Grayscale Considering 25 New Digital Assets as Investments

Crypto-focused fund group currently invests in two-dozen digital assets

Grayscale logo; Blockworks exclusive art by Axel Rangel

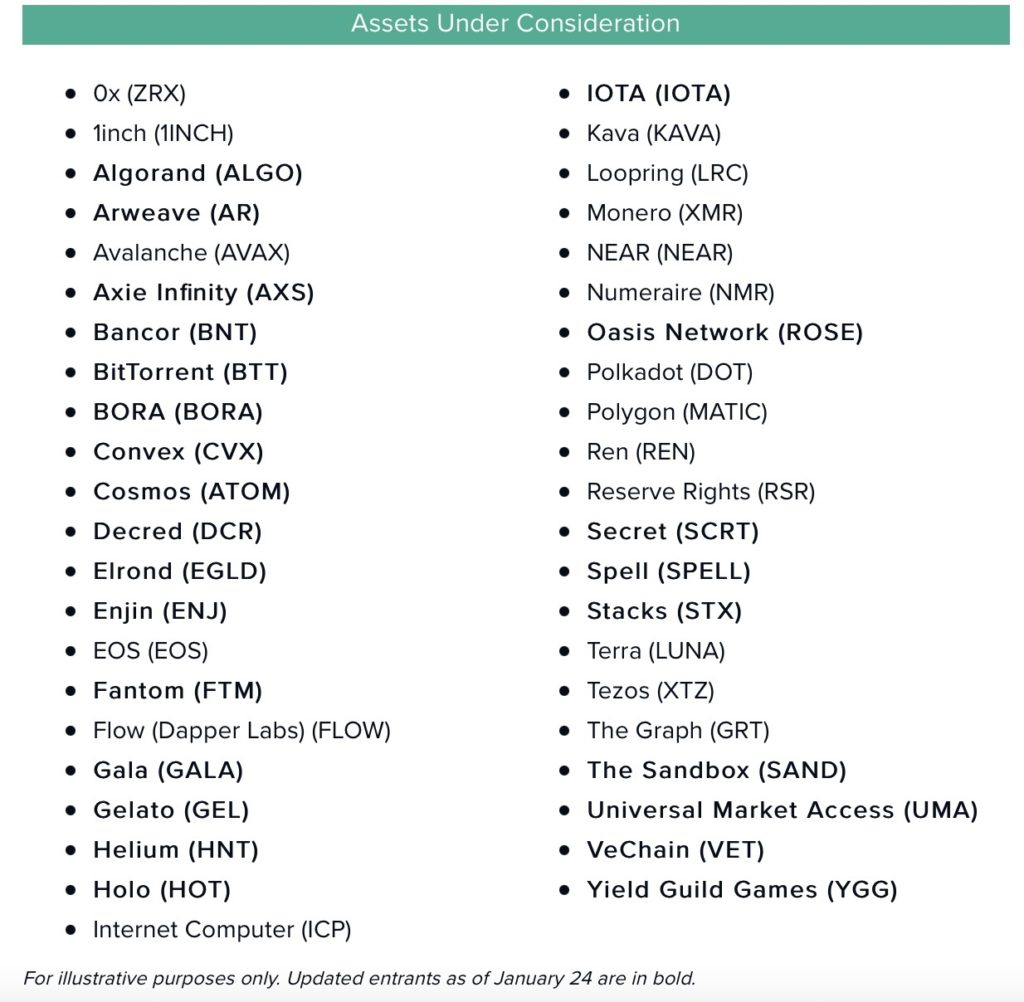

- New assets Grayscale is considering include Algorand (ALGO), Axie Infinity (AXIE), Cosmos (ATOM), Fantom (FTM) and Helium (HNT)

- Grayscale most recently added payment network Amp (AMP) to its investment mix

Grayscale Investments has added 25 assets to a running list of investments it is considering making available to investors.

The crypto-focused firm currently supports 24 assets. The most recent addition was Amp (AMP), which Grayscale added to its DeFi Fund earlier this month. AMP is the native token of the Flexa network, which enables crypto-collateralized payments at stores and online.

Grayscale had announced at the time that it was removing Bancor (BNT) and Universal Market Access (UMA) from the DeFi Fund. BNT and UMA remain on the firm’s under consideration list.

With the addition of the 25 assets, the firm is now evaluating 43 new assets. The most recent additions are in bold.

“The process of creating an investment product similar to the ones we already offer is a complex, multifaceted process,” the firm said in a Monday statement. “It requires significant review and consideration and is subject to our internal controls, custody arrangements, and regulatory considerations, among other things.”

A Grayscale spokesperson did not immediately return Blockworks’ request for comment.

Grayscale added Solana (SOL) and Uniswap (UNI) to its Digital Large Cap Fund in October. Craig Salm, Grayscale’s chief legal officer, told Blockworks at the time that the company was considering products around layer-1 protocols, gaming and the metaverse.

Roughly $22 billion of the firm’s assets under management reside in the Grayscale Bitcoin Trust (GBTC), which the firm is trying to convert to an ETF. The firm ran $43.6 billion overall at the end of 2021.

The company is also expected to launch the Grayscale Future of Finance ETF — investing in the stocks of companies with exposure to the digital economy— in coming weeks.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.