El Salvador Buying Back Debt Following Bitcoin Losses

President Nayib Bukele insists the country can pay its debt despite losing more than 50% on its bitcoin investments

El Salvadorian President Nayib Bukele | Blockworks exclusive art by axel rangel

- The value of the country’s junk-priced bonds increased by 10% to 40% following the buyback announcement

- The buybacks will be financed partly by the IMF, which has criticized El Salvador’s bitcoin investment

El Salvadoran President Nayib Bukele once again wants to buy the dip — but instead of bitcoin, he’s eyeing his own country’s bonds.

The controversial leader tweeted Tuesday that he sent two bills to El Salvador’s congress asking for authorization to take loans out and buy back sovereign debt bonds at market prices, which had dropped up to 75% over the past year.

Bukele’s move aims to reduce the government’s debt positions as some speculate El Salvador is near default.

El Salvador recognizes bitcoin as legal tender, and Bukele made waves the past year tweeting about his ill-timed bitcoin purchases using El Salvador’s sovereign wealth.

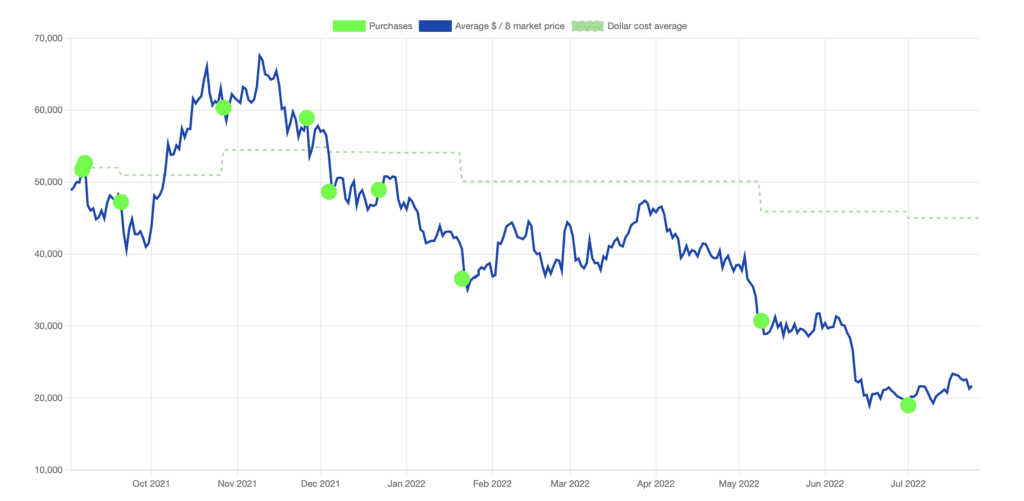

Bukele has overall purchased 2,381 BTC for $107.15 million and is down over 50% on his investments, according to nayibtracker.com.

Nayib Bukele portfolio tracker | Source: Nayibtracker.com

Nayib Bukele portfolio tracker | Source: Nayibtracker.com

Moody’s further downgraded the country’s debt rating in May, citing “bitcoin-related initiatives.” Bukele and his cabinet insist the proposed debt buybacks are not a result of financial mismanagement.

“El Salvador has the liquidity not only to pay all of its commitments when they are due, but also purchase all of its own debt (till 2025) in advance,” Bukele wrote, adding in a separate tweet the debt buybacks would be made “understanding the market price will probably move upwards once we start buying all the available bonds.”

El Salvador’s junk-grade bonds jumped in price following Bukele’s tweet, with bonds set to mature in 2023 rising over 10% and bonds maturing in 2025 up over 40%, according to Bloomberg.

The bills would finance El Salvador’s debt buyback through a $200 million loan from the Central American Bank for Economic Integration and reserve assets from the International Monetary Fund (IMF).

The IMF has been outspoken in its opposition to El Salvador’s bitcoin fixation, asking the country in January to remove bitcoin’s legal tender status over concerns the country’s debt was “unsustainable.”

El Salvador has not clarified the exact purpose of its buyback, though the proportion of the country’s revenue spent on debt interest payments has steadily risen since 2016, according to economics data platform Trading Economics.

For what it’s worth, IMF researchers previously outlined three “core objectives” behind sovereign debt buybacks: reducing debt payments, minimizing sovereign risk and adding liquidity to domestic markets.

Still, past debt buybacks have been mostly unsuccessful in significantly reducing debt payments. In 1988, Bolivia bought back $34 million worth of commercial debt but only saw its debt payments shrink by $400,000, according to VoxEU.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.