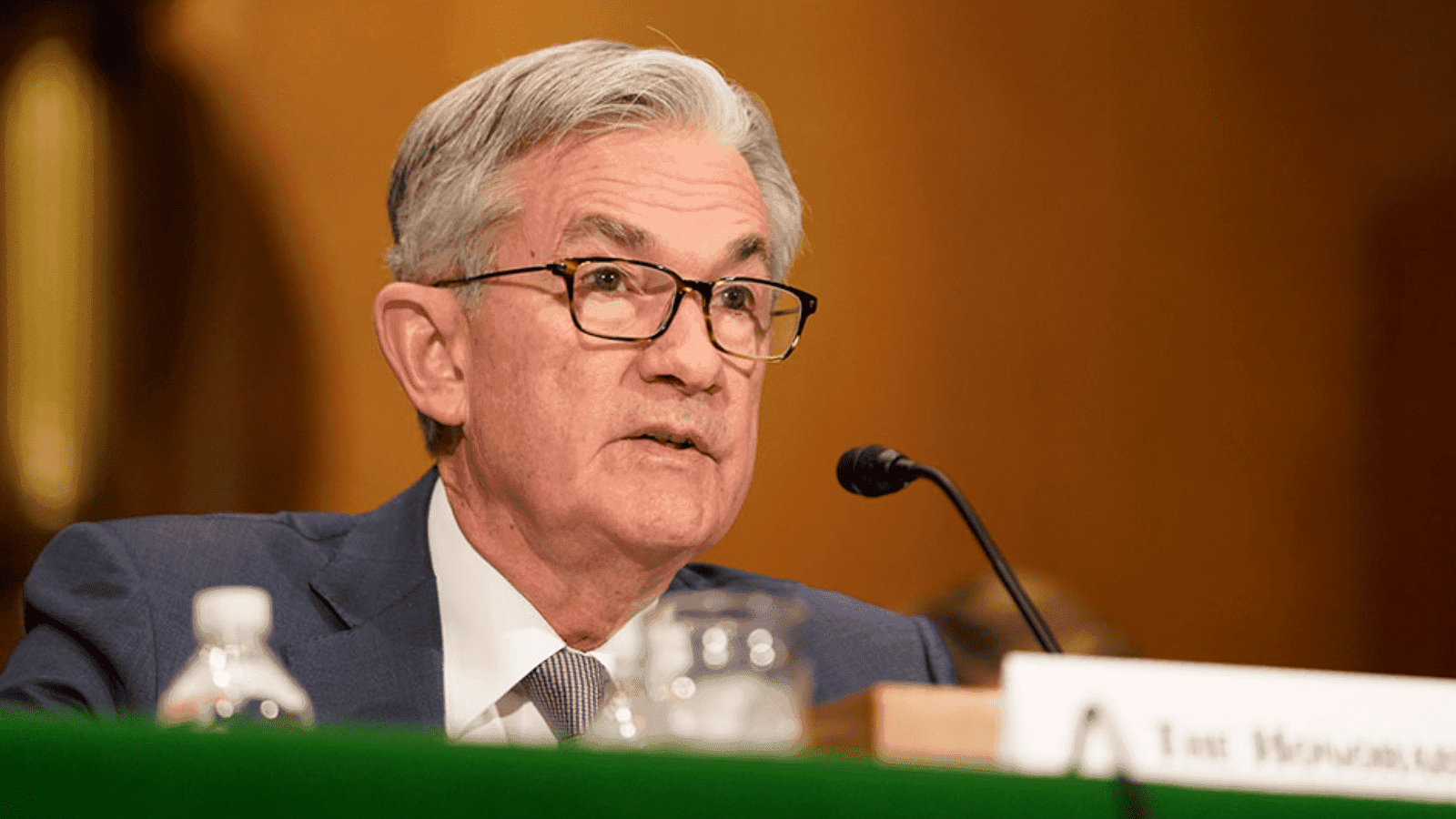

Federal Reserve Chair Jerome Powell | Source:Federal Reserve (CC license)

- Wednesday marks the Fed’s fifth consecutive rate hike, showing the days of easy money are long gone

- Spending and production have shown modest growth, the Fed noted in its statement Wednesday

The Federal Reserve doubled down on its newfound quantitative tightening strategy Wednesday, bumping interest rates by three-quarters of a percentage point for the third straight time.

The US regulator cited slowing consumer spending and production levels. The move marks the central bank’s fifth consecutive rate increase, a strategy it hopes will curb the highest inflation the country has seen in more than four decades.

Overall economic activity appears to have slowed a bit, Fed officials wrote in a statement released at the end of their two-day policy meeting, pointing to reduced spending and business production statistics.

The unemployment rate remains low, the central bank noted in its statement, but considering maximum employment, its inflation goals remain unchanged: a rate of 2% over the longer run.

In June, when the central bank opted to raise rates 75 basis points for the first time, Fed Chair Jerome Powell called the move “unusually large,” but if current conditions persist, higher increases could become the norm.

Crypto markets reacted well to the news, which analysts say was mostly priced in. Bitcoin and ether gained 2.2% and 2.7%, respectively. The S&P 500 and tech-heavy Nasdaq initially fell on the news before rallying slightly back to the green.

“Unfortunately, for investors, the uncertainty still means more rate hikes in the near term, with another 75 basis point hike now almost certain at the next early November meeting,” Bill Cannon, head of portfolio management at digital asset fund manager Valkyrie Investments, said.

Analysts are not confident Wednesday’s initial rally can last.

“Raising rates is negative for crypto because it means that it becomes more expensive to borrow because loan payments are larger, and so it entices people to save more, which is what central banks want to clamp down on persistently high inflation,” said Marcus Sotiriou, analyst at digital asset broker GlobalBlock.

“Any rally in the short term will be unwelcomed by the Federal Reserve, though, as it means people feel more wealthy and more likely to spend, hence contributing to more inflation — something known as the wealth effect.”

The Fed is prepared to continue raising interest rates in the future, if it appears necessary to fight inflation.

“I think there is a possibility, certainly, that we will go to a certain level that we are confident in and stay there for a time,” Powell said during a press conference Wednesday. “But we’re not at that level.”

“Clearly today, we’ve just moved, I think probably into the very, very lowest level of what might be restrictive. And certainly in my view, in the view of the committee, there’s a ways to go,” he said.

Powell was tight lipped when asked about the central bank’s intentions for its next policy meeting in November. Economic data will be key in determining the appropriate level moving forward, Powell said.

“We like to think of price stability as an asset [that delivers long-term benefits],” Powell added.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.